Moving to France from the US: 25 Essential Options for a Smooth Transition

Moving from the US to France represents a significant life change requiring careful planning across multiple areas. From navigating visa requirements to finding housing, understanding healthcare, managing finances, and integrating culturally, each aspect demands attention to detail. This comprehensive guide breaks down the 25 most important options across five key categories to help you plan your move effectively and minimize stress during your transition to French life.

Table of Contents

Visa and Legal Pathways

Long-Stay Visitor Visa

Work Visa

Self-Employed Professional Visa

Student Visa

Talent Passport

Housing and Relocation Options

Long-Term Apartment Rental

Short-Term Furnished Rental

Property Purchase

House Swap Programs

International Relocation Services

Healthcare and Insurance

French Public Healthcare (PUMA)

Private Health Insurance

Mutuelle (Supplementary Insurance)

International Health Insurance

Retiree Healthcare Options

Financial and Banking

Opening French Bank Accounts

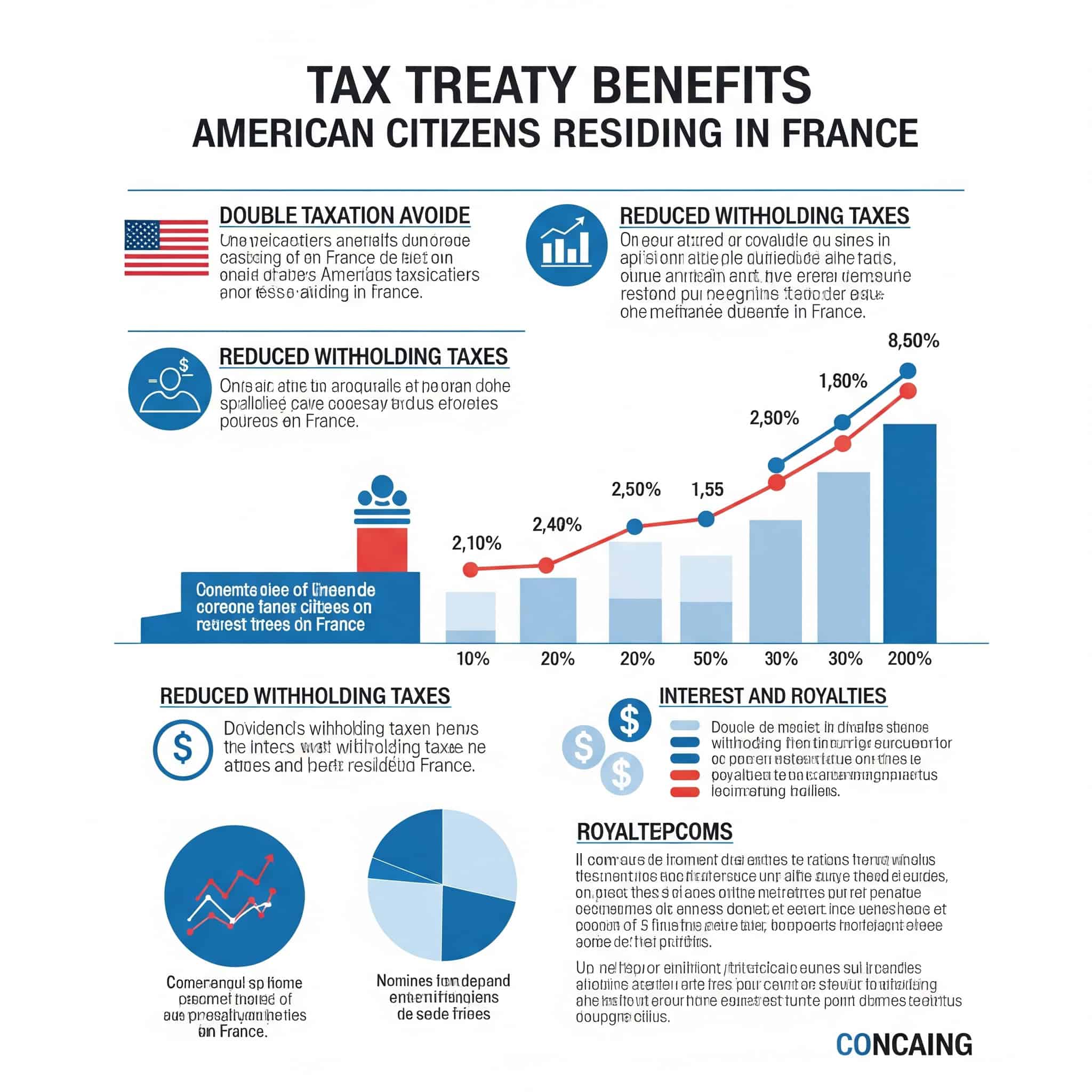

Tax Treaty Benefits

Pension and Social Security Management

Currency Exchange Solutions

Investment Portfolio Adjustments

Cultural Integration and Practical Support

Language Immersion Programs

Expat Community Networks

Cultural Integration Courses

Administrative Support Services

Digital Nomad Setups

Visa and Legal Pathways

Securing the right visa is your first critical step for legally living in France. Each visa type serves different purposes and comes with specific requirements, application processes, and limitations. Your choice depends on your situation—whether you’re retiring, working, studying, or starting a business—and will determine your rights and obligations during your stay in France.

Visa Type | Best For | Duration | Work Rights | Key Requirements |

|---|---|---|---|---|

Long-Stay Visitor | Retirees, Self-sufficient individuals | 1 year (renewable) | Not permitted | €1,500/month per person, health insurance, accommodation |

Work Visa | Employed professionals | 1 year (renewable) | Full-time with sponsoring employer | Job offer, labor market test, minimum salary thresholds |

Self-Employed | Entrepreneurs, freelancers | 1 year (renewable) | Self-employment only | Business plan, proof of funds (€30,000+), qualifications |

Student | Students at French institutions | Duration of program | 20 hours/week | Acceptance letter, €615/month, health insurance |

Talent Passport | Highly skilled professionals | Up to 4 years | Full work rights | Varies by category (10 options), higher qualification/salary requirements |

1. Long-Stay Visitor Visa (VLS-TS Visiteur)

This visa is perfect if you’re retiring or have enough savings to support yourself without working in France. I had to prove I was financially self-sufficient with about €1,500 monthly per person, plus show I had comprehensive health insurance and secured housing.

The application process gets pretty detailed with financial statements. My consulate wanted to see stable passive income or substantial savings—they were looking for at least €18,000 annual income per person to make sure I wouldn’t need public assistance. When it came time for renewal at the prefecture in France, they started looking more closely at my integration efforts, including whether I’d picked up basic French language skills.

The initial visa is valid for one year, and you can renew it if you maintain the required conditions and continue not working in France. This option gives you the freedom to enjoy French life without employment restrictions, making it popular among retirees and those with investment income.

2. Work Visa (VLS-TS Salarié)

Got a job offer from a French company? You’ll need this visa, but there’s a catch—your employer must get authorization from French labor authorities before you can even apply. Your position typically needs to meet minimum salary thresholds and be one that couldn’t be filled by EU citizens.

The labor market test (opposabilité de la situation de l’emploi) is a real hurdle. Your employer has to prove they couldn’t find qualified EU candidates for the position. Some high-demand professions are exempt from this requirement, which can make things easier. Salary requirements vary by profession but generally must hit at least 1.5 times the French minimum wage (SMIC), with specialized positions requiring even higher pay.

The process involves both you and your employer. They’ll file initial paperwork with DIRECCTE before you apply at the French consulate. It’s complex but worth it for the right opportunity to work in France.

3. Self-Employed Professional Visa (VLS-TS Entrepreneur/Profession Libérale)

Freelancers, consultants, and entrepreneurs, this one’s for you! I had to present a viable business plan, proof of financial resources, and relevant qualifications. The French authorities wanted to see that my business had potential viability in France and that I had expertise in my field.

My application required a detailed business plan including market analysis and financial projections for at least three years. I also had to show proof of sufficient startup capital—typically €30,000+ for most business types. Professional qualifications must be documented thoroughly, and certain regulated professions like healthcare, law, and accounting require formal recognition of credentials through specific French authorities.

This option provides flexibility for independent professionals but demands serious preparation. The upside is being your own boss while living in one of the world’s most beautiful countries.

4. Student Visa (VLS-TS Étudiant)

With acceptance to a recognized French educational institution, you can apply for this visa through Campus France in the US before completing your consulate application. When moving to France from the US for education, I needed to prove financial means (approximately €615 monthly) and have health insurance.

The Campus France application process includes creating an online profile, uploading acceptance documents, and completing a pre-consular interview, which is mandatory before the actual visa application. Student residence permits can be extended based on academic progress, with opportunities to switch to work permits after graduation through the recently expanded post-study work authorization program.

Sarah, a 28-year-old graphic designer from Boston, secured a Student Visa to pursue a Master’s degree in Design at École des Arts Décoratifs in Paris. She applied through Campus France four months before her program started, submitting her acceptance letter, bank statements showing €7,500 in savings, and comprehensive health insurance. After arrival, she registered with OFII, obtained her residence permit, and was able to work 20 hours weekly at a local design studio while studying. Upon graduation, she used the post-study work authorization to transition to a full-time position with a French company, eventually converting to a Work Visa without returning to the US.

Benefits include permission to work part-time (20 hours weekly) and access to student housing and benefits, making this an excellent pathway for those pursuing education in France.

5. Talent Passport (Passeport Talent)

This multi-year residence permit targets highly qualified professionals, entrepreneurs, investors, and artists. Requirements vary by category but generally demand exceptional skills or significant investment.

Ten distinct categories exist within the Talent Passport framework, each with specific criteria: innovative entrepreneurs must be recognized by a French tech incubator; investors must commit at least €300,000; and qualified employees must earn at least 2x the average annual salary. Family members receive the same duration permit automatically without separate work authorization applications, unlike with standard work visas where family work permits require separate procedures.

The main advantage is its longer validity (up to four years initially) with a simplified renewal process and automatic inclusion of family members, making it ideal for those with specialized expertise moving to France.

Housing and Relocation Options

Finding suitable housing represents one of the most practical challenges when moving to France. Options range from long-term rentals to property purchases, each with distinct processes, requirements, and benefits. Your choice depends on your timeline, budget, and how permanent you expect your move to be, with several pathways available to ease your transition.

6. Long-Term Apartment Rental

Standard unfurnished apartments in France typically come with three-year leases, offering stability but requiring more commitment. I worked with a real estate agent (immobilier) and searched platforms like SeLoger.com, but was surprised by the substantial documentation required—work contracts, bank statements, previous tax returns, and often a guarantor.

The dossier de location (rental application file) was intense! I needed my last three pay stubs, tax returns, employment contract, bank statements, previous landlord reference, and identification—all documents that new arrivals may struggle to provide. French rental law heavily favors tenants, with strict regulations on deposit amounts, rent increases, and eviction procedures. I learned that unfurnished apartments cannot have rent increased during the lease term except through an indexed formula specified in the contract.

Expect to pay a security deposit of 1-3 months’ rent plus potential agency fees. The process is rigorous but results in strong tenant protections once you’re in.

7. Short-Term Furnished Rental

Furnished rentals offer more flexibility with one-year renewable leases, making them ideal for your initial transition period. While monthly costs run 30-50% higher than unfurnished properties, they include utilities and furnishings with fewer upfront expenses.

Before moving to France, many Americans need to declutter their homes. A comprehensive decluttering guide can help you determine what to take with you and what to leave behind.

These rentals are legally classified as “mobility leases” (bail mobilité) and must meet minimum furnishing requirements including bedding, refrigerator, cooking facilities, tableware, and seating proportionate to the accommodation capacity. Tenant protection differs from unfurnished rentals, with shorter notice periods (one month versus three) and simplified termination procedures, though landlords also have more flexibility in non-renewal.

Platforms like Furnished Finder, Spotahome, or agencies specializing in expatriate housing can help you find suitable options that ease your initial settlement. I found this option gave me time to learn different neighborhoods before committing to something more permanent.

8. Property Purchase

Non-residents can legally buy real estate in France, though the process differs significantly from US practices. I searched via real estate agents and property websites, made an offer, signed a preliminary contract (compromis de vente), then completed the process with a notary.

The compromis de vente creates a legally binding agreement with a 10-day cooling-off period for the buyer only. After this period, backing out results in forfeiting the deposit (typically 5-10% of purchase price). Property transactions must be handled by a notaire (notary), a public official who verifies the legal status of the property, ensures no outstanding claims exist, calculates taxes due, and registers the deed—their involvement is mandatory, not optional.

Budget for notary fees (7-8% of purchase price), possible agency fees (3-5%), and property taxes. Non-residents can obtain French mortgages but expect higher down payments of 30-50%. Despite the complexity, owning property in France can be both a lifestyle choice and a solid investment.

9. House Swap Programs

Temporary exchanges with French homeowners through services like HomeExchange, HomeLink, or InterVac let you test different regions before committing to a permanent move. I created a profile, connected with French homeowners interested in US stays, and arranged exchange details.

Insurance considerations are critical, as standard homeowners policies may not cover exchange guests. I had to get specialized home exchange insurance or specific riders to my existing policies. Your legal status remains as a tourist during house swaps, limiting stays to 90 days within any 180-day period unless you obtain a proper visa, making this option suitable for exploratory visits rather than permanent relocation.

This approach allows you to live like a local, explore different areas, and reduce initial housing costs while deciding where to settle permanently. It’s a fantastic way to get authentic experience in different regions before making a bigger commitment.

10. International Relocation Services

Full-service relocation companies like Cartus, Crown Relocations, or Santa Fe Relocation handle everything from visa support to housing searches, school placement, moving logistics, and cultural training.

Service tiers typically include “essential” (basic orientation and housing search), “comprehensive” (adding school placement and settling-in services), and “executive” (adding spousal career assistance and extensive cultural training). Destination Service Providers (DSPs) often maintain relationships with landlords and agencies willing to be flexible with documentation requirements for newcomers, potentially accessing properties not available to individual applicants.

While expensive (€3,000-10,000 depending on service level and family size), these services save considerable time and stress by managing the complex details of your international move with professional expertise. For those with employer support or sufficient budget, this option removes much of the relocation stress.

Healthcare and Insurance

France’s healthcare system consistently ranks among the world’s best, but accessing it requires understanding several options and requirements. From public healthcare enrollment to supplementary insurance, your choices will affect both your healthcare experience and your finances during your time in France.

11. French Public Healthcare (PUMA)

After three months of legal residency, you can apply for Protection Universelle Maladie (PUMA) through your local CPAM office. This system covers 70-80% of most medical costs and 100% for serious or chronic conditions. Workers gain immediate access, while non-workers must wait the three-month period.

The contribution rate for PUMA is 6.5% of income above a minimum threshold (approximately €9,800 annually), making it potentially expensive for those with significant investment or pension income but no earned income. The carte vitale (health insurance card) is the physical manifestation of enrollment, containing your social security number and enabling direct billing between healthcare providers and the insurance system—obtaining this card can take 1-3 months after application approval.

The application requires your residence permit, birth certificate, and proof of address, with contributions based on income. Despite the paperwork, joining the French healthcare system provides excellent care at reasonable costs compared to the US system.

12. Private Health Insurance

Companies like Cigna Global, Allianz, or French insurers like AXA offer private health insurance that’s essential during your initial period before PUMA eligibility. I found coverage options including inpatient/outpatient care, emergency evacuation, and dental/vision services.

Private insurance for visa applications must meet specific criteria: coverage minimum of €30,000, zero deductible for hospital care, repatriation coverage, and explicit statement that the policy meets French consular requirements. Underwriting practices differ significantly from US insurance, with European insurers typically using community rating rather than individual medical underwriting, resulting in more standardized pricing based primarily on age rather than medical history.

Costs typically range from €1,500-4,000 annually depending on age and coverage level, with policies designed specifically for expatriates living in France. This option bridges the gap until you can access the public system.

Healthcare Option | Coverage Level | Monthly Cost Range | Best For | Key Considerations |

|---|---|---|---|---|

PUMA (Public) | 70-80% of costs | 6.5% of income above €9,800/year | Long-term residents | 3-month waiting period for non-workers |

Private Insurance | 80-100% depending on plan | €125-350 | Initial settlement period | Required for visa application |

Mutuelle | Covers 20-30% gap from PUMA | €30-150 | PUMA enrollees | Different coverage levels (A-E) |

International Health | Coverage in both US and France | €200-500 | Frequent US travelers | Network limitations in both countries |

S1 Form (for retirees) | Same as PUMA | Covered by home country | Retirees from countries with agreements | Limited to certain nationalities |

13. Mutuelle (Supplementary Insurance)

A mutuelle covers the 20-30% of costs not reimbursed by public healthcare. Providers like MGEN, Harmonie Mutuelle, and Malakoff Humanis offer various coverage levels for specific services like dental, optical, and alternative medicine.

Coverage levels are standardized into categories (from “A” basic to “E” comprehensive) for easy comparison, with dental and optical benefits particularly important as these services have the lowest base reimbursement rates from PUMA. Waiting periods for certain benefits (especially dental prosthetics and optical equipment) typically range from 3-12 months, making it important to enroll well before anticipating needing these services.

When selecting a plan, I considered coverage levels, network providers, and premium costs to find the right balance for my healthcare needs and budget. Most French residents consider a mutuelle essential to avoid out-of-pocket costs.

14. International Health Insurance

During your transition period, policies from providers like GeoBlue, IMG, or Cigna offer coverage in both the US and France. These plans provide continuity of care during relocation and coverage for travel back to the US.

While planning your healthcare needs for France, don’t forget to properly dispose of any old medications before leaving. Our guide on how to dispose of old medications safely can help you handle this task responsibly.

Network structures vary significantly, with some plans offering direct billing with specific provider networks in both countries, while others operate on a reimbursement model requiring upfront payment and claim submission. Territorial restrictions and exclusions require careful review, as some policies exclude coverage in the US for non-emergency care or limit US coverage to short visits (typically 30-90 days per year).

While premiums are higher than single-country policies, this option delivers valuable peace of mind during your initial settlement period when you may be traveling between countries. I found this especially helpful during my first year when I made several trips back to the US.

John and Mary, a retired couple from California, moved to Provence with a Long-Stay Visitor Visa. For their first year, they purchased a comprehensive international health insurance policy from Cigna Global costing €7,800 annually for both. The policy covered them in both France and during visits back to the US. After establishing residency, they applied for PUMA through their local CPAM office, submitting their residence permits, birth certificates (with apostille and French translation), marriage certificate, and proof of address. They paid approximately €2,600 annually in PUMA contributions based on their retirement income. To cover the 30% gap in PUMA coverage, they added a mid-tier Mutuelle plan from APRIL for €180 monthly, which fully covered their prescription medications and provided 200% reimbursement for dental work. This three-layer approach (PUMA + Mutuelle + limited international coverage for US trips) optimized their healthcare costs while ensuring comprehensive coverage.

15. Retiree Healthcare Options

American retirees face unique healthcare considerations. Medicare doesn’t cover care in France, though maintaining it for US visits may be wise. Some retirees who paid into Social Security may qualify for healthcare coverage through bilateral agreements using an S1 form.

The S1 form (Certificate of Entitlement to Healthcare) is available to state pensioners from countries with bilateral agreements with France, allowing them to register with the French healthcare system while their home country covers the costs. Medicare Part B premiums continue even when living abroad unless formally disenrolled, which creates a difficult decision as re-enrollment later incurs permanent premium penalties of 10% for each 12-month period you could have been enrolled but weren’t.

Most retirees adopt a combination approach: enrolling in the French system while maintaining supplemental private insurance tailored to senior healthcare needs. This strategy provides comprehensive coverage while managing costs effectively.

Financial and Banking

Managing your finances across two countries requires careful planning and understanding of banking systems, tax obligations, currency considerations, and investment strategies. Setting up proper financial structures from the beginning will save significant headaches and potential tax complications during your time in France.

16. Opening French Bank Accounts

Establishing banking relationships in France is essential for daily life. Traditional banks like BNP Paribas, Société Générale, and Crédit Agricole offer expatriate services, while online options like N26, Revolut, or Wise provide easier setup for newcomers.

Account types differ significantly from US banking, with the standard compte courant (checking account) typically including a checkbook and Carte Bleue (debit card), while savings options include the tax-advantaged Livret A with government-set interest rates and contribution limits. FATCA (Foreign Account Tax Compliance Act) reporting requirements make some French banks reluctant to accept American clients due to the administrative burden, with some institutions requiring minimum balance commitments or charging additional fees to offset compliance costs.

You’ll need your passport, visa/residence permit, proof of address, and sometimes an initial deposit. I scheduled an in-person appointment and waited about 2-3 weeks for full account setup. Having a French bank account is crucial for everything from paying rent to receiving salary or pension payments.

17. Tax Treaty Benefits

The US-France tax treaty prevents double taxation through mechanisms like the Foreign Tax Credit (claim taxes paid to France against US obligations) and the Foreign Earned Income Exclusion (exclude up to $120,000+ of foreign earnings from US taxes). The Totalization Agreement prevents double taxation for social security contributions.

The treaty contains a “saving clause” that allows the US to tax its citizens as if portions of the treaty didn’t exist, creating complications that require careful planning, especially regarding investment income and retirement distributions. French tax residency is determined by having your foyer fiscal (tax household) or principal residence in France, spending more than 183 days per year in France, or having your primary professional activity in France—meeting any one of these criteria makes you tax resident.

You must file both US and French tax returns, with specific forms for foreign accounts. I recommend working with a tax professional who specializes in expatriate taxation to navigate these complex requirements.

18. Pension and Social Security Management

US Social Security benefits can be received directly in French bank accounts. I notified the Social Security Administration of my foreign address and arranged direct deposit to avoid disruption. Consider potential currency exchange fees, timing differences, and tax implications.

The US-France Totalization Agreement allows periods of work in both countries to be combined to qualify for benefits in either system, preventing loss of benefits due to split careers, though the actual benefit calculation becomes complex. Required Minimum Distributions (RMDs) from US retirement accounts remain mandatory even while living abroad, with significant penalties (50% of the amount that should have been withdrawn) for non-compliance, requiring careful calendar management across time zones.

Private pensions may require specialized financial advice to optimize management and minimize tax impacts across both countries. Planning ahead for these issues saves considerable stress and potential tax penalties.

19. Currency Exchange Solutions

Managing currency conversion between dollars and euros significantly impacts your financial well-being. Specialized services like Wise, OFX, or Xe offer better rates than banks for large transfers.

Exchange rate spreads (the difference between the mid-market rate and the rate you’re offered) typically range from 0.5-5% depending on the provider, with banks generally charging the highest spreads and specialized services the lowest. Wire transfer fees involve multiple potential charges: sending bank fee, intermediary bank fee, receiving bank fee, and currency conversion spread—all of which must be considered when comparing services, as some providers advertise “no fees” but embed costs in less favorable exchange rates.

Consider forward contracts to lock in exchange rates for planned large transfers, multi-currency accounts to hold both dollars and euros, and automated systems for regular transfers of pension or investment income. I saved thousands by using specialized currency services rather than traditional banks.

Financial Consideration | US System | French System | Key Differences | Adaptation Strategy |

|---|---|---|---|---|

Banking Structure | Unified checking/savings | Separate compte courant and livret accounts | Checkbooks still common in France; different fee structures | Maintain US accounts + open French compte courant and Livret A |

Tax Filing | Based on citizenship | Based on residency | Americans must file both US and French returns | Use Foreign Tax Credit or Foreign Earned Income Exclusion |

Investment Accounts | 401(k), IRA, brokerage accounts | Assurance Vie, PEA, PER | Different tax treatment; PFIC issues with foreign funds | Restructure portfolio before moving; consider US-domiciled ETFs |

Credit History | FICO score system | No equivalent credit score | French credit history starts from zero | Maintain US credit cards; build French banking relationships |

Retirement Planning | Social Security + private plans | French pension system + private supplements | Totalization Agreement coordinates benefits | Apply for benefits under appropriate system; consider timing |

20. Investment Portfolio Adjustments

Your investment strategy needs reconsideration when moving to France. Some US financial institutions restrict services for non-US residents, while French investment options like Assurance Vie (tax-advantaged investment vehicle) and PEA (equity savings plan) become available.

When planning your investment strategy for France, you might need to liquidate some assets. If you’re selling valuable items before your move, our guide on best scrap metal pick-up services can help you get the best value for metal items you won’t be taking along.

PFIC (Passive Foreign Investment Company) rules create punitive tax treatment for Americans investing in most foreign mutual funds, with complex reporting requirements on Form 8621 and potential interest charges on tax deferral. Assurance Vie contracts offer significant tax advantages under French law, with gains taxed only upon withdrawal and at reduced rates after eight years, plus inheritance tax benefits—but must be structured carefully to avoid negative US tax consequences for American citizens.

Restructure your portfolio to minimize the impact of both US and French tax regimes, and be aware of French wealth tax (IFI) on real estate assets over €1.3 million. I worked with a financial advisor experienced in cross-border issues to optimize my investments for my new situation.

Cultural Integration and Practical Support

Successfully adapting to French life extends beyond legal and financial arrangements to cultural integration and practical support systems. From language acquisition to community connections, understanding cultural norms, and managing administrative challenges, these elements significantly impact your experience and satisfaction with life in France.

21. Language Immersion Programs

Developing French language skills dramatically improves your integration experience. I tried several options including intensive courses at Alliance Française (15-30 hours weekly), free government programs through OFII (French Immigration Office), private tutoring tailored to specific needs, and immersion schools in regions like Provence or the Loire Valley.

The CECRL (Common European Framework of Reference for Languages) standardizes language proficiency levels from A1 (beginner) to C2 (mastery), with most visa renewals requiring proof of A1 level and citizenship applications requiring B1 level. Neurolinguistic approaches like the Michel Thomas Method or immersive techniques like those used at schools like Institut de Français in Villefranche-sur-Mer employ different cognitive strategies than traditional classroom learning, potentially accelerating acquisition for adult learners.

Investing time in language acquisition pays dividends in every aspect of French life. Even basic French opens doors to deeper connections with locals and smoother daily interactions. How much time are you willing to dedicate to language learning before and after your move?

22. Expat Community Networks

Connecting with fellow expatriates provides valuable support during your transition. Organizations like the American Club of Paris, Americans in France, and Association of American Residents Overseas offer structured communities, while Facebook groups like “Americans in Paris” provide informal connections.

Demographic distribution of American expatriates in France shows concentrations in Paris, Nice, Marseille, Lyon, and Toulouse, with approximately 100,000-150,000 Americans living in France according to State Department estimates. Formal expatriate organizations typically offer structured programming including tax seminars, cultural events, professional networking, and advocacy on issues affecting Americans abroad such as banking access and FATCA compliance.

Professional networks through the American Chamber of Commerce or international business associations can help with career development while easing cultural adjustment. I found these connections invaluable for both practical advice and emotional support during challenging moments of cultural transition.

23. Cultural Integration Courses

Formal programs help you understand French customs, etiquette, and social norms. I participated in cultural adaptation workshops from relocation companies, community classes on cooking and wine appreciation, OFII civic training courses on French values and society, and practical workshops on navigating administrative systems.

The Contrat d’Intégration Républicaine (Republican Integration Contract) required for most long-term residents includes mandatory civic training covering French institutions, values, and society, with recent expansions increasing the required hours from 12 to 24. Cultural dimensions theory identifies specific differences between American and French business cultures, particularly in power distance (hierarchy), uncertainty avoidance, and monochronic versus polychronic time orientation—understanding these differences helps prevent workplace misunderstandings.

Michael, a software engineer from Seattle, moved to Lyon for a tech position using the Talent Passport visa. Despite his technical expertise, he struggled with cultural integration during his first six months. His turning point came when he enrolled in a comprehensive integration program that combined language classes at Alliance Française (10 hours weekly) with cultural workshops. The program taught him practical aspects of French business etiquette, including the importance of formal greetings, proper email formats, and meeting protocols. He learned that his American directness in meetings was perceived as rude, while his habit of working through lunch violated cultural norms around mealtime. After adjusting his approach based on this cultural training, his workplace relationships improved dramatically. He supplemented formal training by joining a local hiking club, which provided natural language practice and French friendships outside the expatriate bubble. After 18 months, he reached B1 French proficiency and felt genuinely integrated into his community, citing the structured cultural training as the critical factor in his successful adaptation.

These structured approaches accelerate your cultural understanding and help prevent common misunderstandings. The investment in cultural learning pays off in smoother daily interactions and deeper connections.

24. Administrative Support Services

French bureaucracy presents significant challenges for newcomers. I hired specialized assistance from companies like French Bureaucracy Solutions or France Admin Assist who provided accompaniment to appointments, document translation, and form completion.

Administrative procedures often require specific document formats including apostille certification (international authentication) for vital records and certified translations by court-approved translators (traducteurs assermentés). The French administrative system operates on the principle of “silence means rejection” (silence vaut rejet) for most applications, with specific timeframes after which non-response is legally considered a denial—tracking application status becomes critically important.

Virtual assistants offer remote help with calls and paperwork, while legal advisors specializing in expatriate issues can navigate complex administrative procedures, saving you time and frustration. Having professional support for key administrative processes reduced my stress significantly.

25. Digital Nomad Setups

Remote workers face unique considerations when basing themselves in France. I explored coworking spaces like WeWork, Spaces, and local options that provide professional environments, while implementing technical tools like VPNs, time zone management software, and virtual phone numbers to facilitate connection with US colleagues.

Visa compliance requires careful attention, as remote work technically constitutes working in France even when employed by a US company—the appropriate visa depends on employment structure, with the Passeport Talent “independent professional” category often most suitable. Data protection regulations under GDPR impact remote work practices, requiring secure connections, appropriate data handling protocols, and potentially different software tools than those used in US-based operations.

Ensure your work arrangements comply with visa restrictions and structure your activities to optimize between US and French tax systems. The digital nomad lifestyle in France offers an incredible quality of life when properly structured.

Final Thoughts: Preparing for Your French Adventure

Moving to France represents both a challenge and an opportunity for personal growth. Success depends on thorough preparation across multiple dimensions—legal, financial, practical, and cultural. While the administrative hurdles may seem daunting initially, the rewards of French living—from healthcare quality to work-life balance, culinary experiences, and cultural richness—make the effort worthwhile. Before finalizing your plans, consider how you’ll manage the belongings you won’t be taking with you.

This is where Jiffy Junk can simplify your transition. As you prepare for your international move, our residential junk removal service helps clear out unwanted items quickly and efficiently. Our White Glove Treatment ensures everything from furniture to household items is removed with care, while our eco-friendly approach prioritizes recycling and donation. Let us handle the cleanout of your American home so you can focus on the more exciting aspects of your French adventure. For a stress-free start to your new life abroad, make Jiffy Junk your first call when preparing for this life-changing move.

When moving to France from the US, you’ll likely need to handle old furniture disposal. Our guide on what happens to old furniture after removal can help you understand the eco-friendly options available through professional junk removal services.

Psychological research on international transitions identifies a predictable adjustment curve with initial excitement followed by frustration before eventual adaptation—understanding this pattern helps expatriates normalize their experience and develop appropriate coping strategies. Successful international relocations typically involve a minimum six-month planning timeline, with visa applications started 3-4 months before intended departure, housing searches conducted 2-3 months in advance, and financial arrangements established at least 1-2 months before the move.

Have you started your timeline for this life-changing move? The adventure awaiting you in France is well worth the preparation!

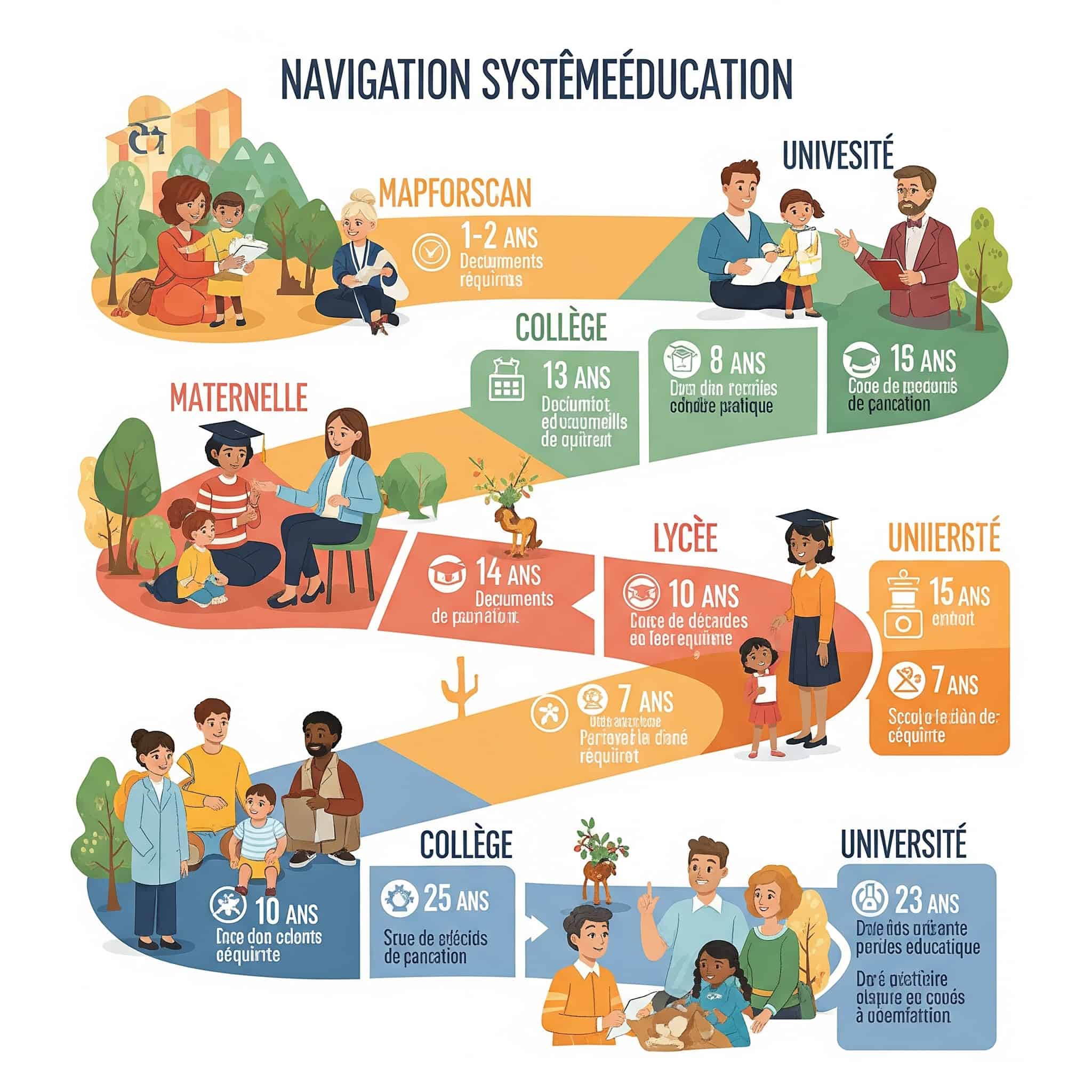

Education System Navigation for Families

Families relocating with children face important decisions about education in France. The French system differs significantly from American schools in structure, schedule, and philosophy. Understanding your options—from public schools conducted entirely in French to international schools offering English instruction—helps ensure your children’s educational needs are met during the transition and beyond.

French public education follows a national curriculum with standardized testing at key transition points (ages 11, 15, and 18), creating a more structured and assessment-oriented approach than many American schools. The weekly schedule typically includes longer school days (8:30am-4:30pm) but with Wednesday afternoons often free and a two-hour lunch break, reflecting cultural priorities around mealtime and family life.

Public vs. Private School Considerations

French public education costs nothing but operates completely in French, creating a steep learning curve for English-speaking children. Private international schools offer English-language instruction but come with substantial fees ranging from €10,000-30,000 annually.

Children under 10 typically adapt more quickly to French-language immersion, often achieving functional fluency within 6-12 months when placed in public schools. International schools vary in curriculum offerings, with options including American (AP), British (GCSE/A-Levels), International Baccalaureate (IB), or hybrid programs—each preparing students for different university pathways.

Your decision depends on your children’s ages, language abilities, planned duration in France, and budget constraints. I’ve seen families thrive with both approaches, though younger children generally adapt better to public schools while teenagers often benefit from international programs.

Enrollment Requirements and Timeline

Registering children in French schools requires proof of residence, vaccination records, and previous academic transcripts. Many documents need official translation and apostille certification. The academic year runs September through early July, making timing your move around school calendars important for minimizing disruption to your children’s education.

The mairie (town hall) handles initial registration for public primary schools, while collèges and lycées (middle and high schools) require direct application to the school or district office. Grade placement often follows strict age guidelines rather than previous academic achievement, potentially placing children in different grade levels than expected based on their US education.

When we moved, my daughter was placed in a grade based solely on her birth year, despite being advanced in math. This initial adjustment period was challenging but ultimately beneficial for her language acquisition and cultural integration.

Pet Relocation Requirements

Bringing animal companions to France involves specific health and documentation requirements. All pets need ISO-standard microchipping before entry, rabies vaccination administered at least 21 days before travel, and an EU Animal Health Certificate obtained from USDA-accredited veterinarians within 10 days of departure. Certain dog breeds classified as dangerous face entry restrictions or prohibition.

The microchip must be 15-digit ISO 11784/11785 compliant; if your pet has a different system, they’ll need a compatible scanner or a new compliant microchip implanted. The EU Health Certificate converts to an EU Pet Passport once in France, simplifying future travel within Europe but requiring registration with a French veterinarian within 10 days of arrival.

My cat’s relocation went smoothly because I started the process early. The trickiest part was timing the vet appointment to get the health certificate within that narrow 10-day window before departure. Once in France, local vets were extremely helpful in transitioning to the EU pet passport system.

Automobile Considerations

Vehicle logistics present unique challenges when moving to France. Importing US vehicles involves significant costs and modifications to meet EU standards, often making local purchase more practical. Americans can drive on US licenses temporarily (up to one year), but eventual conversion to a French license is required, with varying reciprocity by state. Many expatriates ultimately find France’s excellent public transportation eliminates the need for vehicle ownership.

Technical modifications for US vehicles include headlight direction, emissions systems, and speedometer/odometer conversion to kilometers, often costing €1,000-3,000 depending on the vehicle. Driver’s license conversion without retesting is possible for residents from 18 US states with reciprocity agreements; residents from other states must complete both written and practical driving tests in French.

I initially planned to import my beloved SUV but abandoned the idea after researching the costs and bureaucratic hurdles. Instead, I sold it in the US and purchased a small European model after arrival. This decision saved thousands in shipping and modification costs while providing a vehicle better suited to narrow French streets and parking spaces.

Technology Adaptations

Technical adjustments include dealing with France’s 220V/50Hz electrical system, which requires converters for US appliances and replacement of many larger items. Telecommunications options exist for maintaining US phone numbers through VoIP services while establishing French mobile service. Content restrictions affect streaming services, potentially requiring VPN solutions, while data privacy practices differ under GDPR protections.

Before relocating to France, you’ll need to properly dispose of electronics that won’t make the journey. Our recycling electronics guide provides environmentally responsible options for handling old devices during your pre-move cleanout.

Simple voltage converters work for basic electronics, but appliances with motors or heating elements often require transformers or replacement due to the frequency difference (50Hz vs 60Hz). French internet contracts typically run 12 months minimum with early termination fees, but offer higher average speeds (94.8 Mbps) than US averages (42.86 Mbps) according to recent broadband testing data.

My hair dryer fried instantly despite using a voltage converter—the frequency difference was the culprit. I gradually replaced most small appliances with European versions and found the internet speeds a pleasant upgrade from what I had in the States.

Maintaining US Ties

Preserving connections to the United States requires planning. Register for absentee voting in US elections, enroll with the US Embassy’s STEP program for safety updates, arrange mail forwarding through services like US Global Mail, and understand your continuing obligation to file US tax returns regardless of foreign residence.

Consular services available to US citizens abroad include emergency assistance, passport renewal, notarial services, and Consular Reports of Birth Abroad for children born in France. Voting from abroad requires registration with your last state of residence, with ballots typically available 45 days before federal elections and submission deadlines varying by state.

Staying connected to American friends and family takes effort across time zones. I schedule regular video calls and maintain a digital subscription to my hometown newspaper to stay current with local events. These small efforts help maintain important relationships despite the physical distance.

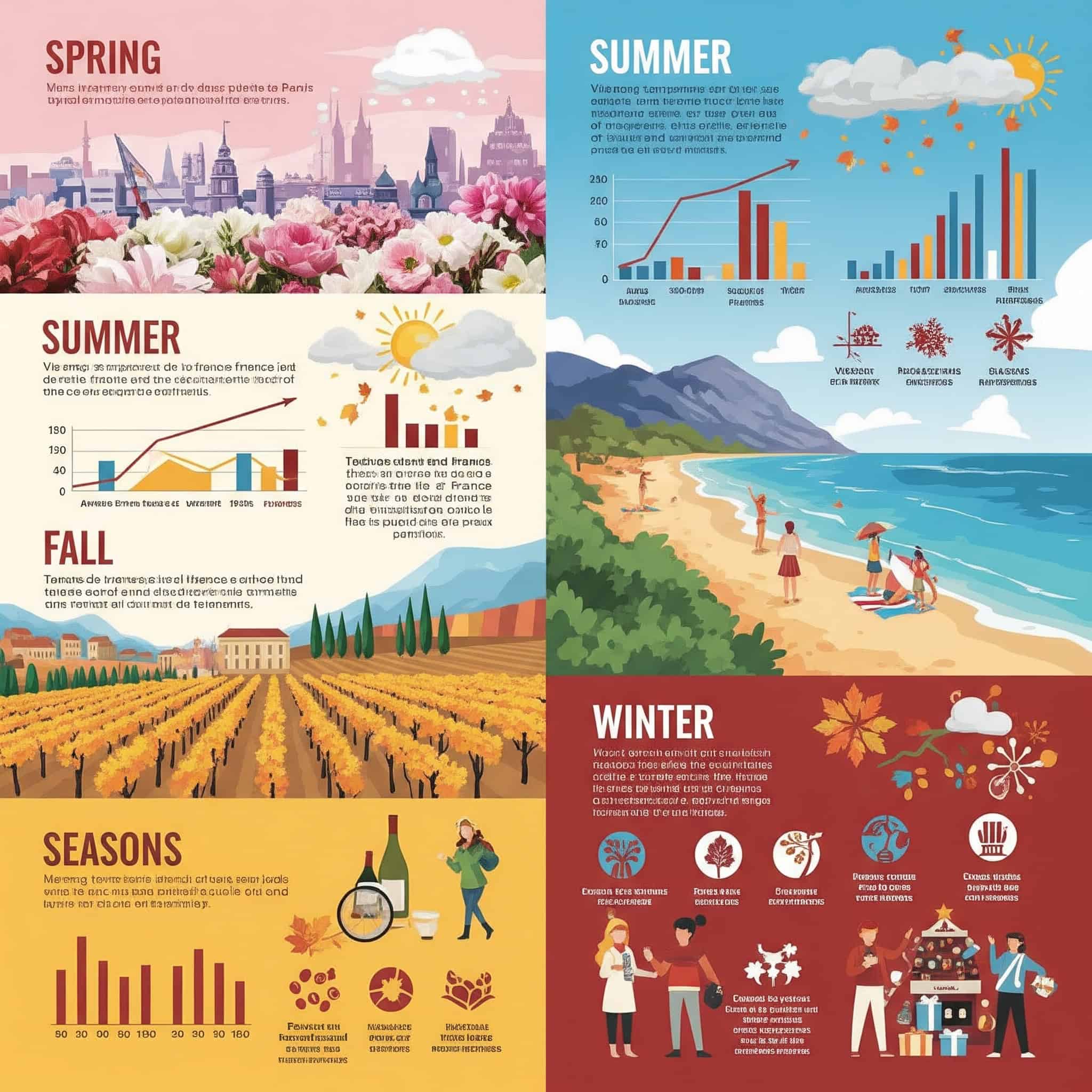

Seasonal Considerations for Relocation

Timing your move strategically affects your initial experience. August sees many businesses closed as French people take vacations, potentially complicating your settlement. Winter moves bring heating concerns with systems that differ from US norms. Families with students should align with school-year calendars, while avoiding administrative delays during France’s numerous holiday periods helps prevent unnecessary complications.

The French academic calendar divides the year into five terms with breaks in October, December, February, and April, creating potential windows for less disruptive mid-year transitions. Administrative offices operate with reduced staff during school holidays and summer months, with some processes effectively paused during August when many civil servants take annual leave.

My June arrival worked well—government offices were fully staffed, the weather was pleasant for exploring, and I had time to settle before the August shutdown. Had I arrived in August, finding housing and completing administrative procedures would have been significantly more difficult.

Regional Variations Within France

France offers diverse living experiences beyond Paris. Provence and the Côte d’Azur attract retirees with their climate but bring higher costs and seasonal tourist influxes. Bordeaux features a growing expatriate community with wine culture and more affordable living than Paris. Brittany and Normandy offer coastal living with strong cultural identity and lower housing costs. Alsace presents a unique Franco-German character, while rural areas provide dramatically lower property costs but potential isolation.

When moving to France from the US, you’ll need to handle moving trash removal on your schedule. Our guide can help you plan the cleanout of your American home efficiently before your international relocation.

Climate variations are significant, from Mediterranean conditions in the south (2,700+ hours of sunshine annually) to oceanic climate in the west (higher rainfall, milder temperatures) and continental conditions in the east (greater seasonal temperature variations). Cost of living indices show Paris approximately 30% more expensive than regional cities like Lyon or Bordeaux, with rural areas often 40-50% less expensive than the capital for housing.

After initially settling in Paris, I relocated to a medium-sized city in western France. The quality of life improved dramatically with lower costs, less crowding, and a more relaxed pace while still maintaining good transportation connections to Paris when needed.

Remote Work Considerations

Maintaining US employment while living in France requires strategies for handling the 6-9 hour time difference with US colleagues, understanding when remote work triggers French tax residency, planning home office requirements, and combating professional isolation through coworking spaces and professional networks.

The 183-day rule for tax residency applies differently to remote workers, as having your “primary professional activity” in France can trigger tax residency regardless of how many days you physically spend in the country. Digital infrastructure varies significantly by region, with fiber optic coverage reaching 70%+ in major cities but dropping to under 30% in some rural departments—critical information for remote workers requiring reliable high-speed connections.

Working remotely for my US company while moving to France from us created unexpected challenges. The time difference meant early morning meetings (5am my time) and late evening availability. I negotiated a compressed schedule with four longer workdays instead of five standard ones, which helped balance work obligations with enjoying my new French lifestyle.

Long-term Planning

Looking beyond your initial move involves understanding the path to permanent residency (carte de résident) after your initial visa period, citizenship possibilities after five years of residence, retirement planning for healthcare and housing as you age in France, and cross-border inheritance issues requiring documentation adjustments.

Permanent residency requirements include five years of continuous legal residence (reduced to three for certain categories), proof of integration including language proficiency at A2 level, and sufficient regular resources. French inheritance law includes forced heirship provisions that may conflict with US estate planning expectations, requiring specialized cross-border estate planning using tools like the EU Succession Regulation (Brussels IV).

The long-term perspective shifts your decision-making. Rather than temporary solutions, I began investing in language fluency, professional networks, and understanding French systems with an eye toward potential citizenship. This approach transformed what might have been a temporary adventure into a sustainable lifestyle.

Return Planning Contingencies

Preparing for possible repatriation involves housing decisions that accommodate potential return, maintaining professional networks and credentials valid in the US, ensuring children’s education remains compatible with US systems, and understanding the process for transferring assets back to the US if your French experience ends earlier than expected.

Educational reintegration challenges vary by age and duration abroad, with standardized testing gaps and curriculum differences requiring potential remediation or placement assessments upon return to US schools. Financial repatriation involves currency conversion timing strategies, closure of French accounts (with potential exit taxes on investment gains), and reestablishment of US credit history which typically diminishes after extended absence.

Despite loving my French life, I maintain a “repatriation folder” with key documents and contacts should circumstances require a return to the US. This contingency planning provides peace of mind without diminishing my commitment to building a fulfilling life in France.