Moving to Canada from US: The Emotional, Financial, and Practical Reality Check

Each year, thousands of Americans relocate to Canada seeking new opportunities, healthcare benefits, and lifestyle changes. While the physical distance may be short, the psychological, financial, and cultural gaps can be surprisingly wide. I’ve put together this guide to break down the lesser-known aspects of moving north—from the emotional challenges to financial complexities and immigration pathways that don’t make the headlines.

Table of Contents

The Lesser-Known Psychological Journey

The Financial Complexity Beyond Currency Exchange

The Immigration Pathway Less Traveled

The Cultural Integration Challenge

Healthcare Navigation Beyond Basic Coverage

Housing Realities and Market Navigation

Career Transition and Professional Recognition

The Lesser-Known Psychological Journey

Moving to Canada involves significant psychological adjustments that most immigration guides overlook. You’ll face identity shifts, cultural adaptation challenges, and emotional hurdles that require preparation. Understanding these psychological aspects before your move can help you develop coping strategies and set realistic expectations for your transition.

The psychological preparation should begin 6-12 months before you physically relocate. This gives you time to process feelings of loss and identity change that inevitably come with international moves.

Research consistently shows that expatriates experience a U-curve of adjustment. You’ll likely feel initial excitement followed by a period of disorientation before reaching stability. This pattern is completely normal but can be disorienting if you’re not prepared for it.

What many people don’t realize is that moves between seemingly similar cultures often create more psychological stress than moves between obviously different cultures. When moving to Canada from the US, the subtle differences can catch you off guard precisely because you expect things to be similar.

According to Immigration, Refugees and Citizenship Canada (IRCC), approximately 10,800 Americans became permanent residents in Canada in 2023. That’s a modest increase from pre-pandemic levels but far short of the numbers suggested by media coverage. The reality of American migration to Canada is much more modest than headlines might suggest.

The Expatriate Identity Crisis

Americans moving to Canada often experience an unexpected identity shift. You’ll need to reconcile your American self-concept with your new status as an immigrant in a country that seems familiar but operates on different cultural assumptions. This identity recalibration affects how you view yourself and how others perceive you.

Identity disruption typically occurs in three phases: separation from origin identity, transition period of ambiguity, and incorporation of new cultural elements. During this process, your brain is working overtime to adjust to new social cues and expectations.

Neurological research shows identity shifts activate the same brain regions involved in processing grief and loss. This explains why even positive moves can trigger unexpected emotional responses – your brain is literally grieving your previous identity.

Successful identity integration requires maintaining core values while adopting new cultural frameworks. This process, called “acculturation” in cross-cultural psychology, takes time and conscious effort. Don’t be surprised if you feel “not quite American, not quite Canadian” for a while.

Many Americans are surprised at how their national identity feels more pronounced in Canada. As one expat in Vancouver explained, “I never thought of myself as particularly ‘American’ until I moved here and realized how many of my assumptions and behaviors were culturally specific.” This heightened awareness of your American identity is a common experience reported by US expatriates.

Anticipatory Grief and Homeland Detachment

Before physically relocating, you’ll likely experience anticipatory grief—mourning the loss of familiar places, relationships, and cultural touchstones. This emotional process begins months before your move and requires conscious acknowledgment.

Anticipatory grief activates the same neurological pathways as conventional grief but occurs before the actual loss. This gives you a unique opportunity to process emotions while still maintaining access to what will be lost.

Documentation of meaningful places and relationships creates psychological anchors that support identity continuity during transition. I recommend creating memory books of favorite US locations, scheduling meaningful goodbye rituals, and journaling about your American identity to help preserve these connections while preparing to forge new ones.

Structured farewell rituals provide closure and signal to your brain that a life transition is occurring. This neurological signaling actually facilitates adaptation by creating clear mental boundaries between life chapters.

Sarah, a marketing executive from Boston, created a “goodbye tour” six months before her move to Toronto. She visited childhood landmarks, organized farewell dinners with different social circles, and collected small mementos from meaningful places. She then created a digital scrapbook that she could access when feeling homesick. “Having these intentional goodbyes made me feel like I was choosing to move forward rather than simply leaving things behind,” she explained. “During my first difficult winter in Toronto, revisiting these memories reminded me of why I made the move while still honoring my connections to home.”

Cultural Whiplash in a “Similar” Country

You’ll likely experience a psychological phenomenon where subtle differences between US and Canadian culture create more disorientation than dramatic differences would. Because Canada appears so similar to the US, you may feel heightened frustration when encountering unexpected differences.

The “cultural iceberg” concept explains why visible similarities mask deeper cultural differences in values, communication patterns, and social expectations. What you see on the surface is just a tiny fraction of the cultural differences you’ll encounter.

Psycholinguistic research shows Canadians use more hedging language and qualification in professional communication than Americans. You might find yourself confused by what seems like indecisiveness when it’s actually a cultural communication pattern.

Prepare by studying Canadian communication styles, which tend to be less direct than American approaches, and practice identifying Canadian cultural markers beyond stereotypes. This preparation will reduce the cognitive dissonance that increases when expectations of similarity are violated, creating stronger negative reactions than when differences are anticipated.

The Social Rebuilding Process

Creating a social network from scratch requires specific strategies that differ from making friends in your home country. You’ll need to navigate Canadian social norms that may prioritize privacy and reserve over American openness. Understanding these differences will help you build meaningful connections in your new home.

Social network research indicates newcomers need approximately 200 hours of interaction to develop close friendships. That’s a lot of coffee dates and social events! Planning for this time investment will help set realistic expectations for your social integration timeline.

Cultural anthropologists have identified “third places” (locations beyond home and work) as critical for immigrant social integration. Finding your local coffee shop, community center, or recreational facility can significantly accelerate your social connections.

Longitudinal studies show immigrants who maintain consistent participation in community activities achieve social integration 40% faster than those who participate sporadically. Consistency matters more than intensity when building a new social network.

When moving to Canada from the US, you’ll need to tackle your personal belongings strategically. Consider reading about furniture removal options to help you decide what to take with you and what to leave behind before your international move.

Breaking Into Established Social Circles

Canadians often maintain long-term friendship groups established early in life, making it challenging for newcomers to integrate. You can succeed by joining recreational sports leagues (particularly hockey-related activities), attending community events consistently rather than sporadically, and volunteering for local organizations where repeated interaction builds trust over time.

Social psychology research identifies “propinquity effect” (repeated exposure) as the primary factor in friendship formation across cultures. Simply showing up regularly to the same places dramatically increases your chances of forming meaningful connections.

Canadian friendship formation typically follows a longer timeline than American patterns, with studies showing 6-8 months of regular contact before social invitations extend beyond group settings. Don’t be discouraged by what might feel like slow progress – it’s cultural, not personal.

Volunteering creates “reciprocity opportunities” that accelerate social acceptance by demonstrating community commitment. When Canadians see you investing in their community, they’re more likely to welcome you into their social circles.

I’ve found that many Americans struggle with the pace of Canadian friendship formation. We’re used to faster, sometimes more superficial initial connections. The slower Canadian approach often leads to deeper, more lasting friendships once established, but requires patience during the formation period.

Social Integration Activity | Effectiveness | Time Investment | Notes |

|---|---|---|---|

Recreational sports leagues | High | 2-3 hours weekly | Hockey-related activities provide strongest cultural connection |

Community volunteering | Very high | 4+ hours monthly | Choose long-term commitments over one-time events |

Professional associations | Medium-high | 2-4 hours monthly | Provides both social and career networking |

Language exchange groups | Medium | 2 hours weekly | Particularly valuable in Quebec or bilingual regions |

Religious communities | High | 2-4 hours weekly | Provides immediate sense of belonging for practitioners |

Parent groups | High | Varies | School and activity-based connections for families |

Digital Community Building

Online platforms specific to American expats in Canada provide crucial support during transition. Beyond Facebook groups, explore province-specific Discord servers for Americans in Canada, the “Yanks in Canada” Slack channels organized by profession, and location-based MeetUp groups specifically for international newcomers.

Digital diaspora communities serve five key functions: information exchange, emotional support, identity maintenance, opportunity networking, and cultural interpretation. Finding the right online communities can significantly ease your transition.

Platform-specific communication norms vary significantly, with Discord communities typically providing more immediate support while Slack channels offer more professional networking. Understanding these differences helps you choose the right platforms for your specific needs.

Research indicates digital-first connections that transition to in-person meetings have a 65% higher retention rate than purely online relationships. Use digital platforms as a starting point, but aim to move connections offline when possible.

Cross-Border Friendship Maintenance

Sustaining meaningful connections with American friends requires intentional strategies that account for distance and time zones. Schedule regular virtual gatherings that accommodate time differences, create shared digital experiences like simultaneous movie viewings, and establish annual traditions where friends visit in either direction.

Relationship maintenance theory identifies three critical factors for long-distance friendship sustainability: communication frequency, ritual creation, and future planning. Working on all three aspects gives your friendships the best chance of surviving the distance.

Synchronous activities create stronger connection than asynchronous communication, with shared experiences activating mirror neuron systems that enhance bonding. This is why watching a movie together virtually feels more connecting than simply texting about your day.

Longitudinal studies show cross-border friendships with established visitation patterns have 70% higher five-year survival rates than those without concrete reunion plans. Setting dates for future visits – whether you’re traveling south or friends are coming north – significantly increases the likelihood of maintaining meaningful connections.

The Financial Complexity Beyond Currency Exchange

Moving to Canada creates intricate financial scenarios rarely covered in standard immigration guides. From tax treaty implications to retirement planning across two systems, you’ll face unique financial challenges that require specialized knowledge and strategic planning to navigate successfully.

Cross-border financial management involves navigating regulatory frameworks from at least four major entities: IRS, CRA (Canada Revenue Agency), FinCEN, and provincial tax authorities. Each has different requirements, deadlines, and reporting formats.

Financial planning timelines for cross-border moves should begin 18-24 months before relocation to optimize tax positioning and account structures. Starting early gives you time to restructure investments, establish cross-border banking relationships, and develop tax strategies that minimize your obligations to both countries.

The Cross-Border Banking Ecosystem

Establishing and maintaining financial presence in both countries requires navigating complex systems that don’t always communicate well with each other. You’ll need specific strategies to manage assets on both sides of the border while minimizing fees and maximizing convenience.

Cross-border banking involves navigating distinct regulatory frameworks: Regulation E in the US versus the Canadian Code of Practice for Consumer Debit Card Services. These differences affect everything from fraud protection to transaction dispute processes.

International banking treaties like the Basel Accords impact how financial institutions manage cross-border accounts and risk assessment. These regulations influence which services banks can offer to clients with international ties.

Banking information exchange between US and Canadian institutions occurs through the SWIFT network but with significant limitations on automated information sharing. This means you’ll often need to manually coordinate information between your US and Canadian accounts.

During the Biden administration, an average of 1,024 Americans per month have become permanent residents of Canada, an increase of almost a third compared to the monthly rate during the Trump presidency (771 per month). This political pattern reflects ongoing trends in American emigration to Canada.

Credit History Non-Transferability

Despite proximity and economic ties, American credit histories don’t transfer to Canada, forcing you to rebuild credit from scratch. Apply for a secured credit card immediately upon arrival (options like TD Bank’s secured Visa or RBC’s newcomer packages have lower barriers), establish utilities in your name with automatic payments, and request credit history letters from American institutions to provide to Canadian lenders as supplementary documentation.

Credit scoring models differ fundamentally: FICO dominates US assessment while Canada uses both the Beacon score and the Empirica score with different weighting factors. These different models mean your credit profile is essentially starting from zero in Canada.

Canadian credit bureaus (Equifax Canada and TransUnion Canada) operate independently from their American counterparts despite shared names. They don’t share data across the border, which is why your US credit history doesn’t automatically transfer.

Credit establishment timeline research shows newcomers typically require 6-8 months to establish sufficient Canadian credit history for basic unsecured products. Planning for this gap is essential, especially if you’ll need to make major purchases or secure housing in your early months in Canada.

Cross-Border Banking Solutions

Specialized financial services exist to bridge US-Canada banking systems, though they’re rarely advertised to newcomers. Investigate cross-border banking packages from TD Bank and RBC that allow linked accounts in both countries, explore Wise for currency conversion at better rates than traditional banks, and consider maintaining US accounts with banks that don’t charge foreign transaction fees for Canadian purchases.

Cross-border banking packages typically utilize correspondent banking relationships governed by inter-bank service agreements rather than true integrated systems. This means transfers between your US and Canadian accounts may still take several business days despite being with the same bank.

Currency conversion through specialized services can save 2-4% compared to traditional bank exchanges due to reduced spread and transparent fee structures. Over time, these savings can add up to thousands of dollars for regular cross-border transactions.

Electronic funds transfer between US and Canadian accounts typically routes through the CHIPS or Fedwire system in the US and the LVTS system in Canada, creating 2-5 business day delays. Understanding these timelines is crucial for managing bill payments and transfers between countries.

Michael, a software developer from Seattle, established a comprehensive cross-border banking setup before moving to Vancouver. He opened a TD Cross-Border Banking package that linked his US and Canadian accounts, maintained his Charles Schwab checking account for its zero foreign transaction fees and ATM reimbursements, and set up a Wise account for larger currency transfers. “The key was establishing everything before moving,” he explained. “I had my Canadian credit card, bank account, and transfer systems ready before my first day as a resident. When unexpected expenses came up during my first month—like needing to pay a larger security deposit because of my lack of Canadian credit history—I could instantly move money without paying excessive fees or waiting days for transfers to clear.”

The Dual-Country Tax Obligation

US citizens face the unusual requirement of filing taxes in both countries regardless of residence, creating complex compliance requirements and potential for tax optimization strategies specific to US-Canada situations. Understanding these obligations early will help you avoid penalties and maximize benefits under the tax treaty.

The US-Canada Tax Treaty contains over 30 articles addressing specific income types and situations, with provisions that can be elected or declined on specific tax forms. Navigating these options requires specialized knowledge but can significantly reduce your overall tax burden.

Citizenship-based taxation (US) versus residence-based taxation (Canada) creates fundamental structural differences in reporting obligations. As a US citizen, you’ll continue filing US tax returns regardless of how long you live in Canada – a requirement that surprises many Americans moving abroad.

Tax filing deadlines differ: April 15 for US returns (with automatic extension to June 15 for Americans abroad) versus April 30 for Canadian returns. Managing these different deadlines requires careful planning, especially in your first year as a dual-country taxpayer.

In recent years, approximately 10,000-12,000 Americans have become permanent residents in Canada annually, representing less than 3% of Canada’s total annual immigration despite high levels of expressed interest. The gap between those who talk about moving to Canada and those who actually complete the process is substantial.

Foreign Account Reporting Requirements

Americans in Canada must navigate FBAR (Foreign Bank Account Report) and FATCA (Foreign Account Tax Compliance Act) requirements, with severe penalties for non-compliance. File FinCEN Form 114 annually if foreign accounts exceed $10,000 combined at any point during the year, complete Form 8938 with your US tax return if foreign assets exceed reporting thresholds, and maintain detailed records of maximum account balances throughout the year.

FBAR filing thresholds apply to aggregate account values at any point during the year, not average or year-end balances. This means even temporary high balances (like when you first transfer funds to establish yourself in Canada) can trigger filing requirements.

FATCA reporting thresholds vary based on filing status and residence location: $200,000 year-end/$300,000 maximum for single filers living abroad versus $50,000/$75,000 for US residents. These different thresholds create different reporting obligations depending on your circumstances.

Penalties for non-filing can reach $10,000 per violation for non-willful cases and the greater of $100,000 or 50% of account balances for willful violations. These steep penalties make compliance essential, even if you don’t owe any US tax.

US Tax Form | Who Must File | Deadline | Penalties for Non-Compliance |

|---|---|---|---|

FBAR (FinCEN 114) | US persons with foreign financial accounts totaling >$10,000 at any point during year | April 15 (automatic extension to Oct 15) | Non-willful: up to $10,000 per violation |

Form 8938 (FATCA) | US taxpayers with specified foreign assets exceeding threshold | With tax return (including extensions) | $10,000 for failure to file, additional $10,000 for each 30 days after notification (max $50,000) |

Form 1116 (Foreign Tax Credit) | US taxpayers who paid foreign taxes and wish to claim credit | With tax return (including extensions) | No specific penalty, but may result in double taxation |

Form 2555 (Foreign Earned Income) | US citizens/residents working abroad meeting physical presence or bona fide residence tests | With tax return (including extensions) | No specific penalty, but may result in higher tax liability |

Form 8833 (Treaty Position) | US taxpayers taking positions based on tax treaty provisions | With tax return (including extensions) | $1,000 for individuals, $10,000 for corporations |

Tax Treaty Benefits and Pitfalls

The US-Canada tax treaty prevents double taxation but contains nuances that can create unexpected tax consequences if not properly understood. Work with a cross-border tax specialist to identify treaty elections that benefit your specific situation, determine whether Foreign Tax Credits or Foreign Earned Income Exclusion better serves your financial profile, and develop strategies for retirement accounts that receive different tax treatment in each country.

Treaty elections require filing specific forms including Form 8833 (Treaty-Based Return Position Disclosure) to claim particular benefits. Without these forms, you may not receive the treaty benefits you’re entitled to, even if you qualify.

Foreign Tax Credit and Foreign Earned Income Exclusion cannot be applied to the same income, requiring mathematical modeling to determine optimal approach. The right choice depends on your specific income sources, tax brackets in both countries, and exchange rates.

The treaty contains specific “saving clauses” that allow the US to tax its citizens as if certain parts of the treaty did not exist, creating exceptions to general protection. These clauses can create surprising tax obligations that many Americans don’t anticipate when moving to Canada.

Investment and Retirement Complications

Investment vehicles and retirement accounts are treated differently under US and Canadian tax systems, creating planning challenges for Americans living in Canada who wish to save for the future. You’ll need specialized knowledge to optimize retirement savings while avoiding tax pitfalls.

Passive Foreign Investment Company (PFIC) rules create punitive tax treatment for Americans holding Canadian mutual funds and ETFs. These rules can result in tax rates exceeding 50% on gains from Canadian investment products, making standard Canadian investment strategies problematic for US citizens.

Retirement account recognition varies by account type and specific treaty provisions, with some accounts receiving preferential treatment. Understanding these differences is crucial for effective retirement planning across borders.

Cross-border estate planning involves navigating both countries’ inheritance and succession laws, which differ particularly regarding deemed disposition at death. Without proper planning, your estate could face double taxation and complex administrative challenges.

TFSA/RRSP Compatibility Issues with US Tax Law

Popular Canadian tax-advantaged accounts like TFSAs (Tax-Free Savings Accounts) create tax complications for US citizens. While RRSPs (Registered Retirement Savings Plans) receive favorable treatment under the tax treaty, TFSAs are not recognized by the IRS, requiring complex reporting and potential tax payments.

RRSP accounts receive special treatment under Article XVIII of the tax treaty, allowing tax deferral with proper election on Form 8891. This makes RRSPs generally compatible with US tax obligations, though you’ll still need to report them.

TFSAs are classified as foreign trusts by the IRS, requiring filing Forms 3520 and 3520-A with potential penalties of $10,000+ for non-compliance. The tax benefits Canadians enjoy from TFSAs are essentially negated for US citizens by these reporting requirements and potential US tax obligations.

Investment holdings within registered accounts may trigger separate reporting requirements under PFIC rules if they include non-US mutual funds or ETFs. This creates an additional layer of complexity for Americans trying to invest through Canadian accounts.

Consider prioritizing RRSP contributions over TFSAs, file Form 8891 for RRSP accounts, and consult a cross-border financial advisor about potential treaty elections to optimize retirement savings. The right strategy depends on your specific financial situation and long-term plans.

The Immigration Pathway Less Traveled

While Express Entry and family sponsorship receive the most attention, several lesser-known immigration pathways offer viable options for Americans seeking to move to Canada. These alternative routes may better match your specific circumstances, particularly if you don’t qualify under point-based systems or have specialized situations.

Canada maintains over 80 different immigration programs across federal and provincial jurisdictions, each with distinct eligibility criteria and application processes. This diversity of options means there’s likely a pathway that fits your specific situation, even if the mainstream programs don’t work for you.

Immigration program selection should consider not just current eligibility but pathway to permanent residency, as some temporary programs offer clearer transitions than others. Planning your long-term immigration strategy from the beginning can save years of uncertainty.

After election day 2024, Canadian immigration websites reported traffic spikes from U.S. visitors, echoing similar patterns seen during previous contentious electoral cycles. This cyclical interest in Canadian immigration often follows US political events, though only a small percentage of interested individuals complete the process.

Provincial Nomination Programs Beyond the Popular Provinces

While Ontario, British Columbia, and Quebec’s immigration programs receive the most attention, smaller provinces offer nomination programs with lower thresholds and specialized streams that may better match your profile. These programs often have less competition and more targeted criteria for specific skills and backgrounds.

Provincial Nomination Programs operate under agreements between federal and provincial governments, with each province allocated nomination quotas annually. These quotas influence how selective each province needs to be and how quickly they process applications.

Nomination success rates vary significantly by province, with Atlantic provinces typically having higher approval percentages than larger provinces. This difference reflects both the lower volume of applications and the greater demographic need for immigrants in these regions.

Processing times for provincial nominations average 15-19 months but vary by province and stream, with some expedited pathways available for critical occupations. Understanding these timelines is crucial for planning your move effectively.

Atlantic Immigration Program Opportunities

The Atlantic Immigration Program covers New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island, offering streamlined pathways for workers with job offers in these regions. The program requires lower language scores and work experience than Express Entry, making it accessible to a wider range of applicants.

The Atlantic Immigration Program requires minimum language scores of CLB 4 (Canadian Language Benchmark) compared to CLB 7 for many Express Entry categories. This significantly lower language requirement opens doors for applicants who might not qualify under other programs.

Designated employers must demonstrate labor market need and commitment to settlement support through formal endorsement processes. This employer involvement creates a more supportive transition for newcomers.

Settlement plans are mandatory components of applications, requiring detailed integration strategies and community connection plans. This focus on settlement success distinguishes the Atlantic program from many other immigration pathways.

Research designated employers in Atlantic provinces, understand the specific provincial requirements that vary slightly between regions, and prepare documentation that demonstrates your intention to settle permanently in the selected Atlantic province. The program is designed to address population decline in these regions, so showing genuine interest in building a life there strengthens your application.

Rural and Northern Immigration Pilot

This pilot program targets smaller communities facing labor shortages and population decline, offering Americans willing to settle in these areas a faster path to permanent residency. Participating communities include North Bay and Sudbury (Ontario), Brandon and Altona/Rhineland (Manitoba), Moose Jaw (Saskatchewan), and several others across Canada.

Community recommendation processes vary by location but typically involve community committee reviews of applications against local economic needs. These committees often include local business leaders, municipal officials, and settlement organization representatives.

Program requirements include proof of financial resources specific to the selected community’s cost of living, not standardized national thresholds. This community-specific approach recognizes the different financial requirements for settling in different regions.

Retention requirements mandate continued residence in the nominating community, with monitoring mechanisms to ensure compliance. These requirements reflect the program’s goal of addressing population decline in specific communities.

The application process requires community recommendation letters, demonstrated intent to reside in the community long-term, and meeting community-specific criteria that may be lower than national standards. For Americans seeking a smaller community lifestyle, these programs can offer both a simpler immigration pathway and a more affordable cost of living than major urban centers.

Entrepreneurial and Self-Employment Pathways

Americans with business experience or creative talents can pursue specialized immigration streams that aren’t based on traditional employment or point systems. These pathways evaluate your potential contribution to Canada’s economy through entrepreneurship or cultural activities rather than through conventional employment.

Entrepreneurial immigration streams evaluate business viability through detailed business plans assessed against market research and economic impact metrics. The scrutiny is substantial, but the pathways can be more accessible than point-based systems for those with strong business backgrounds.

Self-employment categories use different evaluation criteria than economic classes, with greater emphasis on cultural contribution and international recognition. These pathways can be particularly valuable for artists, athletes, and creative professionals.

Success rates for business immigration vary significantly by program, with provincial entrepreneur programs typically having higher approval rates than federal streams. This difference reflects both the volume of applications and the specificity of provincial economic needs.

For entrepreneurs considering a business move to Canada, understanding how to manage commercial assets is crucial. Learn about commercial junk removal options that can help with business transitions or office setups when moving your operations across the border.

Start-Up Visa Program Navigation

This program allows entrepreneurs with innovative business ideas to gain permanent residency if supported by designated Canadian venture capital funds, angel investor groups, or business incubators. The process involves developing a comprehensive business plan, securing a letter of support from a designated organization (which often requires pitching your concept), demonstrating language proficiency, and showing sufficient settlement funds.

Designated organizations must commit minimum investment thresholds: $200,000 from venture capital funds, $75,000 from angel investor groups, or acceptance into business incubators. These thresholds ensure that supported ventures have sufficient resources to launch successfully.

Application processing prioritizes completeness of submission packages, with incomplete applications facing significant delays beyond standard processing times. Thorough preparation is essential for timely processing.

Ownership requirements mandate that applicants maintain essential ownership positions in the business, with specific equity thresholds that must be maintained. This ensures that the entrepreneur remains integral to the business’s operations and success.

Unlike many other programs, the Start-Up Visa leads directly to permanent residency rather than temporary status. This direct path to permanent status provides greater security for entrepreneurs making significant investments in their Canadian ventures.

Jennifer, a tech entrepreneur from Austin, secured Canadian permanent residency through the Start-Up Visa program after her AI-driven educational platform gained support from a designated business incubator in Waterloo, Ontario. “The process was intensive but straightforward compared to other immigration pathways,” she noted. “I spent three months developing relationships with Canadian incubators before submitting my formal pitch. The key was demonstrating both innovation and market viability—not just a novel idea, but one with clear potential to create jobs and economic value in Canada.” Jennifer’s application process took 11 months from initial incubator acceptance to permanent residency approval, during which she operated her business remotely while making regular trips to Canada to build local connections.

Self-Employed Persons Program for Artists and Athletes

Americans with significant experience in cultural activities, athletics, or farm management can immigrate through this specialized program that evaluates applicants on their potential cultural or athletic contribution to Canada rather than traditional economic criteria. Qualification requires demonstrating international recognition in your field, providing evidence of self-employment in these areas for at least two years, and passing a points-based assessment that weighs experience more heavily than education.

Evaluation criteria focus on demonstrated ability to be self-supporting through relevant activities, with specific documentation requirements for different fields. The evidence requirements vary significantly between artistic disciplines, athletic pursuits, and farm management.

“Significant contribution” assessment involves evaluation of previous work against Canadian cultural policy objectives outlined in the Broadcasting Act and other legislation. Understanding these policy frameworks can help you position your application effectively.

Points system allocates up to 35 points for experience compared to 25 for education, with minimum threshold of 35 points out of possible 100. This weighting favors demonstrated achievement over formal credentials, making the pathway accessible to self-taught professionals with strong portfolios.

This pathway is particularly valuable for creative professionals and athletes who might not qualify under other economic immigration streams. If you’ve built a career in the arts, sports, or cultural industries, this program may offer your most direct path to Canadian permanent residency.

Temporary Pathways to Permanent Residency

Several temporary programs offer Americans a foothold in Canada that can be leveraged into permanent status through programs that aren’t widely publicized. These “two-step” immigration approaches often provide more flexibility and higher success rates than direct permanent residency applications.

Transition rates from temporary to permanent status vary significantly by initial entry category, with study permit holders having higher success rates than temporary workers. This difference reflects both the additional points awarded for Canadian education in permanent residency applications and the longer duration of typical study permits.

Canadian Experience Class requires specific documentation of qualifying work experience, with strict definitions of eligible employment. Understanding these requirements before beginning temporary work in Canada can help you ensure your experience will qualify for permanent residency pathways.

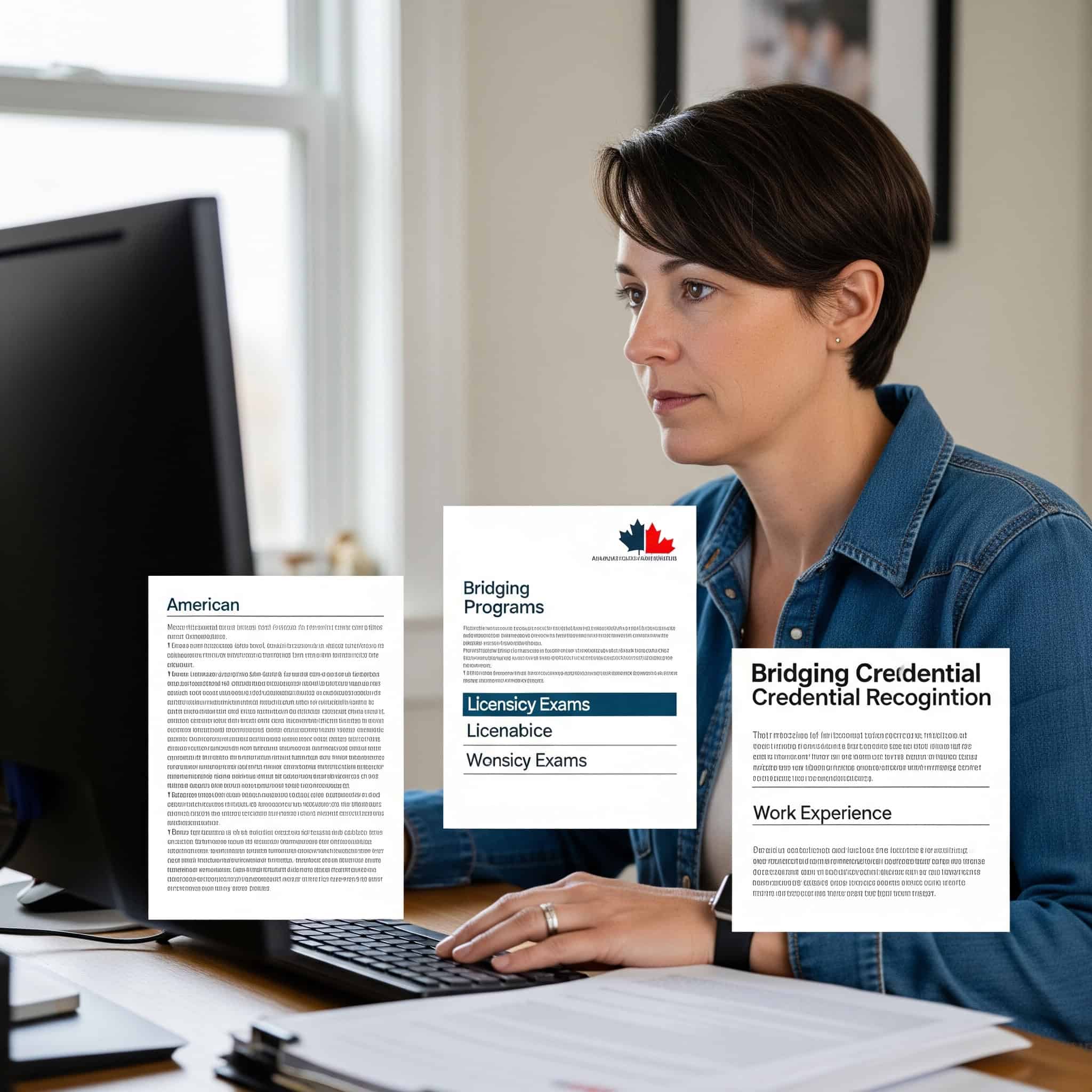

Bridging open work permits provide continued status during permanent residency processing, with specific eligibility criteria tied to application stage. These permits allow you to maintain legal work status during the often lengthy permanent residency processing period.

Post-Graduation Work Permit as Strategic Immigration Step

Pursuing education in Canada offers Americans a clear pathway to work permits and eventual permanent residency, with strategic advantages over direct immigration applications. This approach allows time to build Canadian work experience, establish social networks, and navigate the immigration system from within.

Post-Graduation Work Permits are issued for durations equal to the study program length, up to a maximum of three years, with specific calculation formulas for different program types. This duration provides substantial time to gain qualifying work experience for permanent residency applications.

Canadian educational credentials receive additional points in Express Entry’s Comprehensive Ranking System, with bonus points for Canadian education combined with Canadian work experience. This combination can significantly increase your competitiveness in permanent residency applications.

Provincial nominee programs often maintain specific streams for international graduates, with lower thresholds and expedited processing compared to other nomination categories. These graduate streams can provide faster and more certain pathways to permanent residency than other options.

Select programs that qualify for post-graduation work permits (typically programs of at least 8 months at designated learning institutions), understand how different provinces treat international student graduates in their nomination programs, and plan course selection to develop skills in National Occupation Classification codes with labor shortages. This strategic approach to Canadian education can significantly increase your immigration success rate.

The Cultural Integration Challenge

Moving beyond stereotypes about Canadian politeness, you’ll face subtle but significant cultural adjustments that impact professional success, social acceptance, and overall satisfaction with expatriate life in Canada. Understanding these nuances will help you integrate more effectively into Canadian society.

Cultural integration research identifies four primary acculturation strategies: integration, assimilation, separation, and marginalization, with integration (maintaining home culture while adopting host culture) associated with best psychological outcomes. Finding this balance requires conscious effort and cultural awareness.

Hofstede’s cultural dimensions show Canada and the US differ most significantly in power distance and uncertainty avoidance metrics. These differences manifest in workplace hierarchies, communication styles, and approaches to risk and innovation.

Regional Cultural Variations Across Canada

Canada’s cultural landscape varies dramatically by region, with differences that go far beyond the obvious French-English divide. These regional variations create distinct integration challenges depending on your destination province, requiring targeted preparation for your specific location.

Regional identity studies show stronger provincial identification in Quebec, Newfoundland, and Alberta than other provinces. This stronger regional identity influences everything from political perspectives to social customs and business practices.

Communication pattern research identifies distinct regional conversational norms, with Maritime provinces demonstrating higher context communication than Prairie provinces. These differences affect how information is shared, how disagreements are expressed, and how relationships develop.

Historical settlement patterns continue to influence regional cultural expressions, with immigration waves creating distinct cultural foundations in different regions. Understanding these historical influences can help you interpret current cultural patterns more effectively.

Maritime Cultural Expectations vs. Prairie Provinces

The cultural norms in Canada’s Maritime provinces (New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador) differ substantially from those in Prairie provinces (Alberta, Saskatchewan, Manitoba), affecting everything from business networking to social expectations.

Maritime provinces demonstrate higher “uncertainty avoidance” cultural dimensions, with greater emphasis on established relationships and historical connections. You may find that “who you know” and family histories play a more significant role in social and business contexts in these regions.

Prairie provinces show higher “individualism” scores combined with strong community orientation, creating a distinct cultural pattern of “collaborative self-reliance.” This combination values both individual initiative and community contribution in ways that can seem contradictory to newcomers.

Linguistic analysis shows Maritime English contains more Celtic and Gaelic influences, while Prairie English incorporates more Ukrainian, German, and Scandinavian linguistic elements. These linguistic differences reflect historical settlement patterns and create subtle but meaningful communication variations.

Maritime culture typically values established community connections and family histories, while Prairie provinces often emphasize self-sufficiency and practical contributions to community. Research regional idioms and expressions before arrival, connect with region-specific expat groups for cultural coaching, and adjust your communication style to match local patterns.

Navigating Quebec’s Distinct Society Beyond Language

Quebec’s cultural distinctiveness extends far beyond language differences, encompassing business practices, social customs, and values that can surprise unprepared Americans. Beyond French language acquisition, successful integration requires understanding Quebec’s unique approach to work-life balance (which typically prioritizes leisure more than American culture), appreciating the province’s historical context that shapes current attitudes toward English speakers, and adapting to different business networking practices that often emphasize long-term relationship building over immediate transactions.

Quebec civil law operates on different principles than common law used in other provinces, affecting business contracts and personal legal matters. This legal distinction creates fundamental differences in how agreements are structured and interpreted.

Cultural identity research shows Quebecois identify more strongly with their province than other Canadians, with distinct values around secularism, collectivism, and cultural preservation. These values influence everything from business practices to social expectations.

Business communication in Quebec follows more formal protocols than other provinces, with greater emphasis on proper titles, formal correspondence, and hierarchical respect. Americans often find Quebec business culture more formal than they expect, requiring adjustments to communication style and relationship development approaches.

Professional Culture Shock in Canadian Workplaces

Canadian workplace norms differ significantly from American expectations in ways that can impact career advancement and job satisfaction. Understanding these differences will help you navigate professional environments more effectively and avoid misunderstandings with Canadian colleagues.

Workplace culture research identifies Canadian business environments as more consensus-oriented and less hierarchical than American counterparts. Decision-making typically involves more consultation and less top-down direction than many Americans are accustomed to.

Performance evaluation typically emphasizes different metrics, with greater focus on teamwork and collaboration than individual achievement. This difference can affect how your contributions are valued and recognized in Canadian workplaces.

Management style studies show Canadian leaders tend toward transformational rather than transactional leadership approaches compared to US norms. This difference manifests in more coaching-oriented management and less directive supervision than many Americans expect.

When transitioning to a Canadian workplace, you might need to adapt your professional environment. Consider office clean-out strategies that can help you organize your new workspace efficiently after moving to Canada from the US.

Communication Style Adjustments

Canadian professional communication tends to be more indirect and consensus-oriented than the typical American approach, requiring conscious adaptation to avoid misunderstandings or unintended offense.

Linguistic analysis shows Canadian business communication contains 40% more hedging language and qualification than American equivalents. Phrases like “I wonder if we might consider” or “Perhaps we could explore” are standard Canadian business communication rather than signs of uncertainty or lack of conviction.

Meeting structures typically allocate more time for discussion and consensus-building, with different expectations for decision timelines. What might seem like unnecessary delay to American sensibilities is often viewed as appropriate deliberation in Canadian contexts.

Feedback delivery follows more indirect patterns, often using the “feedback sandwich” approach and avoiding direct criticism. Learning to decode these more subtle feedback styles is essential for professional development in Canadian workplaces.

Practice recognizing Canadian conflict avoidance patterns, where disagreement is often expressed through questions rather than direct statements, learn to decode Canadian understatement (where “that’s interesting” might actually mean “I disagree”), and adjust email and meeting communication to include more relationship-building elements rather than focusing exclusively on efficiency and outcomes.

I’ve found that many Americans struggle with what they perceive as Canadian indecisiveness or conflict avoidance. What’s actually happening is a cultural difference in how decisions are reached and how disagreement is expressed. Adapting to these differences requires patience and a willingness to embrace a more collaborative approach to professional communication.

Work-Life Balance Expectations

Canadian workplace culture generally places different emphasis on work hours, vacation usage, and performance metrics than many American companies, creating potential adjustment challenges.

Canadian labor legislation mandates minimum vacation allowances (typically 2-3 weeks) with cultural expectation of full utilization. Unlike in many American workplaces, using all available vacation time is considered normal rather than showing lack of commitment.

Working hour norms vary by province and industry but generally trend 5-10% shorter than US equivalents in similar sectors. The expectation of regular overtime is less common in many Canadian industries than in their American counterparts.

Performance evaluation typically includes work-life balance as a positive factor rather than rewarding overwork or “hustle culture.” Demonstrating sustainable work patterns may actually enhance your professional reputation rather than diminishing it.

Research industry-specific norms in your Canadian destination, as expectations vary between sectors and provinces, understand that demonstrating dedication through long hours may be viewed differently than in American workplaces (sometimes negatively rather than positively), and recognize that using allotted vacation time is often considered normal rather than showing lack of commitment.

Recognition and Advancement Differences

Career advancement in Canadian professional environments often follows different patterns than in the US, with self-promotion and achievement highlighting sometimes viewed differently.

Resume formats differ significantly, with Canadian CVs typically being more comprehensive and including personal details often omitted from American resumes. Canadian resumes may include information about citizenship/immigration status, sometimes include photos, and often provide more detail about education.

Promotion timelines tend to be longer, with greater emphasis on institutional knowledge and relationship development. The rapid job-hopping that’s become common in some American industries may be viewed less positively in many Canadian professional contexts.

Salary negotiation follows different cultural norms, with less aggressive approaches and greater emphasis on total compensation package including benefits. The direct negotiation tactics that work well in American contexts may be perceived as overly aggressive in Canadian professional environments.

Observe how Canadian colleagues present their accomplishments (often with more emphasis on team contributions), adjust resume and interview styles to match Canadian expectations (which typically value stability and steady progression over rapid advancement), and build broader professional networks rather than focusing solely on vertical relationships with superiors.

Healthcare Navigation Beyond Basic Coverage

While universal healthcare is frequently cited as a benefit of relocating to Canada, you’ll need to prepare for the complexities of the Canadian system. Provincial differences, supplementary insurance needs, and access challenges aren’t typically covered in promotional materials about Canadian healthcare but will significantly impact your experience.

Canada’s healthcare system operates as 13 distinct provincial and territorial systems rather than a single national program. Each has different coverage policies, enrollment procedures, and supplementary programs that you’ll need to navigate based on your specific location.

Healthcare delivery models vary by province, with different approaches to primary care access and specialist referrals. Understanding your province’s specific model will help you access care more effectively and set realistic expectations for your healthcare experience.

Provincial Health Insurance Waiting Periods

Each Canadian province imposes waiting periods before newcomers qualify for public health coverage, creating a critical gap that requires advance planning and alternative solutions during your initial months in Canada. Understanding these waiting periods and preparing appropriate coverage will protect you from significant financial risk.

Waiting period durations vary by province: Ontario and British Columbia impose 3-month waiting periods, while Quebec requires up to 3 months after registration. Planning for this gap is essential to avoid being uninsured during your initial months in Canada.

Coverage eligibility criteria include both immigration status requirements and physical presence thresholds that must be documented. Different provinces have different documentation requirements to prove your residency during the application process.

Interprovincial coverage transfer agreements exist but contain specific timing requirements and documentation needs. If you’re moving between provinces, understanding these transfer processes can help you maintain continuous coverage.

Bridging Coverage Solutions During Waiting Periods

The gap between arrival and provincial health coverage eligibility creates significant financial risk for newcomers. Purchase visitor-to-Canada policies from providers like Manulife and Blue Cross before leaving the US. Additionally, investigate whether your US employer’s insurance offers cross-border coverage extensions, typically available for 3-6 months after relocation.

Visitor policies typically exclude pre-existing conditions unless specifically rider-covered, requiring careful policy selection for those with ongoing health needs. Reading the fine print is essential, as coverage limitations vary significantly between providers.

Coverage limits vary significantly between providers, with emergency-only policies starting around $100,000 and comprehensive coverage offering $1-5 million limits. The right choice depends on your health status, planned activities during the waiting period, and risk tolerance.

Policy coordination between US extension coverage and Canadian temporary insurance requires understanding of primary/secondary coverage determination rules. If you have multiple policies during the transition period, knowing which one pays first can prevent claim complications.

Some Canadian employers provide interim health benefits specifically designed for this waiting period – a detail worth negotiating during job discussions. This employer-provided coverage can be the most comprehensive solution if available.

Province-Specific Application Procedures

Each province handles health insurance enrollment differently, with varying documentation requirements and processing timelines that can impact how quickly you gain coverage.

Application processing times vary from immediate card issuance in some provinces to 4-6 weeks in others, affecting timing of coverage activation. Planning for this processing time is essential for coordinating the end of your temporary coverage with the beginning of your provincial coverage.

Documentation requirements include specific combinations of primary and secondary identification, with precise specifications for acceptable documents. Preparing these documents before arrival can expedite your application process.

Coverage effective dates are determined by different rules in each province, with some backdating to application date and others using fixed waiting period calculations. Understanding these rules helps you plan your healthcare needs during the transition period.

Ontario’s OHIP requires in-person applications at ServiceOntario locations with proof of residency and immigration status, while British Columbia’s MSP allows online applications but may require additional verification steps for newcomers. Quebec’s RAMQ has particularly strict residency verification procedures, often requesting utility bills and lease agreements in addition to immigration documents. Research your specific province’s requirements before arrival and prepare a documentation portfolio that exceeds minimum requirements.

Supplementary Health Insurance Necessities

Provincial health plans cover basic medical services but exclude numerous healthcare needs that Americans typically expect from comprehensive insurance. You’ll need to understand these gaps and arrange appropriate supplementary coverage to avoid unexpected expenses.

Provincial plans typically exclude outpatient prescription medications, dental care, vision care, paramedical services, and medical equipment. These exclusions can create significant out-of-pocket costs if you don’t have supplementary coverage.

Supplementary insurance markets operate differently than US models, with group coverage predominating and individual policies structured differently. Individual policies are typically more expensive and more limited than group coverage, making employer benefits particularly valuable.

Coverage coordination between provincial plans and supplementary insurance follows different rules than US primary/secondary determination. Understanding these coordination rules helps you maximize your benefits and minimize out-of-pocket costs.

Dental and Vision Coverage Strategies

Unlike the US system, Canadian public healthcare excludes routine dental and vision care, requiring separate insurance arrangements. Options include employer-sponsored supplementary benefits (which vary widely in comprehensiveness), private insurance from providers like Sun Life and Great-West Life (with premiums that increase substantially with age), and discount plans like CDSPI for dental services.

Dental insurance typically imposes waiting periods for major procedures, with immediate coverage limited to preventive services. These waiting periods mean you should secure coverage well before anticipating major dental work.

Vision coverage structures differ from US models, with lower frame allowances but often better coverage for lens options. Understanding these differences helps you budget appropriately for vision care.

Fee guides vary by province, with dental procedures costing 15-30% less than US equivalents but still representing significant out-of-pocket expense without insurance. Even with these lower costs, dental care remains a substantial expense without supplementary coverage.

Some newcomers maintain relationships with US providers in border communities, making periodic trips for care while establishing Canadian options – a strategy particularly viable in cities like Windsor, Vancouver, and Niagara Falls. This cross-border care approach can be cost-effective for predictable care needs like annual dental check-ups or vision exams.

Prescription Drug Coverage Gaps

Prescription medications in Canada aren’t universally covered outside hospitals, creating potential financial strain for those with ongoing medication needs.

Provincial formularies determine which medications receive coverage, with significant variation between provinces. A medication covered in one province might not be covered in another, creating potential challenges for inter-provincial moves.

Catastrophic drug programs establish maximum out-of-pocket thresholds based on income, typically ranging from 3-7% of household income. These programs provide important protection against extremely high medication costs but still leave substantial potential expenses.

Special authorization processes exist for non-formulary medications, requiring physician documentation of medical necessity. Understanding these processes is essential if you take medications that aren’t on standard formularies.

Provincial pharmacare programs like Ontario’s Trillium Drug Program and BC’s Fair PharmaCare offer income-based coverage but require separate enrollment processes beyond basic health insurance registration. The OHIP+ program in Ontario covers prescriptions for those under 25, while Quebec mandates participation in either private or public prescription drug insurance. Research Canadian drug formularies before relocating, as not all US medications are available or covered in Canada.

Specialist Access and Referral Systems

The referral-based approach to specialist care in Canada differs significantly from the direct-access model many Americans are accustomed to. You’ll need to adapt to new healthcare navigation strategies and understand how to access specialized care within the Canadian system.

Specialist referral processes follow triage protocols that prioritize cases based on clinical urgency rather than patient preference or convenience. This prioritization system means wait times vary significantly based on the urgency of your condition.

Wait time reporting varies by province, with some publishing comprehensive data while others provide limited transparency. Researching typical wait times for your specific health needs can help set realistic expectations.

Patient rights frameworks differ from US models, with different mechanisms for addressing access concerns or seeking second opinions. Understanding these frameworks helps you advocate effectively within the Canadian system.

Finding a Family Physician in Underserved Areas

Securing a primary care provider presents a significant challenge in many Canadian regions experiencing doctor shortages. Register with provincial physician finding services like Health Care Connect (Ontario) or the Patient Attachment List (Alberta) immediately upon arrival, explore community health centers that often accept new patients when private practices don’t, and investigate virtual care options like Maple or Dialogue that provide primary care consultations online.

Primary care models vary by province, with traditional fee-for-service, capitation models, and mixed payment systems creating different practice patterns. These different models affect everything from appointment availability to referral processes.

Physician distribution programs offer incentives for practice in underserved areas, creating potential opportunities in smaller communities. If you’re willing to live in a smaller community, you may find easier access to primary care.

Virtual care regulation varies by province, with different rules regarding prescribing, referrals, and billing for online consultations. These virtual options can provide important stopgap care while you search for a permanent provider.

Some newcomers temporarily utilize walk-in clinics while searching for permanent providers, though this approach creates continuity-of-care challenges. While not ideal for long-term care, walk-in clinics can address immediate needs during your search for a family physician.

Understanding Wait Times and Prioritization

Specialist appointments and procedures in Canada’s public system operate on prioritization frameworks that differ from the US private system, potentially resulting in longer waits for non-urgent care.

Clinical prioritization frameworks use standardized urgency classifications that determine maximum appropriate wait times. Understanding these classifications helps you set realistic expectations for your care timeline.

Wait time guarantees exist in some provinces for specific procedures, creating potential for out-of-region treatment if timelines aren’t met. These guarantees provide important protections for time-sensitive procedures.

Patient navigation services operate in most major health regions, providing assistance with complex cases or coordination challenges. These services can be valuable resources for navigating complicated care needs.

Learn how Canadian triage systems classify conditions (most provinces publish their clinical prioritization guidelines online), maintain comprehensive personal medical records to facilitate referrals, and understand the patient advocacy resources available through provincial health ministries. For time-sensitive but non-emergency situations, some provinces offer referral optimization services that can identify specialists with shorter wait lists.

Housing Realities and Market Navigation

Canada’s housing landscape presents unique challenges for American transplants, from unfamiliar market practices to regional affordability crises and tenant regulations that differ significantly from US norms. Understanding these differences will help you make informed housing decisions in your new country.

Housing markets vary dramatically by region, with price-to-income ratios ranging from 3:1 in some areas to over 10:1 in major urban centers. This variation means housing affordability differs significantly depending on your destination.

Regulatory frameworks differ from US models, with different mortgage qualification rules, tenant protections, and property tax structures. These differences affect everything from rental applications to home purchase financing.

Before settling into your new Canadian home, you may need to handle furniture logistics. Read about getting rid of old furniture to learn disposal strategies that might apply when moving to Canada from the US and deciding what to bring along.

Neighborhood Selection Beyond Tourist Knowledge

Selecting appropriate communities requires understanding factors beyond those visible during preliminary visits. You’ll need to consider seasonal considerations, transportation infrastructure, and community integration potential for newcomers to find a neighborhood that meets your long-term needs.

Neighborhood demographic profiles vary significantly within cities, with integration patterns showing distinct clustering of newcomer communities. Some neighborhoods have established support networks for newcomers, while others may present more integration challenges.

Municipal service levels differ between neighborhoods within the same city, affecting everything from snow removal to public transit frequency. These service variations can significantly impact your daily quality of life, especially during winter months.

Community amenity distribution follows different patterns than typical US urban planning, with greater emphasis on public spaces and mixed-use development. Understanding these patterns helps you identify neighborhoods that match your lifestyle preferences.

Winter Livability Assessment

A neighborhood’s winter characteristics dramatically impact quality of life in ways summer visitors can’t anticipate.

Municipal snow clearing policies establish priority routes and clearing timelines, with residential streets often receiving lower priority than main arteries. In some neighborhoods, you might wait days for residential street clearing after major snowfalls.

Building code requirements for insulation have evolved significantly, with pre-1970s housing typically having R-values 50-70% lower than modern standards. Older homes may have significantly higher heating costs and comfort issues during extreme weather.

Microclimate variations within cities can create 5-10°F temperature differences between neighborhoods due to factors like elevation, proximity to water, and building density. These variations can make a substantial difference in winter livability.

Evaluate snow clearing protocols (which vary by municipality and even by street classification within cities), public transit reliability during winter conditions (with significant variations between systems), and building insulation standards (older housing stock often performs poorly despite Canada’s cold climate). Visit potential neighborhoods during January or February if possible, or conduct virtual research through community forums where winter-specific complaints and recommendations are discussed.

Immigrant Integration Patterns by Neighborhood

Some Canadian neighborhoods foster newcomer integration more effectively than others, based on community structures and demographic patterns.

Settlement pattern research identifies “reception communities” with infrastructure specifically supporting newcomer integration. These communities often have established settlement services, language support programs, and cultural integration activities.

Social capital development varies by neighborhood design, with some physical layouts facilitating community connection more effectively. Neighborhoods with community centers, public gathering spaces, and pedestrian-friendly design typically foster stronger social connections.

Service accessibility mapping shows significant disparities in newcomer support resources between neighborhoods, even within the same municipality. Proximity to settlement services, language classes, and cultural integration programs varies widely between neighborhoods.

Research areas with established newcomer support networks, typically identified through settlement agency recommendations rather than general real estate guides. Consider proximity to cultural amenities that match your background, as maintaining some cultural connections eases transition stress. Investigate local library branches, which often serve as community integration hubs with programs specifically designed for new residents.

Rental Market Navigation Strategies

Canada’s rental markets operate under different rules and customs than American equivalents, creating potential pitfalls for newcomers unfamiliar with local practices and regulations. Understanding these differences will help you secure appropriate housing and protect your rights as a tenant.

Vacancy rates vary dramatically by region, from below 1% in some urban centers to over 7% in others, affecting competition and landlord requirements. In tight markets, landlords can be extremely selective, while in markets with higher vacancy rates, you’ll have more negotiating power.

Rental regulation frameworks differ by province, with varying levels of rent control, tenant protection, and dispute resolution mechanisms. These differences significantly affect your rights and responsibilities as a tenant.

Application evaluation criteria typically emphasize different factors than US rental markets, with greater emphasis on stability and references. Canadian landlords often place more weight on employment stability and personal references than credit scores, especially for newcomers.

Building Credit History for Landlord Approval

Without Canadian credit history, securing rental housing requires alternative approaches to demonstrate financial reliability.

Credit check authorization forms differ from US versions, with specific provincial privacy requirements governing information collection. These forms typically require explicit consent for specific types of information gathering.

Income verification typically requires different documentation than US standards, with specific requirements for newcomers without Canadian employment history. Offer letters, bank statements showing sufficient funds, and international employment verification may all be required.

Security deposit regulations vary significantly by province, from maximum half-month limits in Ontario to full month in British Columbia and two months in Quebec. Understanding these limits helps you prepare financially and avoid illegal deposit requests.

Obtain employment verification letters that detail compensation packages, secure reference letters from previous US landlords formatted to address Canadian landlord concerns, prepare larger security deposits when legally permitted (deposit limitations vary by province), and explore rent guarantor services that provide assurance to landlords while you establish Canadian credit. Some newcomers find success offering several months’ rent in advance, though this approach requires careful documentation to prevent future disputes.

Tenant Rights Variations Across Provinces

Provincial tenancy laws in Canada vary dramatically, creating a patchwork of rights and responsibilities that differ from American expectations and between Canadian locations.

Notice periods for tenancy changes vary from 30 days to 90 days depending on province and situation. These different notice requirements affect everything from lease termination to rent increases.

Rent increase limitations range from strict percentage caps in some provinces to no controls in others, with different rules for existing versus new tenancies. In some provinces, rent can only increase by a government-set percentage annually, while others have no such restrictions.

Dispute resolution mechanisms differ fundamentally, from Quebec’s Régie du logement tribunal system to Ontario’s Landlord and Tenant Board to more court-based systems in other provinces. Understanding your province’s specific system helps you protect your rights effectively.

Quebec’s Civil Code provides different protections than the common law systems in other provinces, with unique rules regarding lease renewals and assignments. Ontario’s Residential Tenancies Act includes rent control provisions for qualifying units, while British Columbia’s Residential Tenancy Act establishes different eviction notice requirements. Before signing any lease, review the specific provincial tenancy guide published by government housing authorities and consider consulting tenant advocacy organizations like ACORN Canada or housing help centers funded by settlement agencies.

Homebuying Differences for American Purchasers

The Canadian homebuying process contains significant differences from US practices, from mortgage qualification to closing procedures. Understanding these differences will help you navigate the purchase process more effectively and avoid costly mistakes.

Real estate representation models differ from US practices, with different agency relationships and disclosure requirements. Understanding who represents whom in transactions helps you ensure your interests are protected.

Mortgage markets operate under different regulatory frameworks, with stress test requirements and qualification criteria unlike US standards. These differences affect how much you can borrow and under what terms.

Property transfer tax structures vary by province, with some imposing substantial land transfer taxes while others have minimal fees. These taxes can add significant costs to property purchases, especially in major urban centers.

Foreign Buyer Considerations and Restrictions

Recent legislation has created additional hurdles for non-permanent residents purchasing Canadian property.

The Prohibition on the Purchase of Residential Property by Non-Canadians Act defines specific property types and buyer categories with different restriction levels. Understanding these categories helps you determine whether your status and desired property type are affected by the restrictions.

Provincial speculation taxes impose surcharges ranging from 15-20% of property value for foreign purchasers in designated regions. These taxes can add substantial costs to property purchases by non-residents.

Exemption qualification requires specific documentation of immigration status, intended use, and in some cases, future residency intentions. Preparing this documentation in advance can help you navigate exemption processes more effectively.

The federal Foreign Buyer Ban prohibits non-residents from purchasing residential property in Canada with certain exceptions, while provincial measures like British Columbia’s and Ontario’s Non-Resident Speculation Taxes add substantial costs to purchases by foreign nationals. Americans with work permits may qualify for exemptions but must navigate complex documentation requirements. Those planning eventual property purchase should consult immigration attorneys about structuring their entry pathway to preserve property purchase eligibility, as some temporary residence categories offer clearer paths to property ownership than others.

Mortgage Qualification Without Canadian Credit

Securing mortgage financing without established Canadian credit history requires specialized approaches unfamiliar to most American homebuyers.

Mortgage stress test requirements mandate qualification at contract rate plus 2% or 5.25%, whichever is higher, regardless of actual interest rate. This stress test significantly reduces purchasing power compared to US qualification methods.

Down payment requirements increase for non-residents or those with limited Canadian credit history, with graduated scales based on purchase price. Non-residents or newcomers often need substantially larger down payments than established Canadian residents.

Mortgage default insurance (similar to PMI in the US) is mandatory for high-ratio mortgages but structured differently, with premiums added to principal rather than monthly payments. This structure increases your loan amount but reduces monthly payments compared to US PMI.

International banking relationships provide potential solutions – major Canadian banks with US operations (TD, RBC, BMO) offer cross-border mortgage programs that consider US credit history in underwriting decisions. Alternative strategies include working with mortgage brokers specializing in newcomer financing, who access lenders offering “new to Canada” programs with modified qualification criteria. These programs typically require larger down payments (often 35% or more) but accept alternative credit verification methods including international credit reports, banking relationship letters, and proof of timely payment for services not traditionally reported to credit bureaus.

Career Transition and Professional Recognition