Moving to Vancouver from the US: 25 Essential Considerations for a Smooth Transition

Table of Contents

Immigration and Legal Requirements

Housing and Relocation

Financial Adjustments

Lifestyle and Cultural Integration

Practical Logistics

How Jiffy Junk Can Help

Final Thoughts

Immigration and Legal Requirements

1. Navigating Visa and Immigration Pathways

Relocating to Vancouver from the US means diving into Canada’s immigration system head-first. I’ve found that understanding your options early saves massive headaches later. You’ll need to choose between several pathways: Express Entry (a points-based system), the BC Provincial Nominee Program (targeting specific occupations), work permits (usually requiring a Canadian job offer), family sponsorship, or study permits.

Each pathway comes with its own timeline and requirements. For Express Entry, you’ll receive a Comprehensive Ranking System (CRS) score based on your age, education, work experience, and language skills. Currently, you typically need scores above 470 to receive an invitation to apply for permanent residency.

The BC Provincial Nominee Program offers specialized streams for skilled workers, healthcare professionals, and entrepreneurs. This route can be faster for those whose skills match what BC’s labor market needs right now.

Immigration Pathway | Processing Time | Key Requirements | Best For |

|---|---|---|---|

Express Entry | 6-8 months | High CRS score, language proficiency | Skilled professionals with work experience |

BC PNP | 4-6 months | In-demand occupation, job offer | Workers with skills needed in BC |

Work Permit | 1-3 months | Valid job offer from Canadian employer | Those with immediate employment |

Family Sponsorship | 12+ months | Canadian spouse/partner/relative | Those with close family in Canada |

Study Permit | 2-3 months | Acceptance to Canadian institution | Those pursuing Canadian education |

2. Managing Border Crossing

Logistics

Crossing the border with all your belongings requires serious preparation. I’ve learned you’ll need a detailed inventory of everything you’re bringing, including approximate values for customs declaration. This isn’t just a formality – border agents will use this to determine if you owe any duties.

Vehicles present a particular challenge. If your car is less than 15 years old, it must comply with Canadian safety and emission standards, which might require modifications and inspection before crossing. I’ve seen people get turned away at the border because they didn’t realize their vehicle needed specific changes to meet Canadian requirements.

For pet owners, preparation is crucial. Your furry friends need rabies vaccinations administered at least 30 days before travel, health certificates from USDA-accredited veterinarians, and potentially microchipping for future identification. These documents must be issued within 30 days of entry, so timing matters.

3. Obtaining Your Social Insurance Number

The Social Insurance Number (SIN) is your key to working legally in Canada. Without it, you can’t get paid, open bank accounts, or access many government services. I had to apply in person at a Service Canada office, bringing my work permit and permanent residency documentation.

Applications require original immigration documents – not photocopies – showing your work authorization or permanent resident status. The good news is processing typically happens on the same day, so you’ll walk out with your number.

If you’re a temporary resident, your SIN will begin with “9” and will expire when your immigration status does. This means you’ll need to renew it whenever your immigration documents are extended. I mark these dates in my calendar well in advance to avoid any gaps in my ability to work legally.

4. Understanding US-Canada Tax Treaty Implications

Being a US citizen in Canada means juggling tax obligations to both countries. The US-Canada Tax Treaty helps prevent double taxation, but you’ll still need to file in both places. I file Form 8833 with the IRS to claim treaty benefits and report my worldwide income to both countries.

The Foreign Earned Income Exclusion allows qualifying US citizens to exclude up to $120,000 (2023 figure) of foreign earnings from US taxation. This isn’t automatic – you must actively claim it on your tax return.

FBAR (Foreign Bank Account Report) filing is another requirement when your foreign accounts exceed $10,000 at any point during the year. The penalties for non-compliance are steep, so I never skip this step.

Sarah, a software engineer from Seattle, moved to Vancouver on a work permit. During her first tax season as a Canadian resident, she had to file both US (Form 1040) and Canadian (T1 General) tax returns. She reported her Canadian income of CAD $95,000 on both returns. On her US return, she filed Form 8833 to claim treaty benefits and Form 1116 for Foreign Tax Credits, allowing her to offset her US tax liability with the taxes she paid in Canada. She also filed FBAR (FinCEN Form 114) because her Canadian accounts exceeded $10,000 USD at one point during the year. By working with a cross-border tax specialist, she avoided double taxation while remaining compliant with both countries’ requirements.

5. Converting Your Driver’s License

You’ll need to exchange your US driver’s license for a British Columbia license within 90 days of becoming a BC resident. I visited an ICBC driver licensing office with my valid US license, proof of driving experience, identification, and proof of BC residency.

License reciprocity agreements exist between BC and certain US states, allowing direct exchange without testing. If you’re from a non-reciprocal state, you’ll need to take knowledge and road tests regardless of your driving experience.

When you go to get your BC license, bring two pieces of ID (including one primary photo ID) and proof of BC residency such as a utility bill, rental agreement, or bank statement showing your BC address. I found the process straightforward, but it’s best to make an appointment rather than walking in.

Housing and Relocation

6. Selecting the Right Vancouver Neighborhood

Finding your perfect spot in Vancouver can make or break your relocation experience. I’ve explored many neighborhoods and found each has its own distinct vibe and price point. Downtown offers high-rise living with amazing walkability, but you’ll pay premium prices for those conveniences.

Kitsilano (or “Kits” as locals call it) gives you beach access and a family-friendly atmosphere with diverse housing options. I love the mix of character homes and low-rise apartments here. Mount Pleasant attracts a trendy crowd with independent businesses and an artistic community that gives the area a creative energy.

East Vancouver neighborhoods like Commercial Drive and Hastings-Sunrise offer more affordable housing with strong community vibes and excellent transit connections. I’ve found the multicultural dining scenes in these areas to be incredible.

Neighborhood | Character | Housing Types | Price Point | Best For |

|---|---|---|---|---|

Downtown | Urban, bustling | High-rise condos | $$$ | Young professionals, urban enthusiasts |

Kitsilano | Beach-oriented, active | Low-rise apartments, houses | $$ | Families, outdoor enthusiasts |

Mount Pleasant | Trendy, artistic | Character homes, apartments | $$ | Creatives, young couples |

Commercial Drive | Diverse, eclectic | Apartments, heritage houses | $$ | Cultural diversity seekers |

North Vancouver | Outdoorsy, spacious | Houses, townhomes | $$ | Nature lovers, families |

Richmond | Asian influence, suburban | New condos, townhomes | $$ | Asian cuisine lovers, suburbanites |

7. Navigating Vancouver’s Competitive Rental Market

Vancouver’s rental market is no joke – I’ve never seen anything quite like it. You’ll be competing with multiple applicants for every decent unit, so preparation is key. Have your documentation ready: credit reports, references, employment verification, and income proof. I created a “rental resume” that I could quickly email to potential landlords.

BC’s Residential Tenancy Act provides strong tenant protections, including limits on security deposits (half a month’s rent), with pet deposits capped at an additional half month. Rent increases are regulated by the province and limited to once annually according to a set formula.

I’ve found that purpose-built rental buildings often provide more stable long-term housing than condos. Individual condo owners can reclaim units for personal use with proper notice under BC tenancy laws, which can leave you hunting for a new place unexpectedly.

Michael and Jamie started their Vancouver apartment search two months before their planned move from Portland. They created a rental resume that included their credit scores, employment verification letters, references from previous landlords, and bank statements showing financial stability. They set up alerts on multiple rental websites and responded to listings within hours of posting. When they found a suitable two-bedroom apartment in Kitsilano, they arrived at the viewing with completed application forms and all supporting documents. They also brought a personal letter explaining their move and why they would be excellent tenants. Despite competing with 12 other applicants, their preparation and professionalism impressed the landlord, who approved their application within 24 hours. Their thoroughness and quick response made all the difference in securing housing in Vancouver’s competitive market.

8. Understanding Home Purchase Considerations

Buying property in Vancouver comes with unique challenges for Americans. Non-residents face a 20% foreign buyer tax in Metro Vancouver, which significantly increases your purchase costs if you’re not yet a permanent resident.

Down payment requirements start at 5% for Canadian residents but can be higher for non-residents. I was surprised to learn about the mortgage stress testing requirements – Canadian borrowers must qualify at either the Bank of Canada’s five-year benchmark rate or their contract rate plus 2%, whichever is higher. This applies regardless of your actual down payment amount.

Property transfer tax follows a tiered structure based on purchase price, and annual property taxes range from 0.25% to 0.4% of assessed value. These ongoing costs add up quickly, so I make sure to budget for them alongside my mortgage payments.

9. Selecting Cross-Border Moving Services

Choosing the right moving company for your international relocation can save you from major headaches. I recommend selecting movers with specific experience in customs documentation and border crossings. When I moved, I obtained quotes from three companies with international moving experience: Atlas Van Lines, United Van Lines, and Mayflower.

International movers should provide a detailed inventory system that assigns tracking numbers to each item. This allows customs officials to quickly verify contents against declaration forms, speeding up your border crossing.

For the actual customs clearance, you’ll need Form B4 (Personal Effects Accounting Document) and Form B4A (Personal Effects Inventory). Your mover should help prepare these before crossing the border. I found having these forms properly completed in advance made my border crossing much smoother.

10. Finding Temporary Accommodation

When I first moved to Vancouver, I needed a short-term place while searching for a permanent home. Extended-stay hotels like Residence Inn or Sandman Suites offer monthly rates, though they’re not cheap. Furnished short-term rentals through Airbnb or VRBO typically range from $3,000-$5,000+ CAD monthly.

Short-term rental agreements typically require larger security deposits (often one month’s rent) compared to standard leases. The upside is they offer flexibility with notice periods as short as 14-30 days.

I found corporate housing providers like DelSuites or Premier Executive Suites to be surprisingly cost-effective for stays longer than two weeks. They include utilities, internet, weekly cleaning, and basic furnishings in their rates. University housing may also be available during summer months when student residences are vacant – worth checking if you’re on a budget.

Financial Adjustments

11. Setting Up Canadian Banking

Establishing your financial presence in Canada should be one of your first priorities. Major Canadian banks (RBC, TD, CIBC, Scotiabank, BMO) offer newcomer packages with fee waivers and credit-building options. I was pleasantly surprised by how accommodating they were to new arrivals.

When I opened my accounts, I brought proof of address, identification, immigration documents, and employment information to my appointment. Newcomer banking packages typically waive monthly account fees for 6-12 months and may offer unsecured credit cards with modest limits to help establish your Canadian credit history.

If you’ll maintain financial ties to the US, consider cross-border banking options like RBC Bank or TD Bank. Their cross-border services allow fee-free transfers between linked US and Canadian accounts and provide consolidated account viewing across countries. I’ve found this invaluable for managing finances in both countries.

12. Developing a Currency Exchange Strategy

Managing the conversion from USD to CAD efficiently saved me thousands when I moved. Currency exchange spreads (the difference between buy and sell rates) typically range from 0.5% at specialized forex services to 3-5% at banks and 8-10% at airport kiosks. This difference significantly impacts large transfers.

I avoid airport kiosks and hotel exchange services due to their poor rates. For large transfers, I use specialized forex services like Knightsbridge Foreign Exchange or OFX to get rates closer to the interbank rate.

Forward contracts allow you to lock in current exchange rates for future transfers (typically up to 12 months). I used this strategy to protect against currency fluctuations during my transition period when the exchange rate was favorable. I also maintain USD accounts in Canada for my ongoing US expenses, which saves me from constantly converting currencies.

13. Adjusting to Vancouver’s Cost of Living

Vancouver’s affordability index (ratio of median home price to median household income) exceeds 12:1, compared to the North American average of 4:1. This makes it one of the least affordable housing markets globally. I experienced serious sticker shock when I first arrived.

Combined federal and provincial income tax rates in British Columbia range from 20.06% (on income up to $43,070) to 53.50% (on income over $240,716). These rates are generally higher than comparable US federal and state combined rates, which required adjusting my budget expectations.

Expense Category | Vancouver vs. US Average | Monthly Cost (CAD) | Notes |

|---|---|---|---|

1-Bedroom Apartment | 30-50% higher | $2,000-$2,800 | Downtown locations at upper end |

Groceries (2 people) | 15-20% higher | $500-$700 | Produce prices vary seasonally |

Utilities | Similar | $150-$250 | Includes electricity, water, internet |

Public Transit | Lower than major US cities | $98-$177 | Monthly pass, zone-dependent |

Dining Out | 10-15% higher | $20-$35 per person | Includes tax and tip for casual dining |

Healthcare Premiums | Significantly lower | $0 for MSP | Prescription coverage additional |

Gasoline | 40-60% higher | $1.70-$2.00 per liter | Approximately $6.50-$7.60 per gallon |

Income Tax | Generally higher | Varies by income | Combined federal and provincial |

14. Enrolling in British Columbia’s Healthcare System

Registering for British Columbia’s Medical Services Plan (MSP) comes with a three-month waiting period. I applied immediately upon arrival and purchased private insurance from Pacific Blue Cross to cover the gap. This three-month MSP waiting period begins on the first day of the month following your arrival in BC, making private insurance coverage essential during this transition.

MSP premiums were eliminated in 2020, making public healthcare coverage free for eligible residents. Registration requires proof of BC residency and immigration status. I found the process straightforward but started it immediately upon arrival to minimize my waiting period.

MSP covers medically necessary services from physicians and hospitals but excludes prescription drugs, dental care, vision care, and paramedical services. I purchased supplemental insurance through my employer to cover these additional needs.

15. Managing Retirement Accounts Across Borders

Your US retirement accounts can remain in the US while you build Canadian retirement savings. I kept my 401(k) and IRA accounts active but opened a Registered Retirement Savings Plan (RRSP) in Canada for tax-advantaged retirement savings going forward.

US retirement accounts (401(k), IRA) remain tax-deferred under the US-Canada tax treaty, but withdrawals must be reported on both Canadian and US tax returns. Foreign tax credits are available to prevent double taxation, which has helped me avoid paying twice on the same income.

Tax-Free Savings Accounts (TFSAs) are considered foreign trusts by the IRS, requiring annual filing of Forms 3520 and 3520-A. The potential penalties for non-compliance can exceed the account value over time. I consulted with a cross-border financial advisor to determine whether a TFSA made sense in my situation given these reporting requirements.

Lifestyle and Cultural Integration

16. Using Vancouver’s Public Transportation System

Vancouver’s transit system has been a game-changer for me. I purchased a Compass Card for access to all transit services including buses, SkyTrain, and SeaBus. Monthly passes cost $98-$177 CAD depending on zones traveled, which I found reasonable compared to maintaining a car.

TransLink’s integrated fare system allows transfers between buses, SkyTrain, and SeaBus within a 90-minute window on a single fare. Zone-based pricing only applies to SkyTrain and SeaBus journeys, which makes the system fairly straightforward to navigate.

The SkyTrain system operates three lines (Expo, Millennium, and Canada Line) covering 79.6 km with 53 stations. It runs automatically without drivers and offers service until approximately 1:00 AM with frequencies as high as every 2-3 minutes during peak hours. For occasional driving needs, I use car-sharing services like Evo or Modo, which has saved me thousands compared to owning a car.

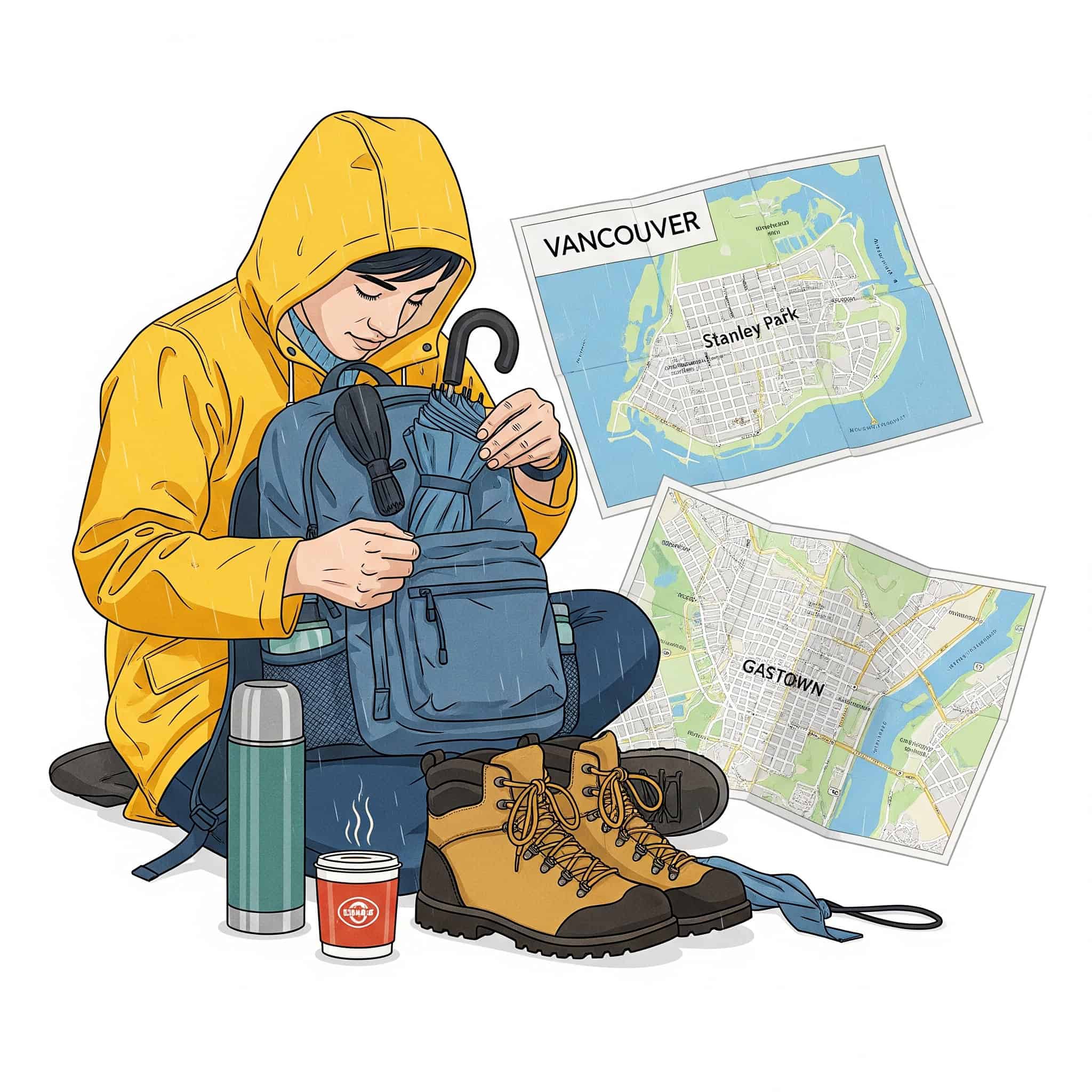

17. Preparing for Vancouver’s Rainy Climate

Vancouver receives approximately 1,200 mm (47 inches) of annual rainfall, concentrated in the winter months. I was surprised to find it’s typically a persistent drizzle rather than heavy downpours, with snow falling only a few days per year at sea level.

I invested in quality waterproof outerwear, shoes, and umbrellas for daily comfort. My Gore-Tex jacket and waterproof boots have been essential purchases. When apartment hunting, I prioritized homes with covered outdoor spaces and good drainage.

The “rain shadow effect” created by Vancouver Island and the Olympic Mountains means rainfall varies significantly across Metro Vancouver. North Vancouver receives nearly twice the precipitation of areas like Tsawwassen or White Rock. I’ve found the summer months (June-September) are typically dry and mild with temperatures around 20-25°C (68-77°F), which makes the rainy season more bearable knowing sunshine is coming.

18. Understanding Canadian Cultural Differences

Canadian communication styles often employ “indirect speech” and qualification phrases. When my Canadian colleagues say “I think perhaps” or “maybe we could consider,” they’re not being indecisive – it’s just a more polite communication style than I was used to in the US.

Vancouver’s cultural makeup is distinctly influenced by its large East Asian population (approximately 31% of residents). This creates a multicultural environment with different social norms and expectations than many US cities. I’ve found the fusion of cultures makes Vancouver an incredibly diverse and interesting place to live.

Political discussions tend to be more moderate here, with less polarization than I experienced in the US. Multicultural awareness is highly valued, and I’ve noticed Canadians generally avoid confrontational topics in casual settings. Hockey occupies a cultural position similar to American football in the US – it’s not just a sport but a cultural touchstone.

John, who relocated from Chicago to Vancouver, initially struggled with what he perceived as Canadians’ reluctance to express direct opinions. During his first team meeting at his new job, he presented a marketing proposal and asked for feedback. Instead of the direct critiques he was accustomed to in Chicago, his colleagues responded with phrases like “I wonder if we might consider…” and “Perhaps another approach could be…” John initially interpreted this as lack of engagement or clarity, but his Canadian manager later explained that this communication style reflected cultural politeness rather than indecision. Over time, John learned to recognize these subtle language patterns as constructive feedback rather than hesitation, allowing him to better integrate with his team and adapt to Canadian workplace culture.

19. Transitioning to the Canadian Educational System

When I enrolled my kids in Vancouver schools, I noticed significant differences from the US system. BC’s curriculum emphasizes core competencies (communication, thinking, personal/social) alongside content knowledge, with less standardized testing than many US states and greater teacher autonomy in instructional methods.

Public schools are free for residents and typically high quality. School catchment areas determine enrollment, so I researched school ratings before choosing our housing location. This paid off – my children’s schools have excellent programs and supportive teachers.

For families considering post-secondary education, international student tuition at BC universities ranges from CAD $20,000-$35,000 annually until permanent residency is established. This compares to domestic rates of CAD $5,000-$7,500. We’re working toward permanent residency partly to reduce these future education costs.

20. Building Your Professional Network

Establishing professional connections has been crucial for my career success in Vancouver. Industry-specific professional associations in BC often provide continuing education, certification programs, and job boards exclusively for members. I joined the Greater Vancouver Board of Trade and found it invaluable for meeting professionals in my field.

Government-funded immigrant employment programs like WorkBC provide free career counseling, resume workshops, and job search assistance specifically designed for newcomers. I took advantage of these services when I first arrived and found them extremely helpful.

I’ve also attended meetups through platforms like Meetup.com to find interest-based groups. Professional immigrant networks like S.U.C.C.E.S.S. or MOSAIC offer newcomer support that goes beyond just employment help. Don’t forget to update your LinkedIn profile to reflect your Canadian location and networking interests – I received several job leads this way.

Practical Logistics

21. Finding Healthcare Providers

Securing medical care in Vancouver required understanding the local healthcare landscape. BC’s primary care network is transitioning to a team-based approach with “Primary Care Networks” and “Urgent and Primary Care Centres” designed to improve access for patients without family doctors.

Family doctors often have waiting lists for new patients. I used the Pathways Medical Care Directory and Health Link BC to find physicians accepting new patients. It took some persistence, but I eventually found a great doctor taking new patients.

PharmaCare provides income-based prescription coverage for BC residents, with deductibles ranging from 0-3% of family income before coverage begins. I had to register separately from my MSP enrollment, which wasn’t immediately obvious. Dental care isn’t covered by MSP and costs about the same as in the US, so I maintained my dental insurance through my employer.

22. Transferring Mobile Phone Service

Switching to Canadian mobile service was one of my first tasks after arriving. Canadian mobile plans typically include unlimited Canada-wide calling and texting but charge premium rates for US calling/texting, unlike many US plans that include North America-wide services.

Major providers include Rogers, Telus, and Bell, with discount brands like Fido, Koodo, and Virgin offering lower-cost options. I found plans typically cost 20-30% more than comparable US plans, which was an unwelcome surprise.

The Canadian Radio-television and Telecommunications Commission (CRTC) mandates that all phones sold in Canada must be unlocked. This allowed me to bring my existing phone rather than purchasing a new device. I just popped in a new SIM card from a Canadian provider and was good to go.

23. Relocating Pets to Canada

Canada doesn’t require quarantine for pets from the US that meet documentation requirements, which was a huge relief when bringing my dog. Dogs and cats need rabies vaccinations at least 30 days before entry, and USDA-endorsed health certificates issued within 30 days of travel.

Certain dog breeds face import restrictions, though BC is more lenient than provinces like Ontario (which restricts pit bull terriers). Animals under 3 months old cannot be imported as they cannot meet the rabies vaccination requirements.

Finding pet-friendly housing in Vancouver adds another challenge to the already competitive rental market. Landlords can charge pet deposits (up to half a month’s rent) but cannot outright ban pets in some types of rental housing under BC’s tenancy regulations.

The Rodriguez family was moving from San Diego to Vancouver with their two dogs, a Labrador and a French Bulldog. Six months before their move, they researched Canada’s pet import requirements and discovered their French Bulldog would need special attention due to being a brachycephalic breed that sometimes faces travel restrictions. They scheduled veterinary appointments for both dogs to update vaccinations and obtain microchips. Thirty days before travel, they visited their USDA-accredited veterinarian to complete health certificates and had these endorsed by their local USDA office. They chose a pet-friendly temporary accommodation in Vancouver that specifically accepted both breeds. For the actual border crossing, they brought copies of all vaccination records, health certificates, and proof of microchipping. The preparation paid off—both dogs were cleared immediately at the border, allowing the family to begin their Canadian adventure without the stress of pet quarantine or unexpected complications.

24. Managing Mail and Important Documents

USPS international mail forwarding is available for 6-12 months at a cost of $1.10+ per piece, which I found impractical for long-term use. Instead, I set up a mail scanning service with US Global Mail for my ongoing US mail needs. They digitize my mail contents and forward only the important physical documents.

I brought original documents including birth certificates, marriage certificates, academic credentials, and tax records. For some documents, I obtained apostilles (special certification for international recognition) to ensure they would be recognized in Canada.

Creating a digital documentation system before departure ensured I had immediate access to important records during my transition. I use secure cloud storage for scanned documents as backup to physical originals, which has saved me several times when I needed to reference something quickly.

25. Creating an Emergency Support Network

The US Consulate in Vancouver (1075 West Pender Street) provides emergency services to US citizens including passport replacement, assistance during disasters, and coordination with local authorities during emergencies. I registered with them through the Smart Traveler Enrollment Program (STEP) to receive safety updates.

BC’s emergency services operate under the 911 system, but the province also offers 811 for non-emergency health advice and 311 in Vancouver for municipal information and services. I programmed these numbers into my phone for quick access.

I connected with expat groups like InterNations and Americans in Canada for support from others who’ve made the same move. These communities have provided invaluable advice and friendship during my transition. I’ve also made a point to establish relationships with neighbors and community members who can provide assistance during emergencies.

How Jiffy Junk Can Help With Your International Move

Relocating internationally creates a perfect opportunity to evaluate what possessions truly deserve to make the journey with you. I found that decluttering before my move saved me thousands in shipping costs. Cross-border moving costs typically range from $5,000-$15,000+ depending on volume, making pre-move decluttering a strategic financial decision.

Jiffy Junk provides comprehensive pre-move cleanout services that streamline this decision process. Their team handles the heavy lifting, sorting, and responsible disposal of items you choose not to bring to Vancouver. This service reduces your international shipping volume, directly cutting moving expenses while ensuring your discarded items are recycled or donated whenever possible.

Their White Glove service includes removal of difficult-to-dispose items like electronics, appliances, and furniture that would otherwise require multiple specialized disposal arrangements. When I was preparing for my move, dealing with these items was one of the most stressful parts of the process. Having professionals handle it would have saved me considerable time and headaches.

Final Thoughts

Most successful international relocations follow a three-phase adjustment pattern: the initial honeymoon period (1-3 months), the challenge phase (3-9 months), and finally, adaptation and integration (9+ months). I’ve found this timeline to be surprisingly accurate in my own experience moving to Vancouver.

Relocating to Vancouver opens exciting opportunities while presenting unique challenges that require methodical planning. Each of the 25 considerations we’ve explored represents a critical piece of your successful transition puzzle. From navigating immigration requirements to building new social connections, your preparation directly influences how smoothly you’ll adapt to life in Canada.

Remember that this transition happens in stages—what feels overwhelming initially becomes manageable as you tackle each aspect systematically. By leveraging services like Jiffy Junk for your departure logistics and connecting with resources for newcomers upon arrival, you’ll create a solid foundation for your new Canadian chapter.

How Jiffy Junk Can Help With Your International Move

Before packing up for Vancouver, taking stock of what truly deserves the international journey can transform your moving experience. International moving costs are calculated primarily by volume, with each cubic foot costing $15-30 for cross-border shipping. This makes pre-move decluttering with Jiffy Junk a direct money-saver.

I’ve witnessed firsthand how quickly belongings accumulate over years in one place. Jiffy Junk’s team excels at helping you determine what to bring, what to discard, and what to donate. Their sorting and disposal services include specialized handling of electronics, hazardous materials, and oversized items that would otherwise require separate disposal arrangements before an international move.

The “broom clean” condition they leave your US property in proves especially valuable if you’re selling or renting your home before departure. When I was preparing to list my house, achieving this level of cleanliness while juggling all the other moving tasks felt overwhelming. Professional assistance would have reduced my stress considerably during this hectic period.

Final Thoughts

The first year after relocation typically presents the greatest challenges. Most immigrants report significant improvement in comfort and integration after completing a full annual cycle in their new country. This matches my experience – that first Christmas in Vancouver felt strange, but by the second year, I’d created new traditions that now feel like home.

Maintaining dual country presence through digital banking, mail services, and periodic visits can ease the transition while gradually shifting your center of life to Canada. I’ve maintained connections to both countries, which has provided a safety net during my adjustment period.

Vancouver offers extraordinary opportunities for those willing to navigate its unique challenges. The stunning natural beauty, diverse cultural landscape, and high quality of life make the effort worthwhile. With thorough preparation and realistic expectations, your move from the US to Vancouver can become the adventure of a lifetime rather than an overwhelming ordeal.