25 Essential Considerations When Moving to Wales from the US: Your Complete Guide

Moving from the US to Wales represents a significant life change requiring careful planning. While both countries share a language, the differences in immigration requirements, healthcare systems, and daily living can be overwhelming. This comprehensive guide breaks down everything you need to know before packing your bags for the Welsh countryside or city life. I’ve compiled the 25 most critical considerations based on extensive research and real experiences of Americans who’ve made the move successfully.

Table of Contents

Immigration and Legal Requirements

UK Visa Requirements

Residency Pathways

Dual Citizenship Considerations

Post-Brexit Immigration System

Legal Right to Work

Financial and Practical Matters

Cost of Living Comparison

Banking and Finance Setup

Tax Obligations

Currency Exchange Management

Housing Options in Wales

Healthcare and Benefits

NHS Registration Process

US-UK Social Security Agreements

Health Insurance Needs

Prescription Medication Differences

Mental Health Support for Expatriates

Cultural Adaptation

Welsh Language Basics

British vs. American Cultural Differences

Expat Communities in Wales

Weather Adjustment

Education System Differences

Logistics and Planning

International Moving Services

Pet Relocation Requirements

Driving License Conversion

Technology and Service Transitions

Return Planning Considerations

How Jiffy Junk Can Help With Your Move

Final Thoughts

Immigration and Legal Requirements

Understanding the UK’s immigration system forms the foundation of your move to Wales. Post-Brexit changes have created a points-based system that affects how Americans can live and work in the UK. You’ll need to navigate visa applications, understand pathways to permanent residency, and manage the complexities of maintaining dual citizenship status. Each visa type comes with different requirements, costs, and restrictions that will directly impact your life in Wales.

The Immigration Health Surcharge (currently £624 per year) must be paid upfront with most visa applications. This isn’t just an extra fee – it’s your ticket to accessing the NHS during your stay in Wales. The payment covers your basic healthcare needs, though some services may still require additional payments.

Most work-related visas require sponsorship from UK employers who hold a valid sponsorship license. This requirement significantly limits your job mobility until you achieve permanent residency status. I’ve seen many Americans surprised by how this restricts their ability to change jobs easily during their first years in Wales.

1. UK Visa Requirements

Americans need appropriate visas to live in the UK long-term, with options including Skilled Worker visas, Family visas, Global Talent visas, and Innovator visas. Each visa category has specific documentation requirements including proof of finances, employment offers, or family relationships. Processing times typically range from 3-12 weeks, with fees varying from £600-£1,500 plus the Immigration Health Surcharge.

Visa Type | Purpose | Basic Requirements | Processing Time | Cost (2023) |

|---|---|---|---|---|

Skilled Worker | Employment | Job offer from licensed sponsor, salary threshold (£26,200+), English language | 3-8 weeks | £625-£1,423 + IHS |

Family/Spouse | Join UK family | Relationship proof, financial requirement (£18,600+), accommodation | 8-12 weeks | £1,538 + IHS |

Global Talent | Exceptional talent | Endorsement from approved body in science, arts, digital tech | 3 weeks | £623 + IHS |

Student | Study | Offer from licensed institution, financial proof, English language | 3 weeks | £363 + IHS |

Innovator | Start a business | £50,000 investment funds, business plan endorsement | 3-8 weeks | £1,036 + IHS |

Skilled Worker visas require a job offer from a UK employer with a minimum salary threshold. This threshold typically starts at £26,200 but varies by occupation. You’ll also need to prove the position cannot be filled by a UK resident, which your employer must demonstrate during the sponsorship process.

The UK’s priority service can expedite visa processing to 5-7 working days for an additional fee of approximately £500. This service becomes crucial for time-sensitive relocations, especially when coordinating job start dates, housing arrangements, and family moves.

2. Residency Pathways

After living legally in Wales for 5 years, you can apply for Indefinite Leave to Remain (ILR), the UK equivalent of permanent residency. This status costs approximately £2,400 and requires passing the “Life in the UK” test and meeting English language requirements. Following 12 months with ILR status, you become eligible to apply for British citizenship, which involves an additional application fee of £1,330 and a citizenship ceremony.

Time spent in the UK on certain visa types may not count toward the 5-year residency requirement for ILR. Visitor or student visas often don’t contribute to this timeline, making visa planning crucial from the start. I recommend mapping out your long-term residency strategy before even applying for your first UK visa.

The “Life in the UK” test covers British traditions, values, and history with a 75% passing threshold. Preparation materials cost around £20 and the test itself costs £50. Many Americans underestimate the specific historical knowledge required – it’s not just about current events but detailed British history and governmental structures.

3. Dual Citizenship Considerations

The US allows dual citizenship with the UK, but maintaining both statuses requires attention to specific obligations. You must continue filing US tax returns regardless of where you live, report foreign bank accounts exceeding $10,000 through FBAR filings, and manage passport renewals for both countries. Understanding these ongoing responsibilities helps prevent legal complications that could affect your status in either country.

Sarah, a software engineer from Boston, obtained British citizenship after living in Cardiff for seven years. She maintains dual citizenship by carefully tracking her tax obligations to both countries. She files her US taxes annually using the Foreign Earned Income Exclusion, which allows her to exclude her Welsh income from US taxation. She also submits FBAR reports for her UK bank accounts each year. When traveling, she uses her US passport when entering the United States and her UK passport when entering the UK or EU countries, which simplifies immigration procedures and avoids confusion about her status.

The Foreign Bank Account Report (FBAR) must be filed annually with the Financial Crimes Enforcement Network if your non-US accounts exceed $10,000 at any point during the tax year. The penalties for non-compliance start at $10,000 and can increase substantially for willful violations. This reporting requirement catches many dual citizens by surprise.

The US-UK tax treaty contains a “saving clause” that allows the US to tax its citizens as if certain parts of the treaty do not exist. This creates complex tax situations for certain investment types and retirement accounts. I’ve found that working with tax professionals who specialize in expatriate taxation is essential for navigating these complexities.

4. Post-Brexit Immigration System

The UK’s points-based immigration system awards points for factors like job offers, salary levels, English language proficiency, and educational qualifications. You typically need 70 points to qualify for a work visa. The system prioritizes skilled workers in shortage occupations including healthcare, engineering, and information technology. Understanding how points are calculated helps you determine your eligibility before beginning the application process.

The UK’s Shortage Occupation List is updated regularly and provides a 20-point boost in the points-based system. This boost potentially allows for lower salary thresholds in qualifying occupations. Checking this list before your job search can significantly improve your chances of visa approval.

Applicants with PhD degrees receive additional points in the UK’s system. You’ll get 10 points for a general PhD and 20 points for a STEM field PhD relevant to the job. These additional points can be crucial for meeting the 70-point threshold, especially if your offered salary is near the minimum requirement.

5. Legal Right to Work

Your visa must explicitly permit employment in Wales. UK employers are legally required to verify your right to work before hiring you, with substantial penalties for non-compliance. Self-employment requires specific visa types like the Innovator visa. Working without proper authorization can result in deportation and future UK entry bans, making it essential to understand the specific work permissions attached to your visa.

Employers use the UK government’s online checking service to verify work authorization. This system requires your share code and date of birth, with results typically provided within minutes. The process is straightforward but strict – employers face fines starting at £15,000 per unauthorized worker.

Certain activities like remote work for US companies while physically in Wales exist in a legal gray area. These arrangements may violate visa conditions depending on your specific visa type and duration of stay. I’ve seen cases where digital nomads thought they could simply work remotely on tourist visas, only to discover this violated their immigration status.

Financial and Practical Matters

Managing finances across two countries requires careful planning. You’ll need to understand how the cost of living in Wales compares to your current US location, establish banking relationships in the UK, navigate tax obligations to both countries, manage currency exchange efficiently, and find suitable housing. These practical matters directly impact your daily life and financial stability during and after your move.

The US-UK tax treaty contains specific provisions for different types of income including pensions, investments, and property income. These provisions can significantly affect your tax liability, sometimes in unexpected ways. For example, certain US retirement accounts may not receive the same tax-advantaged treatment in the UK.

Welsh property transactions use a Land Transaction Tax rather than Stamp Duty (used in England). This system has different threshold amounts and percentage rates that can affect the total cost of purchasing property in Wales compared to other parts of the UK.

6. Cost of Living Comparison

Housing in Welsh cities like Cardiff averages 30-40% lower than major US cities, while rural Wales offers even more affordable options. Grocery costs are comparable to the US, but dining out tends to be more expensive. Healthcare costs are significantly lower through the NHS. Utilities and internet services typically cost £120-200 monthly. Public transportation is more comprehensive than in most US locations, but petrol (gasoline) costs nearly double US prices.

Expense Category | Cardiff, Wales | New York City, US | Chicago, US | Rural Wales |

|---|---|---|---|---|

Monthly Rent (1BR) | £650-850 | $2,800-3,500 | $1,500-2,000 | £400-600 |

Monthly Utilities | £120-180 | $150-250 | $120-220 | £140-200 |

Public Transport | £65 (monthly pass) | $127 (monthly pass) | $105 (monthly pass) | Limited service |

Restaurant Meal | £15-25 | $25-40 | $20-35 | £12-20 |

Petrol/Gasoline | £1.45/liter (≈$6.60/gallon) | $3.50/gallon | $3.40/gallon | £1.47/liter |

Groceries (monthly) | £200-300 | $400-600 | $300-500 | £180-280 |

Pint of Beer | £4-5 | $7-9 | $6-8 | £3.50-4.50 |

Council Tax (similar to US property tax) varies by property band and local authority. This tax typically ranges from £1,200-2,500 annually, with a 25% discount for single occupants. Unlike US property taxes, Council Tax is based on the property’s value band rather than a percentage of current market value.

Energy costs in Wales are regulated by Ofgem with price caps that change quarterly. This regulation creates more predictable utility expenses compared to many US markets where prices can fluctuate dramatically. The predictability helps with budgeting, though recent energy crises have still led to significant increases.

7. Banking and Finance Setup

Opening a UK bank account requires proof of address and immigration status, which creates a common catch-22 for new arrivals. Major UK banks include Barclays, HSBC, Lloyds, and NatWest. Consider international banks with both US and UK presence for easier transfers. Mobile banking options like Monzo or Starling often offer easier setup for newcomers. Setting up direct debits for bill payments is standard practice in the UK and essential for establishing a credit history.

The UK uses a different credit scoring system than the US, with scores from agencies like Experian ranging from 0-999 rather than the US 300-850 scale. Your US credit history doesn’t transfer to the UK system, meaning you’ll start from scratch regardless of your excellent American credit score.

Most UK banks require proof of address through utility bills or council tax statements. This creates a frustrating situation for newcomers who need a bank account to set up utilities but need utilities to open a bank account. Some digital banks like Monzo accept your BRP (Biometric Residence Permit) as sufficient documentation, making them popular first accounts for Americans in Wales.

8. Tax Obligations

The US-UK tax treaty prevents double taxation, but you must file returns in both countries. The UK tax year runs April 6 to April 5, unlike the US calendar year system. The Foreign Earned Income Exclusion allows Americans to exclude up to about $112,000 (2023 figure) of foreign earnings from US taxes. Working with tax professionals who specialize in expatriate taxation can help navigate these complex requirements and identify available deductions and credits.

The UK operates a Pay As You Earn (PAYE) system where employers withhold income tax and National Insurance contributions. Under this system, most employees never need to file a self-assessment tax return unless they have additional income sources or complex tax situations.

The US Foreign Tax Credit and Foreign Earned Income Exclusion cannot be applied to the same income. This restriction requires strategic planning to minimize your overall tax liability. I typically recommend consulting with tax professionals who understand both systems to develop the optimal approach for your specific situation.

9. Currency Exchange Management

Services like Wise (formerly TransferWise) or OFX typically offer better exchange rates than traditional banks. Consider setting up regular transfers when exchange rates are favorable rather than making as-needed transfers. Some expatriates maintain both dollar and pound accounts to manage currency fluctuations strategically. Poor exchange timing or high fees can significantly reduce your effective income, especially if you’re receiving payments from US sources.

Michael, a remote worker who moved from Seattle to Swansea, needed to manage regular payments from his US-based employer. After comparing several options, he set up a Wise multi-currency account that provided him with both US and UK bank details. His employer deposits his salary to the US account, and Michael then transfers portions to pounds when exchange rates are favorable. He established a monthly automatic transfer for his regular expenses while keeping a dollar reserve that he converts manually when the GBP/USD rate improves. This approach saved him approximately £1,200 in his first year compared to using traditional bank transfers, effectively giving him a 3% raise through smarter currency management.

Forward contracts allow you to lock in current exchange rates for future transfers (typically up to 12 months). These contracts provide protection against currency fluctuations for major expenses like property purchases. They’re particularly valuable during periods of high currency volatility.

Multi-currency accounts from providers like Wise or Revolut offer “borderless” banking with local account details for both the US and UK. These accounts simplify receiving payments in either currency without the need for conversion until you’re ready. They’ve become increasingly popular among Americans in Wales who maintain income sources in both countries.

10. Housing Options in Wales

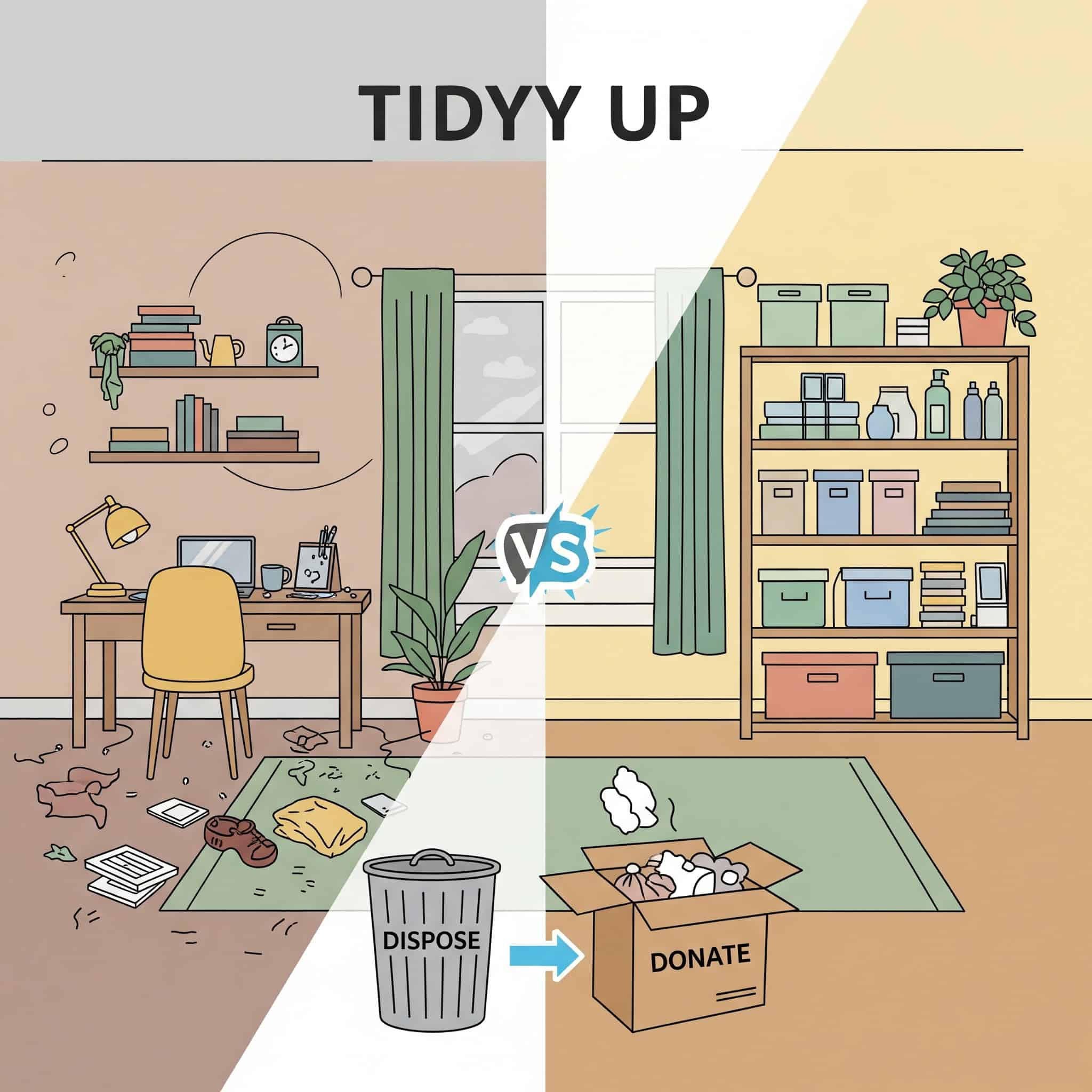

Rental properties typically require references, proof of income, and security deposits equal to 5 weeks’ rent. Property purchases by foreigners are permitted but may require larger down payments (25-40%). Popular expatriate areas include Cardiff Bay, Swansea’s Maritime Quarter, and coastal towns in Pembrokeshire. Rural properties in areas like Snowdonia offer significantly lower prices but may have limited services and transportation options. If you’re planning to sell your US home before moving to Wales, consider how professional junk removal services can help prepare your property for the market with a thorough cleanout and decluttering service.

Welsh rental deposits must be protected in government-approved schemes like the Deposit Protection Service within 30 days of payment. Landlords must provide specific documentation to tenants confirming this protection. Failure to protect deposits can result in penalties of 1-3 times the deposit amount.

Property purchases in Wales use a different legal system than England. The Land Transaction Tax replaces Stamp Duty with different thresholds applying. First-time buyers pay no tax on properties under £225,000, which can represent significant savings compared to similar properties in England.

Healthcare and Benefits

The UK’s National Health Service (NHS) operates fundamentally differently from the US healthcare system. You’ll need to understand how to register with a local doctor, what services are covered, and whether supplemental private insurance makes sense for your situation. Additionally, managing benefits across two countries requires knowledge of specific agreements between the US and UK regarding social security and retirement benefits.

The NHS prioritizes care based on medical need rather than ability to pay. This approach results in potentially longer wait times for non-urgent procedures compared to private US healthcare. Emergency and urgent care receive immediate attention, but elective procedures may have waiting lists of several months.

The US-UK Social Security Agreement (Totalization Agreement) prevents dual taxation for social security contributions. This agreement allows for benefit eligibility based on combined work credits from both countries. Without this agreement, many expatriates would lose benefits they’ve paid into for years.

11. NHS Registration Process

Register with a local General Practitioner (GP) by visiting their office with proof of address and immigration status. The Immigration Health Surcharge paid with your visa application gives you NHS access. Services are generally free at the point of use, but prescriptions in Wales cost £9.35 per item (though Wales offers more exemptions than England). Registration should be a priority upon arrival to ensure immediate access to healthcare services.

While Wales charges for prescriptions, certain groups receive free prescriptions. These groups include those under 25, over 60, pregnant women, and people with specific medical conditions. The exemption system is more generous than in England, where most adults pay for all prescriptions.

The NHS operates a triage system where GPs serve as gatekeepers to specialist care. This system requires referrals for most specialist consultations, unlike the direct access often available in the US system. Understanding this fundamental difference helps set appropriate expectations for how you’ll access healthcare in Wales.

12. US-UK Social Security Agreements

The US-UK Totalization Agreement allows work credits to count toward retirement benefits in both countries. You can receive US Social Security benefits while living in Wales, with payments deposited directly to your bank account. Medicare does not cover care received in the UK, so additional planning is needed for retirement healthcare. Understanding how your work history in both countries affects future benefits helps with long-term financial planning.

To claim benefits under the agreement, you must have at least 18 months of coverage in one country. The agreement then allows combined credits to meet minimum eligibility requirements. This provision prevents expatriates from falling through the cracks of both systems.

US Social Security payments to beneficiaries living abroad are not subject to the annual cost-of-living adjustments if you reside in certain countries. Fortunately, the UK is exempt from this restriction, meaning your benefits will continue to receive inflation adjustments while you live in Wales.

13. Health Insurance Needs

While the NHS covers most healthcare needs, private insurance (starting around £30-100 monthly) can provide faster access to specialists, private hospital rooms, and certain treatments not covered by the NHS. Companies like Bupa and AXA offer expatriate-specific plans that complement NHS coverage. Those with chronic conditions may want to consider supplemental coverage to reduce wait times for non-emergency treatments.

Healthcare Comparison | NHS (Public) | Private UK Insurance | US System Equivalent |

|---|---|---|---|

Primary Care Access | Free, GP registration required | Faster appointments, same GPs | Similar to HMO with referral requirements |

Specialist Wait Times | 4-18 weeks average | 1-2 weeks average | Varies by insurance, often 1-4 weeks |

Emergency Care | Free, immediate for true emergencies | Same NHS emergency services | Similar service, significantly higher cost |

Prescription Costs | £9.35 per item in Wales | Often included in plans | Varies widely by US insurance plan |

Dental Services | Limited NHS coverage, subsidized prices | Comprehensive coverage available | Similar to US dental insurance |

Mental Health | Free but limited availability | More options, shorter wait times | Similar to US mental health coverage |

Maternity Care | Comprehensive free care | Private rooms, more choice of care | Similar service, significantly higher cost |

Monthly Cost | Covered by Immigration Health Surcharge | £30-250 depending on coverage | $400-800 for comparable US insurance |

Private health insurance in the UK typically operates as a secondary layer on top of NHS care rather than as a replacement. Most plans cover specialist consultations, diagnostics, and hospital treatment while still relying on the NHS for primary and emergency care.

International health insurance plans that cover both the UK and US can be valuable for frequent travelers or those maintaining connections in both countries. These comprehensive plans offer coverage regardless of location but come with significantly higher premiums, typically starting around £300 monthly.

14. Prescription Medication Differences

Many medications have different brand names in the UK. Bring a detailed list of all medications (including generic names) to your first GP appointment. Some US prescription medications may be unavailable or require different protocols in the UK. Establish care early to ensure continuation of necessary treatments and discuss alternatives if your current medications aren’t available in Wales.

The UK’s National Institute for Health and Care Excellence (NICE) evaluates medications differently than the FDA. This different evaluation process results in some newer medications being unavailable or restricted to specific patient populations. Medications that have been on the market for years in the US might still be considered experimental in the UK.

Controlled substances have stricter regulations in the UK, with some US-prescribed medications like Adderall being heavily restricted or unavailable. These restrictions often require alternative treatment plans developed with UK physicians. I recommend bringing detailed medical records if you take any controlled substances to facilitate these conversations.

15. Mental Health Support for Expatriates

The NHS provides mental health services, but waiting times can be long for non-urgent care. Private therapy costs £50-100 per session. Online resources like InterNations and Expat Focus offer forums for connecting with others experiencing similar adjustment challenges. Universities often have international student services that can help with cultural transition. Recognizing the emotional impact of relocation and having support systems in place is crucial for successful adjustment.

The NHS offers a program called Improving Access to Psychological Therapies (IAPT). This program provides evidence-based treatments like CBT, typically with shorter wait times than specialist mental health services. Self-referral is often possible, making it more accessible than other parts of the mental health system.

Telehealth options that allow continued care with US-based mental health providers may be possible but face regulatory challenges. These challenges include licensing restrictions and insurance limitations. Some expatriates maintain therapy relationships with US providers through private arrangements, though this typically requires out-of-pocket payment.

Cultural Adaptation

While the US and UK share a language, cultural differences can be surprising and significant. Understanding Welsh language basics, British social norms, finding expatriate communities, adjusting to the weather, and navigating the education system all contribute to successful integration. These factors directly impact your daily interactions and overall satisfaction with life in Wales when moving to Wales from the US.

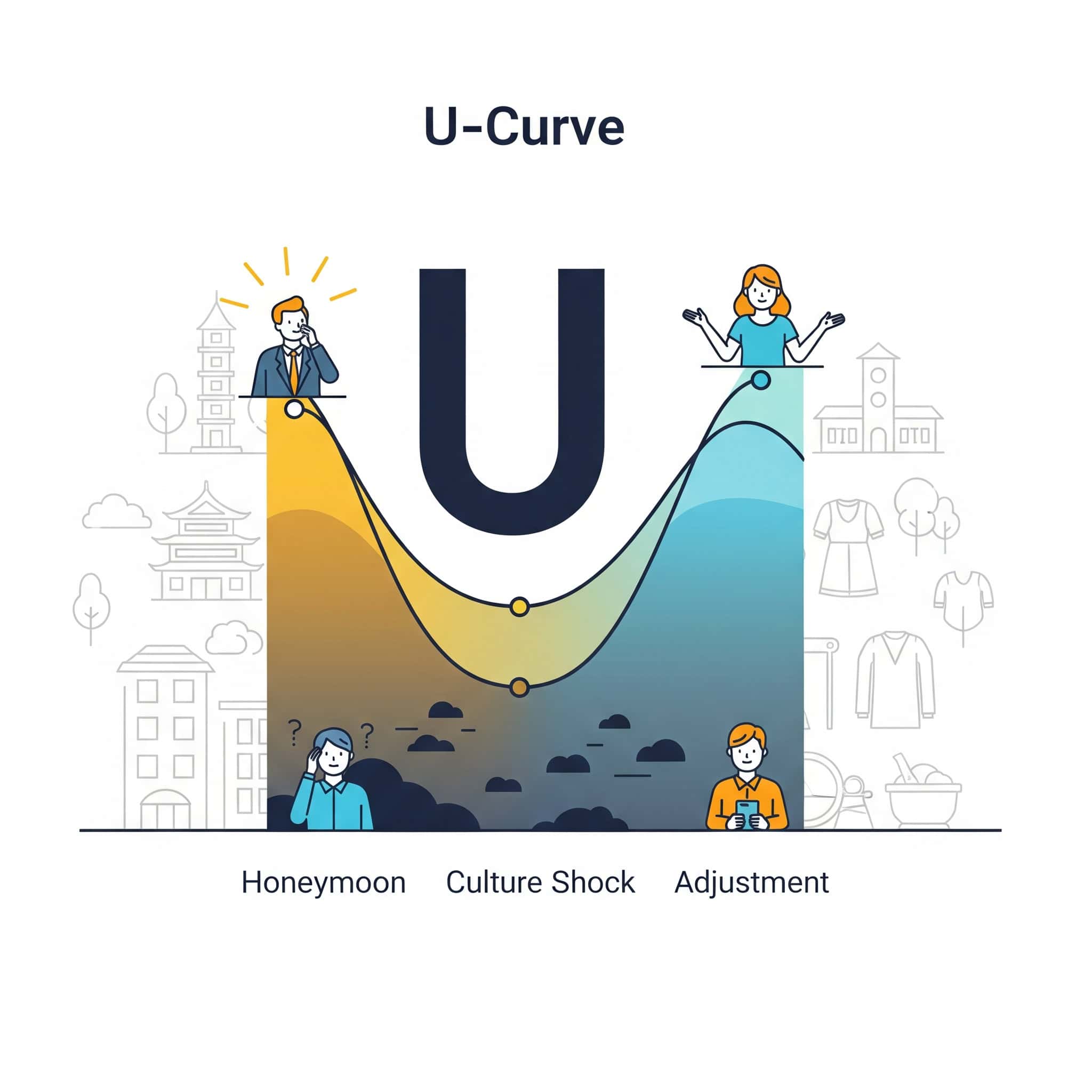

Cultural adaptation typically follows a U-curve pattern with initial excitement, followed by a “culture shock” period of frustration, before eventual adjustment and integration. Recognizing this pattern helps normalize the challenges you’ll face during the transition period.

Research shows that expatriates who engage with local culture while maintaining connections to their home culture report higher satisfaction and better mental health outcomes. This balanced approach allows you to integrate into Welsh society while preserving your American identity.

16. Welsh Language Basics

While English is universally spoken, approximately 29% of the Welsh population speaks Welsh, with higher percentages in northern and western regions. Learning basic phrases like “Bore da” (good morning), “Diolch” (thank you), and “Croeso” (welcome) is appreciated, especially in areas like Gwynedd and Anglesey where Welsh is more commonly spoken. Road signs and official documents are bilingual throughout Wales, making some familiarity with Welsh helpful.

The Welsh Language (Wales) Measure 2011 gives Welsh equal legal status with English in Wales. This legislation results in bilingual official documentation and services throughout the country. Even in predominantly English-speaking areas, government communications arrive in both languages.

Free Welsh language courses are available through the National Centre for Learning Welsh (Dysgu Cymraeg). These courses range from casual conversation groups to intensive immersion programs. Many Americans find that even basic Welsh language skills open doors to deeper cultural connections and local friendships.

17. British vs. American Cultural Differences

British people tend to be more reserved initially and use more indirect communication styles. Humor is often self-deprecating and ironic. Queuing (standing in line) is taken seriously. Tipping practices differ, typically 10-15% in restaurants if service charge isn’t included, but not expected in pubs. Work-life balance generally favors more vacation time than in the US, with most full-time workers entitled to 28 days of paid leave annually.

British communication often employs understatement where “not bad” can mean excellent and “quite good” might indicate disappointment. This communication style requires attention to context and tone rather than just the words themselves. Many Americans initially find this confusing until they adjust to reading between the lines.

The concept of “taking the mick” (gentle mockery) is a form of social bonding in British culture. This teasing can be misinterpreted by Americans as rudeness or criticism when it’s actually a sign of acceptance. Once you understand this dynamic, it becomes easier to participate in the banter that characterizes many British social interactions.

18. Expat Communities in Wales

Cardiff and Swansea have the largest American expatriate communities. Organizations like InterNations host regular meetups. University cities offer international groups. Facebook groups like “Americans in Wales” or “Expats in Cardiff” provide connection opportunities. The US Embassy maintains a list of American organizations throughout the UK. Finding these communities can provide practical advice, social connections, and emotional support during your transition.

Jennifer, a marketing professional from Chicago, initially struggled with loneliness after moving to Cardiff. She joined the “Americans in Wales” Facebook group and attended her first meetup at a local pub within two weeks of arrival. Through this group, she found a weekly language exchange that helped improve her cultural understanding while making local friends. She also connected with a fellow American who had lived in Wales for five years and became her informal mentor, providing invaluable advice about everything from finding a reliable plumber to understanding the nuances of Welsh humor. Within six months, Jennifer had built a diverse social network of both expatriates and locals, significantly easing her transition and enriching her experience of Welsh life.

The American Women’s Club of London has satellite groups throughout the UK including Wales. These groups offer networking, social events, and resources specifically for American women. They often organize cultural outings, professional development opportunities, and social gatherings that help combat isolation.

University cities like Swansea, Cardiff, and Bangor have international student and staff associations that often welcome non-academic expatriates. These associations frequently host events and provide support services that can be valuable resources for Americans adjusting to life in Wales.

19. Weather Adjustment

Wales receives significantly more rainfall than most US regions (approximately 1,400mm/55 inches annually). Winter temperatures are milder but damper than many US regions, rarely dropping below freezing but feeling colder due to humidity. Summer temperatures typically range from 15-25°C (59-77°F). Homes are built to retain heat rather than for cooling, and air conditioning is uncommon. The frequent rain and limited sunshine can affect lifestyle and potentially mental health.

Seasonal Affective Disorder (SAD) affects approximately 2-8% of people in northern European countries due to reduced sunlight. Light therapy lamps and vitamin D supplements are commonly recommended to combat these effects. Many Americans find they need to be more proactive about mental health during the darker winter months.

Welsh microclimates vary significantly, with coastal areas experiencing milder temperatures while inland mountainous regions like Snowdonia can see snow and freezing temperatures regularly in winter. This variation means your experience of Welsh weather will depend greatly on which region you choose to settle in.

20. Education System Differences

The Welsh education system follows a curriculum distinct from England’s. School years are organized differently, with “Year 1” starting at age 5. Universities charge international student fees to Americans (£15,000-25,000 annually) until settled status is achieved. Schools often require uniforms, even in public (state) schools. The academic year typically runs September to July with longer breaks at Christmas and Easter and a six-week summer holiday.

Wales implemented a new Curriculum for Wales in 2022 focusing on six areas of learning rather than traditional subjects. This approach represents a significant departure from both the English system and US approaches. The curriculum emphasizes skills development alongside knowledge acquisition.

School catchment areas strictly determine eligibility for state schools. This system makes housing location crucial for families with school-age children who want specific educational options. Many expatriate families research school performance and catchment areas before deciding where to live in Wales.

Logistics and Planning

The practical aspects of physically moving to Wales require careful coordination. You’ll need to arrange international shipping, understand pet relocation requirements, convert your driving license, adapt to different technological standards, and maintain connections to the US. These logistical considerations directly impact the smoothness of your transition and your ability to settle comfortably in your new home.

International moves typically require 3-6 months of planning time for optimal coordination. This timeline allows for proper sequencing of visa timing, housing arrangements, shipping logistics, and financial transitions. Starting too late often results in rushed decisions and higher costs.

Creating a detailed timeline with dependencies mapped out helps prevent costly delays and complications. For example, you’ll need visa approval before giving notice at work, and housing arrangements confirmed before shipping your belongings. I recommend working backward from your target arrival date to establish key milestones.

21. International Moving Services

Container shipping costs from the US to Wales typically range from $3,000-10,000 depending on volume. Door-to-door services like Allied, Crown Relocations, and Anglo Pacific specialize in US-UK moves. Shipping typically takes 4-8 weeks by sea. Consider whether to ship furniture or buy new items, as UK homes often have different dimensions than US homes. Getting multiple quotes and understanding insurance coverage is essential for protecting your belongings. Before shipping your belongings overseas, consider using professional junk removal services to eliminate items that aren’t worth transporting, as explained in our guide on decluttering for international moves.

Full container loads (FCL) provide exclusive use of a shipping container while less than container loads (LCL) share space with other shipments. LCL offers cost savings but comes with longer transit times due to consolidation with other shipments. For smaller moves, LCL can reduce costs by 30-50%.

UK customs requires a comprehensive inventory with values for all shipped items. Potential VAT and duty charges apply on new items valued over £1,500 total. Used personal effects and household goods owned for more than six months generally enter duty-free, but proper documentation is essential to prove their status.

22. Pet Relocation Requirements

The UK requires pets to be microchipped, vaccinated against rabies at least 21 days before travel, and have an Animal Health Certificate issued within 10 days of travel. Certain dog breeds are prohibited. Airlines charge $200-500 for pet transport in cargo. Consider pet transport specialists like PetAir UK for complex relocations. Planning should begin at least 4 months before travel to ensure all veterinary requirements are met.

The UK no longer accepts the EU Pet Passport from US travelers and requires the Animal Health Certificate. This certificate must be issued by a USDA-accredited veterinarian and endorsed by your state’s USDA office. The process typically takes 1-2 weeks and costs $150-300 depending on your location.

The UK has banned certain dog breeds including Pit Bull Terriers, Japanese Tosas, Dogo Argentinos, and Fila Brasileiros. Mixed breeds showing substantial characteristics of these types are also prohibited. This ban is strictly enforced, and affected dogs will be denied entry regardless of temperament or training.

23. Driving License Conversion

Americans can drive on a US license for 12 months, after which a UK license is required. The UK drives on the left side of the road. Converting to a UK license requires passing both theory and practical driving tests; there’s no automatic conversion. Car insurance is significantly more expensive for recent arrivals without UK driving history. Consider taking refresher lessons to adjust to UK road rules and left-side driving before your test.

The UK theory test consists of multiple-choice questions and a hazard perception test using video clips. You’ll need a 86% pass mark for the questions and 44/75 for hazard perception. The test covers UK-specific road signs and rules that differ significantly from US standards.

Insurance companies typically charge new UK residents without local driving history 3-5 times the standard premium for the first year. These premiums decrease as you build no-claims history. I’ve found that shopping around extensively and considering telematics-based policies can help reduce these initial high costs.

24. Technology and Service Transitions

The UK uses 220-240V electricity (versus 110-120V in the US), requiring adapters or new appliances. Mobile phone plans are generally cheaper than in the US, with providers like EE, Vodafone, and O2 offering pay-as-you-go options for newcomers without credit history. TV licensing (£159 annually) is required for watching live television, including through streaming services. Internet services typically offer faster speeds at lower costs than comparable US services.

Simple voltage converters work for non-heating devices, but appliances with heating elements (hair dryers, coffee makers) require transformer-based converters or replacement with UK-compatible versions. I generally recommend replacing these items rather than using converters long-term.

The UK uses different frequency (50Hz vs 60Hz in the US) which can affect the performance of motor-driven appliances even with proper voltage conversion. This difference can cause issues with appliances like fans, vacuum cleaners, and some kitchen appliances, potentially shortening their lifespan.

25. Return Planning Considerations

Maintain a US address (often through family or mail forwarding services) for financial accounts, voting, and tax purposes. Keep US credit active with occasional use to maintain credit history. Consider whether to rent or sell US property. Regularly review visa status and renewal requirements to avoid complications if a return becomes necessary. Having a contingency plan provides peace of mind and practical benefits regardless of how long you stay in Wales.

Mail forwarding services like US Global Mail provide a permanent US address with mail scanning and forwarding services. These services are crucial for maintaining US financial accounts and receiving important documents. They typically cost $10-30 monthly depending on volume and services needed.

The IRS requires a US address for tax filing purposes, with specific procedures for taxpayers living abroad. These procedures affect refund processing and communication methods. Maintaining a legitimate US address prevents complications with tax filings and ensures you receive important notices.

How Jiffy Junk Can Help With Your Move

Before embarking on your international move to Wales, decluttering your American home is a crucial step that can save you thousands in shipping costs. Jiffy Junk offers comprehensive junk removal services that make this process efficient and environmentally responsible. Their teams can clear out unwanted furniture and appliances that won’t work with UK electrical systems, responsibly dispose of items through donation and recycling, handle the heavy lifting from attics to basements, and leave your property “broom clean” with their White Glove Treatment. When preparing for your international move, consider our specialized estate cleanout services to help you thoroughly sort through belongings before relocating to Wales.

Jiffy Junk’s sorting process identifies items suitable for donation to local charities, diverting usable goods from landfills while potentially providing tax deduction documentation. This approach benefits both your wallet and the environment.

Professional decluttering services can reduce international shipping volume by 30-50% for typical households. This reduction translates to $1,000-5,000 in direct shipping cost savings. I’ve worked with many clients who were shocked by how much they were planning to ship unnecessarily until we helped them sort through their belongings.

Whether you’re preparing your home for sale or rental while you’re abroad, or simply need to downsize before your international move, Jiffy Junk’s efficient service reduces the stress of your transition. Their commitment to environmentally responsible disposal means your possessions might find new homes rather than ending up in landfills. Before moving overseas, many Americans need to clear out furniture that won’t be making the journey; our furniture removal guide explains how professional services can simplify this process.

Ready to simplify your move to Wales? Contact Jiffy Junk today for a free consultation on how their junk removal services can make your international relocation smoother and more cost-effective.

Final Thoughts

Moving to Wales offers Americans a unique opportunity to experience life in a country that balances rich history with modern amenities. While the process involves numerous considerations across legal, financial, healthcare, cultural, and logistical categories, proper planning makes these challenges manageable. The 25 considerations outlined in this guide provide a framework for your preparations, helping you anticipate and address potential obstacles before they become problems. With thorough research and appropriate professional assistance, your transition to Welsh life can be a rewarding adventure rather than an overwhelming ordeal. For additional perspectives on international relocation, check out our comprehensive guide on moving to Scotland from the US, which shares many similarities with the Welsh experience.

Successful international relocations typically involve a preparation phase of 6-12 months. Visa applications should be started 3-6 months before intended move dates to allow for processing times and potential delays. This timeline gives you sufficient flexibility to coordinate the many moving parts of your relocation.

Research shows that expatriates who maintain flexibility in their expectations and embrace cultural differences report higher satisfaction rates and longer stays in their new countries. Approaching your move with an open mind and willingness to adapt significantly improves your experience.

Remember that thousands of Americans have successfully relocated to Wales before you. Connect with expatriate communities both online and in person to learn from their experiences. Government resources from both the US State Department and UK Home Office provide official guidance, while professional services can address specialized needs from immigration law to international taxation. Your Welsh adventure awaits—with proper planning, it can be the beginning of an exciting new chapter in your life.