Moving to Italy from the US: 25 Essential Options for a Smooth Transition

Table of Contents

Key Considerations When Moving to Italy

Visa and Residency Options

Housing Options

Work and Income Solutions

Healthcare and Insurance Options

Logistical Moving Services

Regional Considerations for American Expats

Technology and Connectivity Adaptations

Family Considerations

Retirement-Specific Planning

Financial Management Across Borders

Emergency Preparedness

How Jiffy Junk Can Help

Final Thoughts

Key Considerations When Moving to Italy

I’ve been dreaming about moving to Italy for years, and I finally took the plunge last year. Trust me when I say that careful planning across multiple dimensions is absolutely essential. Before I packed my bags, I had to understand all the legal requirements including visa options and documentation. I quickly discovered that financial considerations vary dramatically depending on where you want to settle – those northern Italian cities are typically way more expensive than southern towns.

The practical matters hit me hard too. Housing decisions aren’t straightforward, and the language barrier was more challenging than I expected. I had to adapt to Italian customs and work on building a community from scratch. The logistics of moving my possessions and establishing realistic timelines took way more effort than I initially thought.

When planning your move to Italy, you’ll need to start early. The permesso di soggiorno (residence permit) must be obtained within 8 days of arrival, and you’ll need extensive documentation including proof of accommodation and financial resources. I was shocked by how different the bureaucratic timeline is compared to what I was used to in the US. Processes that might take days back home can stretch into weeks or months in Italy, requiring multiple in-person visits to government offices. Patience isn’t just a virtue here – it’s a necessity!

Here’s a timeline that helped me stay organized:

Timeline | Critical Tasks | Notes |

|---|---|---|

12-18 months before | Research visa options, Begin language learning | Visa processing can take 3-6 months |

6-12 months before | Apply for chosen visa, Research housing areas | Schedule consulate appointment early |

3-6 months before | Arrange healthcare coverage, Begin housing search | Consider temporary accommodations initially |

1-3 months before | Book moving services, Notify financial institutions | Exchange some currency in advance |

Upon arrival | Register with local authorities, Apply for permesso | Must be done within 8 days |

Visa and Residency Options

1. Elective Residence Visa

This visa became my top choice since I had savings and didn’t need to work in Italy. You’ll need to demonstrate substantial passive income (minimum €31,000 annually for individuals), comprehensive health insurance, and suitable housing. I submitted my application through my local Italian consulate in the US, and once approved, I had 180 days to make my relocation to Italy and apply for my residence permit.

The documentation requirements are intense. I had to provide bank statements showing consistent monthly income for at least 6-12 months prior to application, plus proof of accommodation through property ownership documents or a registered rental contract of at least one year.

One thing that caught me off guard was that the visa application must be submitted to the specific Italian consulate with jurisdiction over your permanent US residence. I almost made the mistake of trying a different consulate with shorter wait times, which would have resulted in automatic rejection when moving to Italy from the US.

2. Work Visa

Getting a work visa requires an Italian employer to sponsor you. My friend went this route and told me the company had to prove they couldn’t find a qualified EU citizen for her position. Her employer requested work authorization from the local Immigration Office before she could apply for the visa at an Italian consulate.

The decreto flussi (flow decree) establishes annual quotas for non-EU workers, typically released in January with applications processed on a first-come, first-served basis until quotas are filled. This makes timing crucial.

Her employer had to file a nulla osta (work authorization) request through the Sportello Unico per l’Immigrazione, which gave her 180 days to apply for the actual visa. The whole process was nerve-wracking because of the quota system, but she eventually made it work.

3. Self-Employment Visa

For entrepreneurs, this option requires proving you have the skills, qualifications, and financial resources to support yourself through self-employment in Italy. You’ll need a comprehensive business plan, adequate financial resources (typically minimum €50,000), necessary professional licenses, and appropriate commercial space if applicable.

The application requires a Chamber of Commerce certificate confirming no impediments to your profession, proof of suitable accommodation, and evidence of minimum income thresholds that vary by profession. This is definitely not the easiest path when moving to Italy from USA.

Self-employed individuals must register with the Italian Social Security Administration (INPS) within 30 days of establishing residency, with mandatory contributions ranging from 24-34% of declared income. These contributions are significantly higher than what most Americans are used to paying.

4. Italian Ancestry Citizenship

I have several friends who qualified for citizenship jure sanguinis (by bloodline), and they swear it’s the best way to go if you’re eligible. There’s no generational limit for paternal lineage, while maternal lineage is limited to births after 1948 (though court challenges have succeeded).

Before starting your Italian ancestry citizenship application, consider clearing out unnecessary documents and family heirlooms. Professional decluttering services can help organize your genealogical records while preparing for your move abroad.

Take Maria Rossi’s experience, for example. She discovered her grandfather was born in Sicily before emigrating to New York in 1935. She gathered his Italian birth certificate, marriage certificate in the US, her mother’s birth certificate, her own birth certificate, and proof her grandfather naturalized only after her mother was born. After apostilling and translating all documents, she applied at the Italian consulate in Boston. After a 14-month wait, she received citizenship recognition, allowing her to move to Italy without visa restrictions and eventually obtaining an Italian passport.

All vital records must be officially apostilled in their country of origin and translated by court-approved translators, with each document requiring certification of conformity to the original. This process is time-consuming but worth it for the benefits of EU citizenship.

The 1948 Rule refers to the Italian Constitution that only allowed citizenship transmission through maternal lines after 1948. Cases falling outside this parameter require filing a lawsuit in the Court of Rome, with success rates exceeding 95% despite costs of €4,000-8,000.

5. EU Blue Card

This option targets highly qualified professionals with university degrees and job offers paying at least 1.5 times the average Italian salary (approximately €38,000 annually). The application process is streamlined compared to standard work visas with faster processing times.

Your degree must undergo a Declaration of Value (Dichiarazione di Valore) process through the Italian consulate, confirming its equivalence to Italian higher education standards. This can be a lengthy process depending on your field of study.

Blue Card holders benefit from professional mobility after the first 18 months, allowing changes in employer without restarting the visa process, provided the new position meets Blue Card criteria. This flexibility makes it an attractive option for career-focused individuals.

Housing Options

6. Long-Term Apartment Rental

When I decided to live in Italy long-term, I opted for a standard Italian rental contract (contratto 4+4) that runs for four years with an automatic four-year renewal. I needed a codice fiscale (tax code), a large security deposit (3 months’ rent), and the first month’s rent in advance.

What shocked me was discovering that “unfurnished” in Italy means something completely different than in the US. My apartment came with no appliances, lighting fixtures, or kitchen cabinets! I had to invest quite a bit to make it livable.

Rental contracts must be registered with the Agenzia delle Entrate (Italian Revenue Agency) within 30 days of signing, with registration fees split between landlord and tenant. This official registration provides important legal protections for both parties.

7. Short-Term Furnished Rental

For my first six months after moving to Italy, I chose a short-term rental (contratto transitorio) that came fully furnished with utilities included. Yes, I paid about 40% more than a long-term lease would have cost, but the flexibility was worth it during my transition.

Short-term contracts require justification for their temporary nature (study, temporary work assignment, etc.) and still must be registered with tax authorities despite their shorter duration. I used my language school enrollment as justification.

Many short-term rentals operate under tourism licenses (affitto turistico) which limits your ability to establish legal residency at that address. This became a problem when I tried to register for healthcare, so make sure your rental allows for residency registration if you need it.

8. Property Purchase

Americans face no restrictions on buying Italian property, which is great news if you’re moving to Italy from the US with plans to put down roots. The process involves selecting a property, making an offer, signing a preliminary contract (compromesso) with a deposit (typically 10-20%), and completing the sale with a notary.

The compromesso is legally binding—backing out results in forfeiture of your deposit, while if the seller backs out, they must pay you double the deposit amount. This creates a strong incentive for both parties to follow through.

Property purchases require verification of property boundaries and ownership through land registry searches, and checks for any liens, easements, or building code violations that could affect ownership rights. I recommend hiring a geometra (surveyor) to help with this process, as they understand the local regulations and can spot potential issues.

9. Rural Renovation Project

When moving to Italy, I was tempted by those “Case a 1 Euro” programs that offer properties in depopulating rural areas for symbolic prices. These require substantial renovation commitments (typically €20,000-100,000+) and a detailed renovation plan.

Renovation projects in historic areas face strict regulations from the Soprintendenza Belle Arti e Paesaggio (Heritage Protection Office), which must approve changes to facades, structural elements, and sometimes even interior features. This can significantly extend your timeline and budget.

Many rural properties have fractional ownership issues (multiple heirs with partial claims) that must be resolved before purchase, sometimes requiring legal proceedings to clear the title completely. I decided this was too complicated for my first Italian home, but I might consider it in the future.

10. Co-Housing/Shared Living

For younger expats or those on tight budgets, shared apartments are common in university cities and among young professionals. Monthly costs range from €300-700 depending on location, typically requiring a month’s deposit.

When considering shared living arrangements, you may need to dispose of excess furniture that won’t fit in your new Italian accommodation, especially since Italian apartments are typically smaller than American homes.

Most shared housing operates under informal agreements rather than registered contracts, creating potential legal vulnerability regarding tenant rights and residency establishment. I’d recommend getting something in writing even if it’s not a formal contract.

Utility cost sharing systems vary widely—some use fixed monthly contributions regardless of usage, while others implement complex tracking systems for individual consumption of electricity, heating, and water. Make sure you understand how costs will be divided before moving in.

Work and Income Solutions

11. Remote Work for US Company

I initially maintained my US job when I first moved to Italy from USA, but I had to address complex tax implications. After 183 days, I became an Italian tax resident, which meant filing taxes in both countries. The time zone difference (6-9 hours) also required adjusting my work schedule to overlap with US business hours.

The US-Italy tax treaty prevents double taxation but doesn’t eliminate filing requirements. I still needed to file US returns and Italian returns, with foreign tax credits offsetting much of the liability. Working with tax professionals in both countries was essential.

Remote workers must navigate the “permanent establishment” risk—if your activities create a deemed Italian presence for your US employer, it could trigger corporate tax obligations for the company. My employer had me sign an agreement acknowledging I wouldn’t represent the company in Italy to help mitigate this risk.

Here’s a breakdown of the tax considerations I had to navigate:

Tax Consideration | US Requirements | Italian Requirements | Notes |

|---|---|---|---|

Income Tax Filing | Required annually for all citizens | Required after 183+ days/year | Tax treaty prevents double taxation |

Social Security | Continues if employed by US company | May be required after 5+ years | Totalization agreement applies |

Corporate Presence | N/A | Possible if creating “permanent establishment” | Can trigger corporate taxes for employer |

Digital Nomad Status | N/A | New visa option with minimum income requirements | Simplifies legal compliance |

Bank Reporting | FBAR required for accounts over $10,000 | All accounts reported to Italian tax authority | Severe penalties for non-compliance |

12. Teaching English

Many of my expat friends teach English to support themselves. Positions typically require TEFL/CELTA certification and sometimes a bachelor’s degree. Language schools pay €15-25 per hour, often as independent contractors rather than employees.

Working as an independent contractor (partita IVA) requires quarterly VAT filings and annual tax declarations, with mandatory social security contributions of approximately 27% of gross income. This administrative burden surprised many of my teaching friends.

The MIUR (Italian Ministry of Education) periodically publishes calls for mother-tongue language assistants in public schools, offering more stable positions with benefits but requiring specific qualifications and timing application submissions precisely. These positions are competitive but worth pursuing if you want more stability.

13. Starting an Italian Business

I’ve met several Americans who figured out how to move to Italy as an American by establishing a business. This requires selecting a business structure (SRL is common for foreigners), securing a business visa, registering with the Chamber of Commerce, obtaining a VAT number, and navigating extensive bureaucracy.

Take John and Sarah Miller, who moved from Chicago to Tuscany with a dream of opening an artisanal gelato shop. They secured a self-employment visa by demonstrating sufficient startup capital (€75,000) and a detailed business plan targeting tourists and locals with authentic, organic ingredients. Working with a commercialista, they established an SRL structure, secured the necessary health permits, and renovated a small storefront in Lucca’s historic center. After a challenging first year navigating bureaucracy and building local supplier relationships, their “Gelato Americano” shop now employs three local staff and has become a stop on local food tours.

The Società a Responsabilità Limitata (SRL) structure requires a minimum capital of €10,000, which must be deposited in a corporate bank account before registration can be completed. This provides some protection for your personal assets.

All businesses must implement certified electronic invoicing (fatturazione elettronica) through the government’s SDI platform, with specific formatting requirements and digital signature protocols. This is one area where having a good accountant is absolutely essential.

14. Digital Nomad Visa

Italy’s digital nomad visa, introduced in 2022, has been a game-changer for remote workers moving to Italy. It requires proof of remote work capabilities, minimum annual income of €28,000, health insurance, and suitable accommodation.

The implementing decree (decreto attuativo) for this visa was only published in March 2023, meaning consulates are still standardizing application procedures and requirements. This has led to some inconsistencies in how applications are processed.

Applicants must demonstrate a minimum three-year history of remote work or digital entrepreneurship, with documentation of consistent income streams and client relationships. This makes it less suitable for those just starting their remote work careers.

15. Seasonal Tourism Work

Coastal regions and tourist destinations offer seasonal work in hotels, restaurants, and tourism services from May-September. These positions typically require Italian language skills and EU work authorization, making them challenging for Americans without existing work permits.

Seasonal work permits (permesso di soggiorno per lavoro stagionale) have a streamlined application process but are limited to specific sectors like agriculture, tourism, and hospitality with maximum duration of nine months. This makes them a temporary solution at best.

Many seasonal employers offer “work exchange” arrangements providing room and board in exchange for part-time work, which technically violates visa regulations but remains common practice in tourist areas. I’d recommend caution with these arrangements as they could jeopardize your legal status.

Healthcare and Insurance Options

16. Italian National Healthcare (SSN) Enrollment

Once I established residency, registering with the Servizio Sanitario Nazionale at my local health office (ASL) was a priority. The annual fee is income-based, typically €400-2,500, which is a bargain compared to US healthcare costs.

Registration requires your permesso di soggiorno, codice fiscale, proof of residence, and self-certification of income, with coverage backdated to your payment date. I found the process straightforward once I had all my documents in order.

Living in Italy with access to the SSN has been a revelation. The quality of care is generally excellent, though wait times for non-urgent procedures can be lengthy. Having a primary doctor who knows me and can provide referrals to specialists has made navigating the system much easier.

The SSN operates on a regional basis with 20 different healthcare systems—benefits, co-pays, and digital services vary significantly between regions, with northern regions typically offering more advanced digital access to medical records and appointment booking. I was lucky to settle in an area with good digital services, which made managing appointments much easier.

17. Private Health Insurance

Before I qualified for the SSN, I needed private health insurance when moving to Italy. International policies from providers like Cigna, Allianz, or GeoBlue cost €1,000-4,000 annually depending on age and coverage level.

Private policies must include a certificate specifically formatted for Italian immigration authorities, stating coverage amounts in euros and explicitly confirming repatriation coverage. My first application was rejected because my policy didn’t explicitly state coverage for Italy.

Most private insurance operates on a reimbursement model rather than direct billing, requiring you to pay upfront for services and submit claims afterward. I found this challenging at first, especially for larger expenses, but eventually worked out a system for tracking and submitting claims efficiently.

18. Combination Public/Private Coverage

Many expats I know opt for basic SSN coverage supplemented with private insurance for specialists and non-urgent care. This approach provides comprehensive protection while reducing wait times for certain services.

Moving to Italy changed my perspective on healthcare. I now have SSN coverage for emergencies and hospitalizations, but maintain a mid-tier private policy for specialist visits and diagnostic tests. This combination gives me the best of both worlds.

Supplemental policies (polizze integrative) are specifically designed to complement SSN coverage, focusing on outpatient specialist visits, diagnostic tests, and dental care without duplicating hospitalization coverage. These are much more affordable than comprehensive private insurance.

Some Italian employers offer supplemental health funds (fondi sanitari integrativi) as benefits, which function similarly to HSAs in the US but with direct payment to affiliated providers. If you’re job hunting in Italy, these benefits are worth considering.

19. US-Based International Health Insurance

Some US insurers offer international coverage extensions for Americans abroad. These typically cost more than Italian private insurance (€3,000-8,000 annually) and may have coverage gaps in Italy.

US Medicare does not cover care received outside the United States, making supplemental coverage essential for retirees who maintain Medicare enrollment. This was a shock to some of my retired friends who assumed their Medicare would work internationally.

US-based international policies often exclude coverage for pre-existing conditions for the first 6-12 months, unlike Italian private insurance which typically covers pre-existing conditions after a shorter waiting period. Read the fine print carefully before selecting a policy.

20. Travel Insurance Bridge Coverage

Most travel policies cap coverage at 90-180 days and exclude treatment for chronic conditions, making them suitable only as temporary solutions during visa processing and initial settlement. I used this as a bridge until I could enroll in the SSN.

Travel policies typically include emergency evacuation coverage that permanent health insurance may not, providing additional protection during your transition period when you’re less familiar with local healthcare resources. This gave me peace of mind during my first months in Italy.

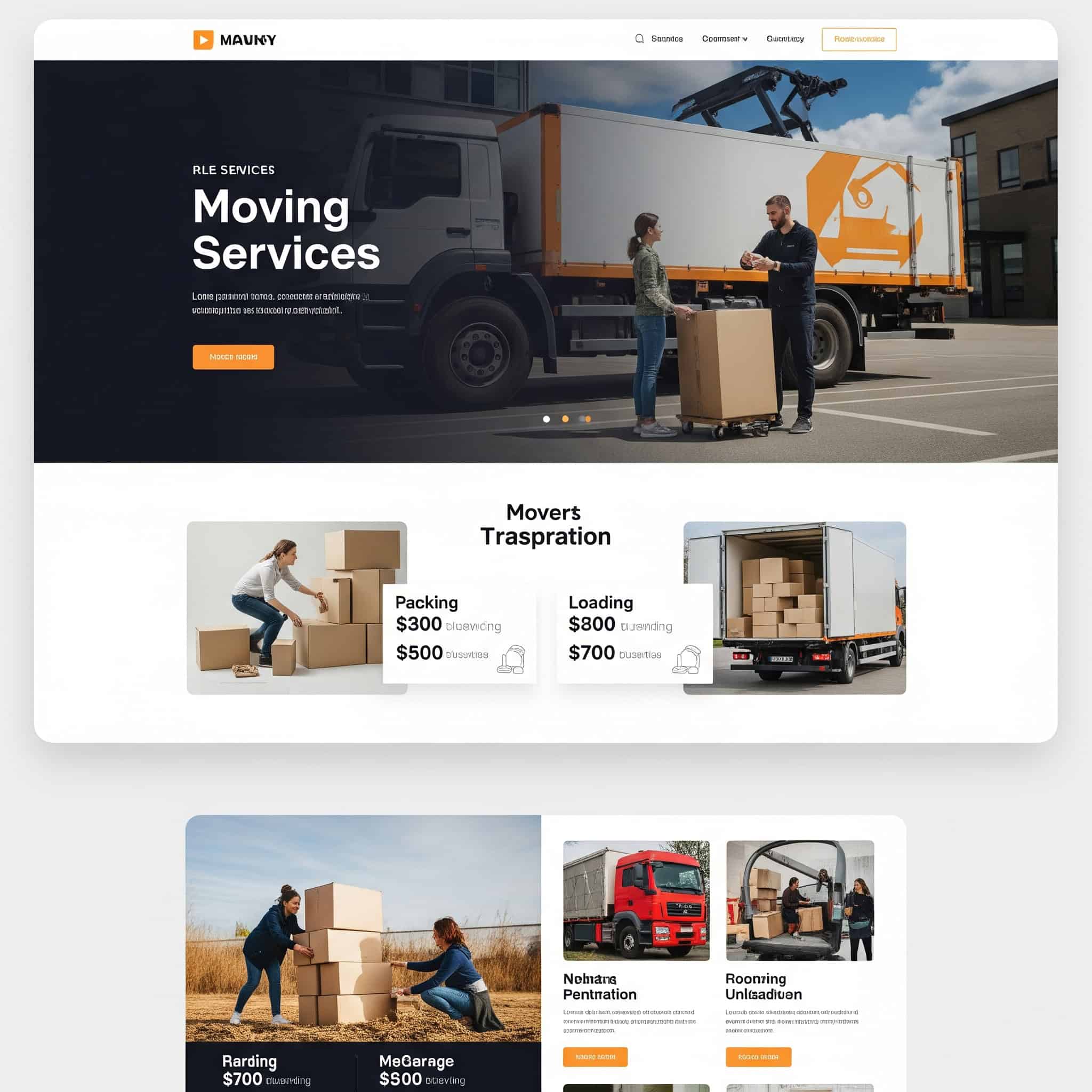

Logistical Moving Services

21. Full-Service International Movers

When moving to Italy, I opted for a full-service international mover to handle everything from packing to customs clearance. Companies like Allied, Schumacher, or Crown Relocations manage the entire process, which was worth the $8,000 I paid for my one-bedroom apartment’s worth of belongings.

Full-service movers provide detailed inventory documentation required for customs clearance, including serial numbers for electronics and valuations for high-value items. This paperwork is essential for smooth customs processing.

Insurance options typically include basic coverage ($.60 per pound) or full-value protection (1-2% of declared value), with specific exclusions for mechanical/electrical failure and items packed by owners. I opted for full-value protection for peace of mind during the long journey.

My advice if you decide to move to Italy this way: book 2-3 months in advance, as schedules fill quickly, especially during summer months. I almost had to delay my move because I waited too long to book.

22. Partial Container Shipping

For friends with fewer belongings, sharing container space through consolidated shipping has been a cost-effective option. Your items are measured by volume (cubic feet/meters) rather than container size, costing $2,000-5,000 for moderate shipments.

Before shipping your belongings to Italy, it’s worth considering what items are truly essential. For bulky or damaged furniture, professional furniture removal services can help dispose of items that aren’t worth the international shipping costs.

Consolidated shipments follow less predictable timelines as they depend on filling a container with multiple clients’ goods, potentially adding 2-4 weeks to transit times. My friend’s shipment took nearly three months to arrive because of consolidation delays.

Customs clearance for consolidated shipments often takes longer as each client’s items must be individually processed, with potential delays if any shipment in the container raises customs concerns. This is another reason to ensure your inventory is accurate and complete.

23. Air Freight for Essentials

For immediate necessities, air freight delivers items within 1-2 weeks but at premium prices ($15-25 per kg). I sent a small shipment of winter clothes and essential documents by air since I moved in October and needed them right away.

Air freight faces stricter restrictions on batteries, liquids, and pressurized containers than sea freight, requiring careful inventory planning and packaging. I had to remove several items from my air shipment because they weren’t allowed.

Dimensional weight calculations (volume-to-weight ratio) often determine air freight costs rather than actual weight, making bulky but lightweight items disproportionately expensive to ship. My duvet, for example, cost more to ship than my much heavier books because of its volume.

24. Storage Solutions

I maintained a small storage unit in the US ($150 monthly) for items I wasn’t sure about shipping immediately when moving to Italy. This allowed me to take a phased approach to my relocation.

Climate-controlled storage units maintain temperatures between 55-85°F and humidity levels of 55%, essential for preserving wooden furniture, electronics, and important documents during extended storage. This was important for my family heirlooms and artwork.

Insurance coverage for stored items typically excludes damage from floods, pests, and mold, requiring supplemental policies for comprehensive protection of valuable items. I added a rider to my homeowner’s insurance to cover my storage unit contents.

Having a storage unit back home also provided peace of mind that if things didn’t work out in Italy, I wouldn’t have to start completely from scratch. It’s a safety net worth considering, especially for your first international move.

25. Sell and Replace Strategy

Liquidating possessions through estate sales, online marketplaces, or consignment shops can offset moving costs. I sold most of my large furniture and appliances before moving to Italy, which helped fund my relocation.

When preparing for your international move, consider estate cleanout services to help liquidate possessions you won’t be taking to Italy, providing a clean slate for your overseas adventure.

Electronics and appliances from the US operate on 110V/60Hz while Italy uses 220V/50Hz, requiring expensive transformers that often still result in suboptimal performance and potential damage. I learned this the hard way when my American blender burned out despite using a transformer.

Italian homes typically have smaller dimensions than American counterparts, with doorways, staircases, and elevators that may not accommodate large American furniture. My American sofa wouldn’t fit through the door of my Italian apartment, so I’m glad I sold it before moving.

Here’s a helpful guide for deciding what to bring:

Item Category | Recommendation | Reasoning | Cost Considerations |

|---|---|---|---|

Electronics/Appliances | Replace | Voltage differences (110V vs. 220V) | Transformers cost $50-200 each and reduce lifespan |

Family Heirlooms/Art | Ship | Irreplaceable sentimental value | Worth insurance premium for safe transport |

Furniture | Case-by-case | Consider size, value, fit in Italian homes | Large American furniture often won’t fit through Italian doorways |

Kitchen Items | Replace basics, ship specialties | Common items available in Italy | Italian kitchens typically smaller with less storage |

Clothing | Ship seasonal rotation | Climate-appropriate attire | European sizing differs; replace gradually |

Books/Media | Digitize when possible, ship selectively | Heavy and expensive to ship | E-readers and digital subscriptions reduce physical needs |

Regional Considerations for American Expats

Northern Italy: Business Hubs and Alpine Proximity

When moving to Italy from the US, I initially considered Milan for its international atmosphere. Northern regions like Lombardy, Piedmont, and Veneto offer robust business environments with higher average salaries. The climate includes colder winters with significant heating costs to consider.

Northern regions operate on a metropolitan ticket system (biglietto integrato) that combines multiple transportation modes under one payment structure, with annual passes offering significant savings for commuters. This makes getting around without a car much easier than in the US.

Building regulations in northern regions require higher energy efficiency standards due to colder winters, resulting in better insulation but higher purchase/rental prices compared to southern properties of similar size. My friend’s apartment in Turin costs nearly twice what I pay in Puglia, but her heating bills are surprisingly reasonable because of better insulation.

Central Italy: Cultural Heartland with Established Expat Communities

Rome, Florence, and Tuscany balance rich cultural heritage with practical amenities. I spent my first year in Florence and benefited from the well-established expat networks that provided support during my transition period.

Living in Italy’s central regions means you’re perfectly positioned for travel throughout the country and beyond. The climate features moderate winters and warm summers, and housing costs fall between northern and southern extremes.

ZTL zones (Zona Traffico Limitato) restrict vehicle access in historic centers, with automated camera systems issuing substantial fines (€80-300) for unauthorized entry, requiring residents to obtain special permits. I got caught in Florence’s ZTL my first week and had to pay a hefty fine – learn from my mistake!

Central regions experience significant seasonal tourism fluctuations, creating dual economies where prices and availability of services vary dramatically between high and low seasons. During summer in Florence, I could barely get a table at my favorite restaurants, but in winter, I had my pick of places.

Southern Italy: Lower Costs with Traditional Lifestyle

I eventually settled in Puglia, where moving to Italy meant embracing a more traditional lifestyle with dramatically lower living expenses—often 40-60% less than northern counterparts. The year-round warm climate reduces utility costs, and I’ve found stronger community bonds here than in the more cosmopolitan north.

Take Robert and Linda, a retired couple from Boston, who compared their monthly expenses between Milan and Lecce (Puglia). Their budget breakdown revealed striking differences: a two-bedroom apartment in Milan’s city center cost €1,500/month versus €600/month in Lecce. Utilities averaged €200/month in Milan (with winter heating costs reaching €300+) compared to €120/month in Lecce. Dining out twice weekly cost approximately €300 in Milan versus €180 in Lecce. Their overall monthly expenses (including food, transportation, entertainment, and healthcare) totaled €3,200 in Milan compared to just €1,800 in Lecce—a 44% reduction that allowed them to live comfortably on their retirement income while enjoying a higher quality of life with more discretionary spending.

Water supply issues affect many southern communities, particularly in summer months, with some areas receiving municipal water only on designated days, necessitating storage tanks (autoclave) in residential buildings. I had to adjust to this reality in Puglia, where water conservation becomes second nature during summer.

Southern regions offer tax incentives for foreign residents and investors, including the 7% flat tax scheme for retirees and reduced income tax rates for professionals relocating to specified southern zones. These incentives have attracted a growing community of digital nomads and remote workers to areas that previously saw little foreign settlement.

Language proficiency becomes more critical in the south as English is less commonly spoken. I’ve had to improve my Italian significantly since moving here, but the effort has been rewarded with deeper connections to my local community.

Technology and Connectivity Adaptations

Mobile Communications and Internet Setup

When moving to Italy, I was surprised that Italian mobile plans require in-person registration with your passport and codice fiscale, even for prepaid options. I chose Iliad for their straightforward pricing (€9.99/month for 120GB), but TIM, Vodafone, and WindTre are also popular options.

Italian mobile contracts typically operate on 30-day renewal cycles rather than calendar months, with automatic renewal unless specifically canceled with notice periods of 30-60 days depending on the provider. This caught me off guard when I tried to switch providers and had to pay for an extra month.

FTTH (Fiber to the Home) coverage reaches approximately 34% of Italian households, concentrated in urban centers, while rural areas often rely on fixed wireless access with lower reliability during adverse weather conditions. I made sure to check internet availability before signing my lease, as working remotely requires reliable connectivity.

Home internet installation typically takes 2-4 weeks and may require landline activation, even if you don’t plan to use a landline phone. I was without internet for nearly three weeks after moving in, which was challenging for someone who works online.

Digital Banking and Payment Systems

Italian banking incorporates different security protocols than US systems. Two-factor authentication often uses physical tokens (dongles) or SMS verification, which can be problematic if you’re traveling and don’t have cell service.

Moving to Italy from the US meant adapting to a new financial ecosystem. SEPA transfers (the European equivalent of ACH) process within one business day within the Eurozone but require IBAN and BIC codes rather than routing and account numbers used in the US system.

PagoPA, Italy’s unified payment platform for public services, requires Italian banking credentials or specific payment cards, creating challenges for newcomers still using US financial products. I couldn’t pay my property tax online until I had an Italian bank account set up.

Payment apps like Satispay, PayPal, and bank-specific applications are widely used, and contactless payment adoption has accelerated, though cash remains important for small transactions. I still keep cash on hand for small shops, markets, and some restaurants that prefer it.

Smart Home and Electronics Compatibility

When moving to Italy, I had to replace most of my electronics due to voltage differences. US electronics require voltage converters (110V to 220V) and often face frequency issues (60Hz vs. 50Hz) that can affect performance.

European energy efficiency labeling (from A+++ to G) differs from US Energy Star ratings, with stricter standards that may make replacement of major appliances more economical than adapting US models. I found this helpful when shopping for new appliances, as the energy ratings are clearly displayed.

Z-Wave smart home devices operate on different frequencies in Europe (868.42 MHz) versus North America (908.42 MHz), making US-purchased equipment incompatible with European controllers despite using the same protocol. I had to replace my entire smart home system when I moved.

Streaming services require VPN solutions to access US content libraries, and gaming consoles and entertainment systems often face region-lock issues requiring workarounds. I maintain a VPN subscription to access US streaming content and to secure my connection on public WiFi.

Family Considerations

Education Options for Children

Moving to Italy with children requires careful planning for their education. International schools in major cities offer American, British, or International Baccalaureate curricula with annual tuition ranging from €5,000-20,000.

International school admissions typically require previous academic records, teacher recommendations, entrance assessments, and proof of vaccinations according to both Italian and school-specific requirements. Application deadlines are often 6-10 months before the academic year begins.

Italian public schools provide free education but require rapid language adaptation. My neighbor’s children struggled initially but became fluent within a year and now have a valuable bilingual education.

Italian public schools operate on a tempo pieno (full time) or tempo modulare (module time) schedule, with the former offering instruction until 4:00-4:30pm including lunch, while the latter dismisses students at 1:00-1:30pm with optional afternoon activities. This schedule difference can significantly impact working parents’ arrangements.

Some cities offer bilingual programs as middle-ground options, combining Italian curriculum with enhanced English instruction at lower costs than full international schools. These programs have become increasingly popular with both expat and Italian families.

Healthcare for Family Members

Children receive comprehensive coverage through the SSN regardless of their parents’ employment status once residency is established. This was a major relief for my friends who moved with their young family.

Italy’s pediatric vaccination schedule includes mandatory vaccinations against 12 diseases, with documentation required for school enrollment and automatic scheduling through the ASL system. The approach to childhood healthcare is very preventive-focused.

Pediatric care follows a different system than adult care, with dedicated family pediatricians (pediatri di base) until age 14. These specialists focus exclusively on children’s health and development, providing continuity of care throughout childhood.

Maternity care includes free prenatal visits, diagnostic tests, childbirth classes, hospital delivery, and postpartum support, with working mothers entitled to 5 months of maternity leave at 80% salary. The support for new parents is significantly better than what I observed in the US.

Pet Relocation Requirements

When I moved to Italy with my dog, I needed to ensure he had a microchip with ISO standard 11784/11785, rabies vaccination at least 21 days before travel but not more than a year old, EU Animal Health Certificate issued within 10 days of travel, and tapeworm treatment since we were coming from the US.

Pet import regulations limit entry to a maximum of 5 animals per person unless proof of participation in competitions, shows, or sporting events is provided. This rarely affects typical families but is good to know if you have multiple pets.

Upon arrival, I had to register my dog with the local veterinary authority (ASL) within 8 days and obtain an EU Pet Passport for future travel. This passport has been invaluable for traveling within Europe with my pet.

The EU Pet Passport system requires annual rabies boosters documented by an Italian veterinarian, with failure to maintain current vaccinations potentially resulting in quarantine if traveling between EU countries. I set calendar reminders to ensure we never miss these important deadlines.

Retirement-Specific Planning

Financial Considerations for Retirees

Many of my retired friends live in Italy and receive their Social Security payments directly deposited to Italian bank accounts without reduction. The US-Italy tax treaty prevents double taxation on retirement income, which simplifies their financial planning.

The 7% flat tax regime (imposta sostitutiva) requires establishing tax residency in qualifying municipalities and applies to all foreign-source income for a maximum period of 9 years. Several retirees I know have taken advantage of this program to significantly reduce their tax burden.

Social Security payments to foreign bank accounts incur a small international transaction fee, but using services like Wise (formerly TransferWise) as an intermediary can reduce currency conversion costs by approximately 2-3% compared to direct bank transfers. These savings add up over time.

Italy offers a special tax incentive for retirees who relocate to towns with fewer than 20,000 residents in southern regions. Required Minimum Distributions from US retirement accounts must still be taken according to US rules, regardless of where you live.

Healthcare Strategies for Seniors

Medicare coverage stops at US borders, which surprises many Americans planning to live in Italy. The SSN provides excellent coverage for chronic conditions and prescription medications at reduced costs for seniors.

Medicare Advantage and Medigap plans must be suspended rather than canceled during foreign residence to preserve re-enrollment rights without medical underwriting upon return to the US. This is crucial if you plan to split time between countries or potentially return to the US.

Italy’s pharmaceutical distribution system categorizes medications into fascia A (essential, fully covered), fascia C (partially covered), and over-the-counter, with seniors receiving additional discounts on fascia C medications based on income. My retired neighbor pays just €2-3 for medications that would cost $50+ in the US.

Private insurance premiums increase significantly with age, making the public system particularly valuable for retirees. Many Italian regions offer additional benefits for residents over 65, including transportation discounts and priority access to certain services.

Age-Friendly Communities

Mid-sized towns often provide better environments for senior expats than major cities or rural villages. When helping my parents plan their potential move to Italy, I looked for flat walking areas, good public transportation, proximity to healthcare facilities, and year-round community activities.

Many Italian municipalities offer senior social programs (centri anziani) providing activities, meals, and community engagement specifically for residents over 65, though participation may require basic Italian language skills. These centers are excellent for integration and building local connections.

Accessibility standards vary significantly—buildings constructed before 1989 often lack elevators and may have exemptions from accessibility requirements, making physical inspection of potential housing essential for those with mobility concerns. I always check for elevator access and proximity to amenities when helping older friends find housing.

Before settling into an Italian retirement community, many seniors need to clear out their American homes. Professional estate cleanout services can help manage this process while you focus on your exciting new chapter abroad.

Coastal towns in regions like Puglia, Abruzzo, and Sicily offer warm climates with lower costs. University towns provide cultural activities and typically maintain better services throughout the year, making them good options for active retirees.

Financial Management Across Borders

Banking and Currency Strategies

I maintain accounts in both countries for flexibility, but this requires careful management. Moving to Italy taught me that specialized services like Wise, Revolut, or OFX offer much better exchange rates than traditional banks, potentially saving thousands annually on transfers.

Italian bank accounts are subject to imposta di bollo (stamp duty) of €34.20 annually if the average balance exceeds €5,000, with the fee automatically deducted from the account. This is just one of many small fees that differ from US banking.

Forward contracts and limit orders through currency exchange services allow locking in exchange rates up to 12 months in advance or executing transfers only when favorable rates occur, providing protection against pension or investment income fluctuations. I use this strategy to transfer larger sums when the exchange rate is favorable.

Italian banks charge account maintenance fees (€50-200 annually) unlike many US banks. Online-only banks like N26 or Revolut provide English interfaces and reduced fees, which has made banking much easier for me as an American. How to move to Italy from USA successfully often comes down to these practical financial arrangements.

Investment and Wealth Management

US brokerage accounts face restrictions when held by Italian residents, with some firms closing accounts upon learning of foreign residency. I had to switch brokerages after moving to find one that accommodates non-resident US citizens.

PFIC (Passive Foreign Investment Company) rules subject US taxpayers investing in most European mutual funds to punitive tax rates and complex reporting requirements on Form 8621. This makes investing in local funds problematic for Americans abroad.

The US-Italy totalization agreement prevents double taxation of social security contributions but requires careful documentation to receive appropriate credits in both systems. This is particularly important for those who work in both countries during their careers.

Italian tax authorities require reporting of all foreign financial assets through the RW form annually. Real estate investments face different tax treatments depending on primary residence status. Specialized cross-border financial advisors familiar with both systems are invaluable for navigating these complexities.

Credit Building in Italy

Italian credit systems differ fundamentally from US models. Credit scores exist but function differently, with emphasis on absence of negative indicators rather than credit history length.

The Central Credit Register (Centrale dei Rischi) maintained by the Bank of Italy tracks loans exceeding €30,000, while the CRIF private credit bureau monitors smaller loans and payment histories. These systems are less transparent than US credit bureaus.

Initial credit access typically begins with secured credit cards or small personal loans from your Italian bank after establishing a relationship. American credit history doesn’t transfer, requiring a fresh start. I had to build credit from scratch despite having an excellent US credit score.

Italian credit cards (carte di credito) typically settle the full balance monthly from your bank account rather than allowing revolving credit, with true revolving credit cards (carte revolving) carrying interest rates of 15-24%. This automatic payment system helps prevent debt accumulation but requires careful cash flow management.

Emergency Preparedness

Medical Emergency Planning

When moving to Italy, I identified English-speaking medical facilities before emergencies occurred. The European emergency number (112) connects to operators who may not speak English fluently, so having key phrases prepared is essential.

The European Emergency Card (tessera europea di assicurazione malattia) or EHIC/TEAM card proves SSN enrollment and guarantees treatment throughout the EU, making it essential to obtain once qualified. I keep mine with my passport when traveling within Europe.

Italy’s guardia medica system provides after-hours medical care when primary physicians are unavailable, with home visits available for those unable to travel to facilities. This service has been invaluable during weekend illnesses when regular doctors’ offices are closed.

I prepared a medical information card in Italian listing my conditions, medications, and allergies. Private hospitals often provide better language support but may require upfront payment, so I keep emergency funds accessible for this purpose.

Natural Disaster Readiness

Italy faces region-specific natural hazards including earthquakes in central regions, flooding in northern areas, and volcanic activity around Naples and Sicily. I registered with the IT-Alert system for emergency notifications on my phone.

Italy’s seismic classification system divides the country into four zones, with building codes and insurance requirements varying accordingly. Properties in Zone 1 (highest risk) face stricter regulations and higher insurance premiums. I checked my apartment’s seismic rating before signing the lease.

The Protezione Civile maintains real-time monitoring systems for natural hazards with public access dashboards showing current alert levels for different regions. I’ve bookmarked their website for quick reference.

When preparing your emergency plans for Italy, review resources like disaster relief guides to understand how emergency response differs from the US system and what preparations are most important.

I familiarized myself with local evacuation routes and emergency protocols and maintain emergency supplies including shelf-stable food, water, and essential medications. I keep digital and physical copies of important documents in waterproof containers, a habit that paid off during a minor flooding event last year.

Legal and Financial Contingencies

I established power of attorney documents valid in both countries, which required working with both a US attorney and an Italian notaio. Creating an Italian will alongside my US will addressed assets in each jurisdiction appropriately.

Italian legal documents require notarization by a notaio (notary public with legal training), whose role differs significantly from US notaries, with powers to draft and authenticate legal documents. Their services are more expensive but provide greater legal certainty.

The US Embassy’s Citizens Services section can assist with emergency passport replacement, notarial services, and coordination with Italian authorities, but cannot provide direct financial assistance or legal representation. I keep their contact information readily available.

I maintain emergency funds in both US and Italian accounts for accessibility regardless of banking system disruptions and ensure family members in both countries have access to critical information. This redundancy provides peace of mind in case of emergencies.

How Jiffy Junk Can Help

Pre-Move Decluttering Services

Transitioning to Italy presents the perfect opportunity to evaluate what truly deserves to make the international journey. Jiffy Junk’s professional team removes unwanted items from your home, apartment, or storage unit with their white-glove service.

Their multi-step removal process includes disassembly of large items when necessary, protecting your property during removal, and thorough cleaning of vacated areas to prepare homes for sale or rental. This comprehensive approach saved me significant time and stress before my move to Italy.

Their team navigates municipal disposal regulations that vary by location, ensuring compliance with local ordinances regarding electronic waste, hazardous materials, and bulk item disposal. This expertise is particularly valuable when you’re focused on international moving logistics and might not have time to research local disposal requirements.

Their comprehensive approach handles everything from furniture and appliances to electronics and general household items, allowing you to focus on the exciting aspects of your international adventure rather than the logistics of disposal.

Environmentally Responsible Disposal

Jiffy Junk prioritizes donation and recycling whenever possible, diverting items from landfills. This environmentally conscious approach aligns perfectly with Italy’s stronger emphasis on sustainability and reduced waste.

Their tracking system documents all donated items, providing receipts that may qualify for tax deductions to offset moving expenses. These deductions can help fund your international relocation.

Their specialized handling procedures for electronics ensure data security while properly recycling components containing hazardous materials that require specific disposal methods. This attention to detail gives peace of mind that sensitive information won’t be compromised.

Their team carefully sorts items, delivering usable goods to local charities and ensuring recyclable materials reach appropriate facilities. This responsible disposal method provides peace of mind during your transition to a country known for its environmental awareness.

Ready to simplify your move to Italy? Contact Jiffy Junk today at 888-543-3992 or visit JiffyJunk.com to schedule your pre-move cleanout and take the first step toward your Italian adventure!

Final Thoughts

Relocating to Italy transforms from dream to reality through methodical planning and realistic expectations. My journey moving to Italy from the US taught me that success hinges on embracing the bureaucratic process with patience while maintaining flexibility when inevitable challenges arise.

The psychological adjustment curve typically includes a “honeymoon phase” (1-3 months), followed by “culture shock” (3-6 months), then “adjustment” (6-12 months), and finally “adaptation” (12+ months), with preparation shortening difficult phases. Understanding this cycle helped me navigate the emotional ups and downs of my first year.

Building language skills opens doors to authentic experiences beyond tourist zones. I started with basic phrases and gradually improved through daily practice, classes, and language exchange meetups. Even imperfect Italian is appreciated by locals.

Cultivating connections with both expat and local communities creates a support network essential during transition periods. I joined Facebook groups for Americans in Italy before arriving and then gradually built relationships with Italian neighbors and colleagues.

Successful long-term residents typically maintain connections to both cultures through dual-language media consumption, participation in both expat and local community events, and regular communication with contacts in both countries. This balanced approach helps prevent homesickness while fostering integration.

The most satisfied expatriates balance appreciation for Italian culture with understanding of systemic differences rather than making constant comparisons. I’ve learned to embrace the Italian approach to time, food, and social connections while adapting my expectations accordingly.

Living in Italy has transformed my perspective on work-life balance, community, and what constitutes a good quality of life. Your Italian chapter begins not when you arrive, but when you commit to the preparation that makes sustainable integration possible.